As a seasoned researcher with over a decade of experience in analyzing financial markets, I have witnessed numerous cycles and trends across various asset classes, including cryptocurrencies like Ethereum (ETH). The recent surge in open interest and the record-high futures funding rate for ETH signal an optimistic outlook on its future performance.

As a researcher studying the cryptocurrency market, I’ve noticed that Ethereum (ETH) has been exhibiting bullish signs as it kicks off the new week with upward trends. The open interest for Ethereum has significantly increased to over $11 billion, which indicates a surge in traders’ confidence and could potentially fuel a positive shift in market sentiment.

Open Interest Shows Renewed Interest

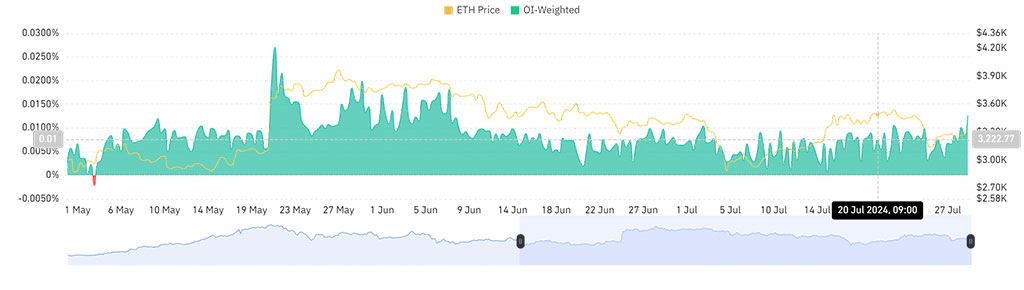

1. The value of derivative contracts such as futures and options, collectively known as open interest, experienced a significant resurgence. After falling from about $12 billion to around $9 billion at the beginning of July, it has climbed up to roughly $11.8 billion in recent weeks, indicating an increase of over $1.5 billion.

The surge in open interest suggests traders are regaining confidence in the market, perhaps due to major events such as Ethereum ETF approvals. An increase in open interest often signifies fresh investment flowing into the market, implying a bullish perspective on Ethereum’s future prospects.

1. The Ethereum futures funding rate has climbed to roughly 0.0126%, reaching its peak in over a month. This significant increase suggests a growing bullish attitude among traders and higher market engagement, implying they anticipate further growth in Ethereum’s price.

Photo: Coinglass

Ethereum Price Trends and Market Dynamics

The price trend of Ethereum has been characterized by significant fluctuations in recent times. After the introduction of spot Ethereum ETFs on July 23, there was a sudden decrease of approximately 11.5% in its value. This decline momentarily drove the price under the $3,200 support mark, but vigorous buying efforts successfully prevented further downturn.

At the moment, Ethereum is hovering near $3,370, attempting to breach significant resistance barriers. Analysts stress that keeping the price above $3,200 is vital for preserving a bullish outlook. If Ethereum successfully surpasses resistance at $3,357 and $3,540, it may aim for higher regions between $4,000 and $4,900.

The Relative Strength Index (RSI) analysis indicates that it is currently above the neutral line.

Impact of Lower Gas Fees on Ethereum

Beyond these market fluctuations, it’s worth noting that Ethereum has experienced a significant decline in transaction fees, currently averaging around 4 Gwei. This drop is primarily due to the rising adoption of layer 2 scaling technologies and recent network enhancements, making transactions more cost-effective. Yet, this reduction also means less Ether is being destroyed through burning, thereby increasing Ethereum’s inflation rate.

Although inflation caused by increased transaction volume could potentially decrease the value of ETH, the implementation of scalability solutions may increase demand for Ethereum and counteract this trend. The affordability of transactions brought about by lower fees makes Ethereum more accessible to a larger user base, which could foster long-term expansion, despite any short-term inflation worries.

1. The escalating open interest, skyrocketing futures funding rate, and fluctuations in network gas fees on Ethereum indicate a shift in trends within the cryptocurrency sector. These occurrences suggest a sophisticated interaction among multiple factors that could potentially impact Ethereum’s trajectory over the upcoming weeks.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-07-30 14:39