As a researcher with a background in cryptocurrencies and market analysis, I find the recent Ethereum price action intriguing. While there is undeniably pressure on the second-largest cryptocurrency by market capitalization at present, with prices tumbling roughly 15% since March 2024, on-chain data suggests a bullish picture.

At present, Ethereum is experiencing a significant downturn, declining approximately 15% since March 2024. Despite this bearish trend, on-chain information indicates a bullish outlook. As sellers intensify their efforts and erase all gains attained from May 20, it’s essential for researchers to closely monitor the situation while remaining open to potential market reversals.

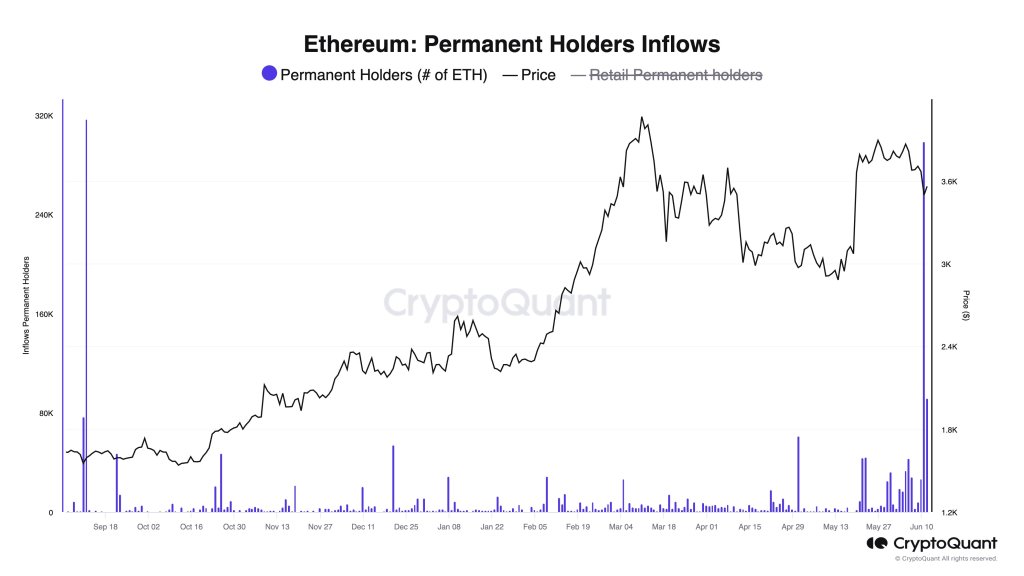

Ethereum HODLers Scoop 298,000 ETH In 24 Hours

A particular analyst points out a surge in the interest towards Ethereum (ETH) among some investors. This rise is predominantly driven by institutional investors, known as permanent holders, who have deeper financial resources and a stronger inclination to maintain their positions for extended periods. In contrast to retail investors, institutions can generally withstand market fluctuations without selling off their assets in response.

According to data from CryptoQuant, these permanent holders are reportedly behind the second-largest single day Ethereum purchase, as recorded in the history. On June 12, when the prices experienced a brief surge, they bought an astonishing amount of 298,000 ETH. Notably, this number comes close to the all-time record high of 317,000 ETH purchased on September 11, 2023.

Based on my analysis, although the daily chart shows a persistent trend of lower lows, the significant increase in buying pressure indicates a robust bullish attitude among investors.

Additionally, given the significant quantity of Ethereum purchased in the markets, this activity might indicate that institutional investors, such as hedge funds or wealthy individuals, are making preparations for larger investments in the market.

They appear to be taking advantage of the lower prices.

As a crypto investor, I’ve noticed that Ethereum is experiencing some weakness at the moment, as indicated by the daily chart. Despite the slight recovery on June 12, bulls were unable to fully regain the ground lost on June 11. The downturn on June 13 has brought sellers back into the picture, and there’s a strong possibility that prices may align with the prominent June 11 candlestick.

Based on the daily chart’s candlestick formation, the price of Ethereum is showing signs of becoming a resistance level around $3,700. Following the breakout on June 7, Ethereum has been experiencing a significant decline, filling in the price gap that existed since May 20.

If the downturn persists, Ethereum, despite the widespread positivity in the crypto world, may dip back down to $3,300.

Spot ETFs To Begin Trading This Summer: Gensler

It’s unclear whether prices will rebound from their current value or continue dropping towards $3,300. Nonetheless, the market sentiment remains optimistic based on recent remarks by Gary Gensler, the chairman of the US Securities and Exchange Commission (SEC).

At a Senate hearing, Gensler indicated that the Ethereum ETF proposed by Coinbase (whose regulatory filings were accepted in May) could potentially start trading as early as summer. BlackRock has also re-filed its application and is now undergoing the approval process.

If the approval of the product occurs within the upcoming weeks, Ethereum (ETH) is expected to experience a significant infusion of liquidity. Similar to the launch of Bitcoin Spot ETFs, institutional investors are predicted to funnel vast amounts into Ethereum, providing their clients with the opportunity for exposure.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-06-15 00:04