As a seasoned crypto investor with a decade of experience under my belt, I find myself intrigued by the recent developments in Ethereum. Despite the weekly dip in its price, the surge in network fees and DeFi activity paints an optimistic picture for ETH.

Over the past week, I’ve observed a 2.08% decrease in Ethereum’s price, aligning with the trend seen among many other altcoins. Despite Ethereum failing to push beyond the $4,000 mark for any substantial breakout, there are intriguing advancements happening within its underlying network that have piqued the interest of investors.

Ethereum Weekly Fees Rise By 18% Amid DeFi Ecosystem Boom

Just last week ending on December 13, IntoTheBlock’s crypto analysis showed a 17.9% increase in Ethereum network fees compared to the previous week, setting a new all-time high of approximately $67 million since April.

Based on reports from IntoTheBlock analysts, it appears that elevated transaction fees on the Ethereum network can be linked to the adjustment of ETH’s value as Bitcoin approached $100,000. Furthermore, there has been a marked surge in decentralized finance (DeFi) activity on the Ethereum blockchain.

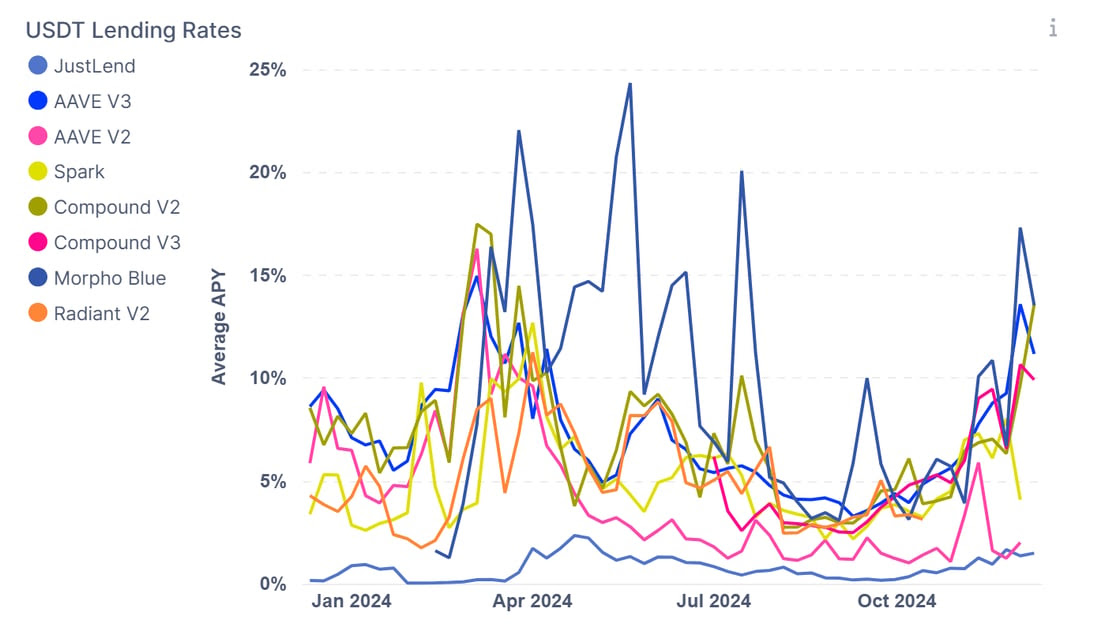

Delving deeper into the dynamic Decentralized Finance (DeFi) landscape on Ethereum, Satoshi Club points out a surge in DeFi lending activities. Users are increasingly using Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) to obtain stablecoins as collateral. This wrapped format empowers users to optimize their collateral’s potential by accessing the liquidity and stability offered by DeFi platforms, all while retaining investment in prominent cryptocurrencies like Bitcoin and Ethereum.

Remarkably, a significant increase in borrowing requests caused interest rates to soar to unprecedented heights, with an average of over 10% and some reaching up to 40%. This is reminiscent of the high-energy market conditions seen during the 2022 bull run.

One DeFi protocol that’s been drawing attention on Ethereum recently is Aave, boasting a total value locked (TVL) of approximately $22.46 billion. This notable platform has managed to attract $500 million in net inflows during the past week, reflecting the surge in decentralized finance (DeFi) activity.

As the Ethereum network’s activity increases due to more Decentralized Finance (DeFi) activities, this could signal a growing enthusiasm for the network. However, investors should be aware that higher transaction fees associated with Ethereum might create difficulties for smaller users, making profits accessible only to those who can effectively leverage high-interest rates.

ETH Price Overview

Currently, Ethereum is being traded at $3,914.08, showing a minor decrease of 0.22% over the last 24 hours. Conversely, on its one-month graph, Ethereum has surged by an impressive 21.39%, demonstrating its outstanding growth in recent weeks.

Previously mentioned, the key hurdle for Ethereum’s price advancement currently lies at the $4,000 mark. Overcoming this level could potentially propel Ethereum towards a new peak of $4,900 – a price point that also serves as its next significant resistance.

Currently, Ethereum holds the position as the second most significant cryptocurrency with a market value of approximately $471.16 billion, accounting for around 12.9% of the entire digital assets sector’s worth.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-12-14 16:34