As a seasoned researcher with a knack for navigating the crypto market’s intricacies, I must admit that Ethereum’s recent price action has left me somewhat perplexed. Having closely monitored the blockchain landscape since its inception, I’ve witnessed the meteoric rise of ETH and the anticipation surrounding its ETFs. Yet, the current performance is a stark contrast to the initial euphoria that surrounded these financial products.

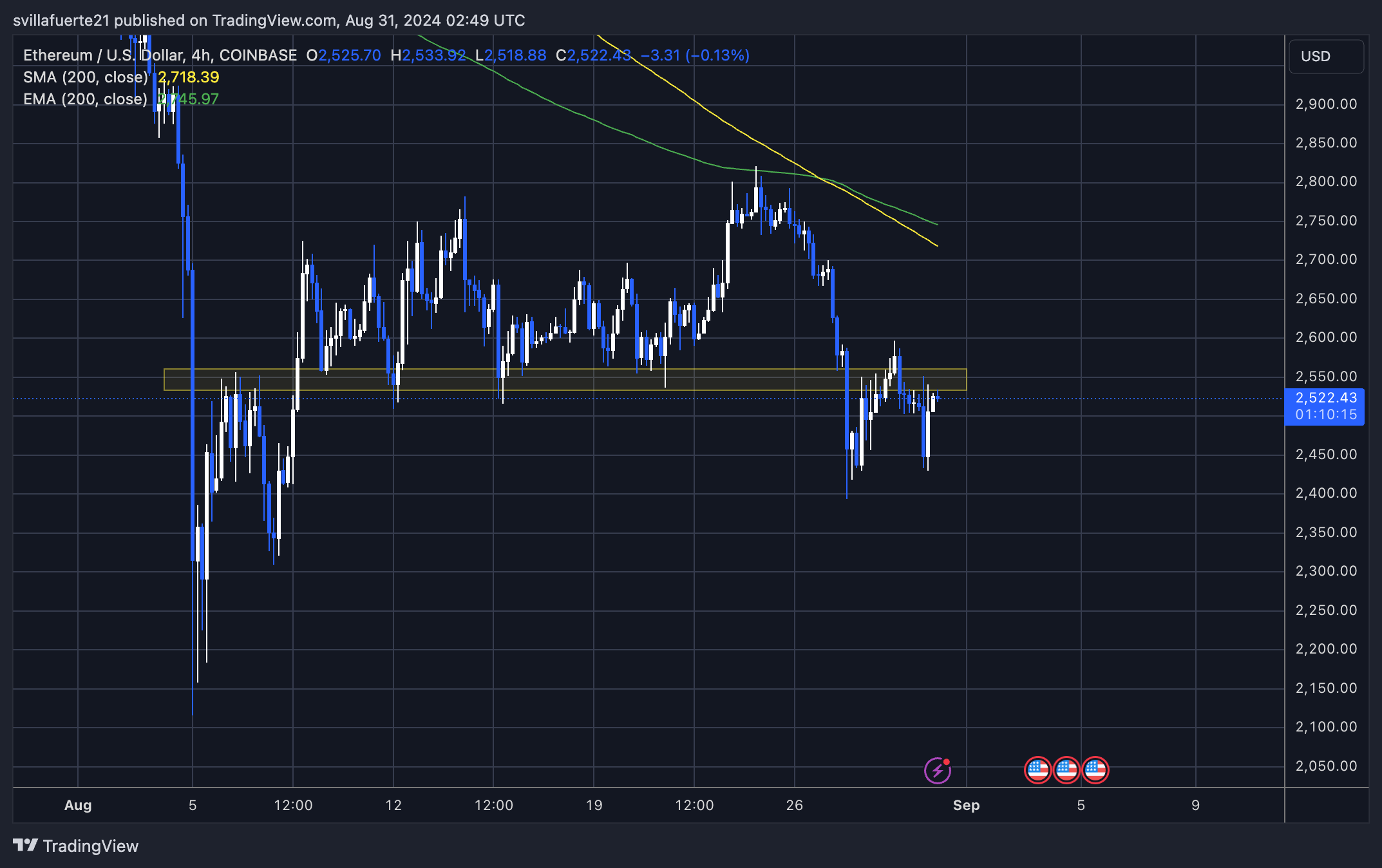

Since early August, Ethereum (ETH) has been fluctuating between approximately $2,300 and $2,800 each day. For the past three days, the price has encountered difficulty surpassing $2,600, leading to apprehension among financial analysts and investors.

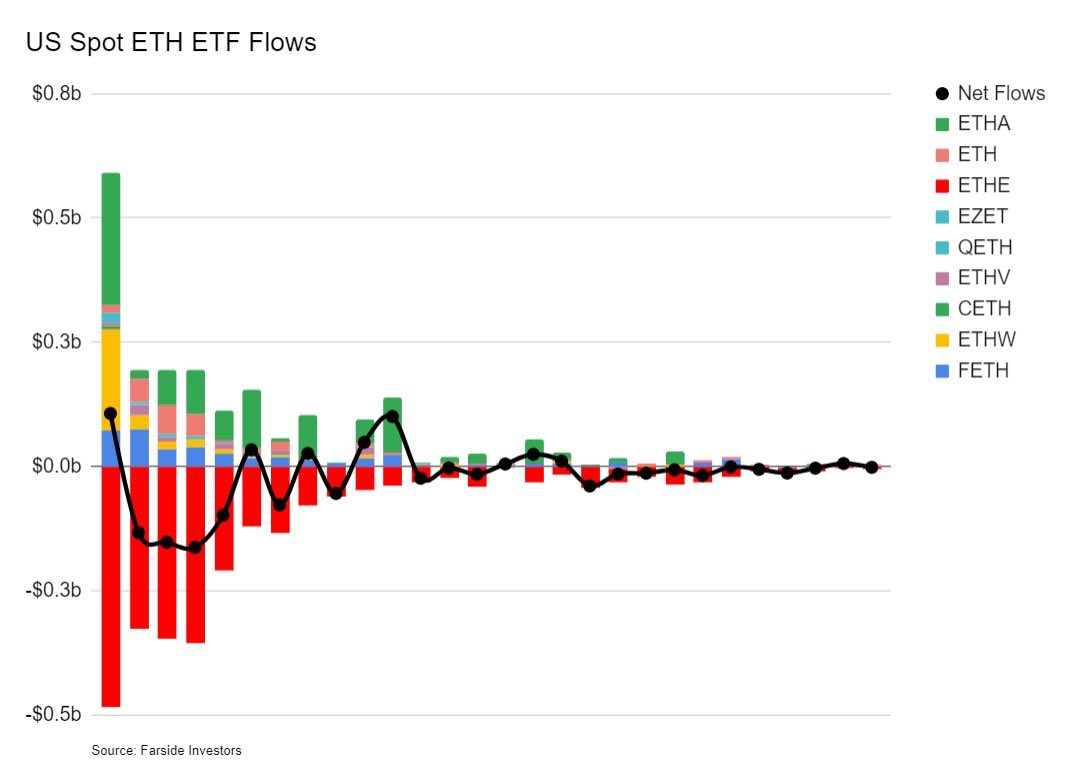

1. The showcased performance has been less impressive than anticipated, especially when set against Bitcoin‘s exceptional growth this year. Insights from Farside Investors suggest a dwindling enthusiasm for Ethereum ETFs, which contributes to the apprehensive outlook towards ETH. This decrease in interest could be a sign of broader reservations about Ethereum’s future accomplishments.

In my crypto investing perspective, I find myself observing the ongoing struggle of ETH at the $2,600 mark. There’s an air of uncertainty as the market ponders over its potential to push through and climb higher. The coming days hold the key to whether Ethereum can regain its stride or if it will keep trailing behind its counterparts in the crypto space. I sense a palpable anticipation from the market, making these developments particularly significant for ETH, as we stand at this critical juncture.

Ethereum ETFs’ Underwhelming Performance

The eagerness surrounding the introduction of Ethereum ETFs was palpable, but it soon turned into a situation where the news of their launch led to selling instead. Analysis from Farside Investors indicates that these Ethereum ETFs have struggled in terms of performance since their initial release. Inflows and outflows have dwindled significantly, indicating a decline in sustained investor interest, which stands in stark contrast to the initial enthusiasm leading up to their launch.

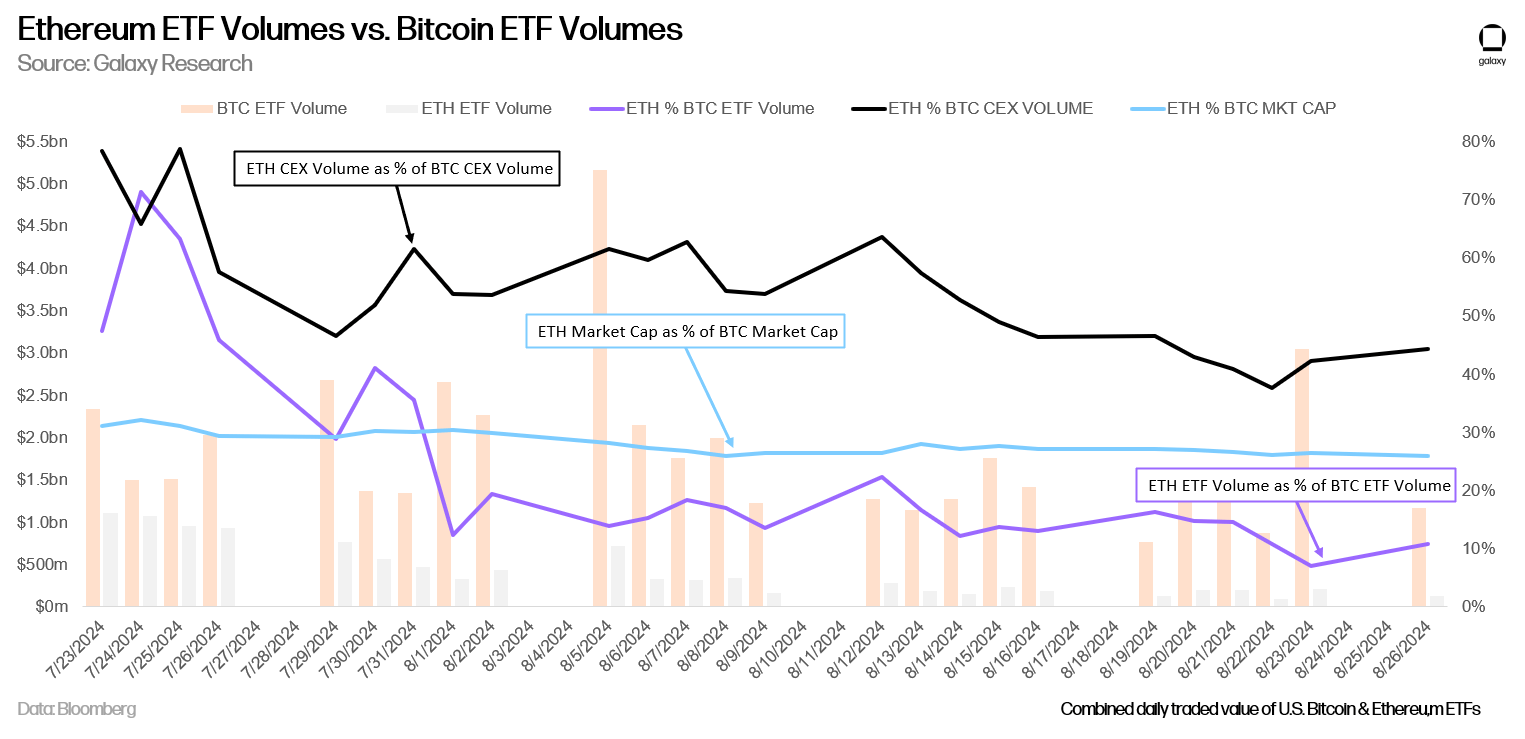

Additionally, data from Bloomberg provided by Galaxy Research shows that Ethereum ETFs have much lower trading volumes than Bitcoin ETFs. This difference is quite apparent, especially when looking at the trading volumes and market capitalization ratios for Ethereum versus Bitcoin on traditional exchanges. Even though Ethereum holds a substantial position in the market, these Ethereum ETFs are not receiving the same level of interest from investors as their Bitcoin equivalents.

As a researcher examining current trends, it appears that under the present market circumstances, investors tend to lean towards Bitcoin or even consider other options such as Solana instead of Ethereum. The lukewarm reception towards Ethereum ETFs reflects a broader market mood where Bitcoin remains dominant, with Ethereum and its financial instruments playing catch-up. This situation leads me to ponder about the future attractiveness of Ethereum ETFs and whether they can make an impact in a market that’s becoming increasingly competitive.

ETH Price Action

At the moment, Ethereum (ETH) is being traded at approximately $2,522. This price has remained below the $2,600 mark since last Tuesday, indicating a phase of doubt and instability. The importance of this $2,600 level stems from its role as a robust support level throughout much of August. Now that it’s acting as resistance, it hints at potential further drops in Ethereum’s price in the coming days.

To have bulls take charge and push prices higher, it’s essential for Ethereum to surpass the resistance at $2,600. If this barrier is broken, the subsequent goal would be reaching the previous high of $2,820, which suggests a possible bullish shift. On the flip side, if Ethereum can’t regain control above $2,600, it might prolong the existing downtrend with the significant support level lying at approximately $2,310.

In this persistent struggle between support and resistance points, the significance of the $2,600 figure becomes clear as it plays a crucial role in shaping Ethereum’s immediate price trend.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-08-31 09:40