As a seasoned researcher and analyst with extensive experience in the cryptocurrency market, I’ve witnessed numerous milestones and events that have shaped the digital asset industry. The recent launch of Ethereum ETFs is undeniably a significant development that has generated immense interest from both retail and institutional investors.

On Tuesday, Ethereum-based exchange-traded funds (ETFs) commenced trading and recorded substantial trading activity within the initial two hours. Notably, these Ethereum ETFs placed amongst the top 1% in terms of ETF trading volume.

Ethereum ETFs Surpass Traditional Launch Volumes

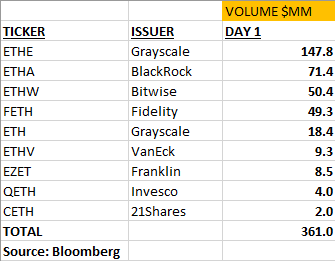

Based on information from Bloomberg ETF specialist Eric Balchunas, Ethereum ETFs traded a substantial amount of $361 million within the initial 90-minute period during their debut day. This figure surpasses the usual trading volume witnessed at the inception of conventional Exchange-Traded Funds (ETFs).

After 90 minutes, the total investment in our group stands at $361 million. This places us among the top 1% of ETFs in terms of trading volume, a rank comparable to that of $TLT and $EEM. However, it’s important to note that this surpasses the typical daily trading volume for new ETF launches, which seldom exceed $1 million on their first day.

Matthew Sigel, the digital asset research chief at VanEck, brought attention to these numbers during early trading hours, emphasizing that Ethereum ETFs accounted for over half of the trading volume compared to Bitcoin‘s $610 million on its first day. This suggests robust investor demand for Ethereum.

The future success of these Bitcoin ETFs, as evidenced by their initial trading volume of $4.6 billion in January, is yet to be determined. This significant volume during their debut could potentially signify promising futures for these newly authorized index funds in the second largest cryptocurrency sector.

ETH’s Price Targets Soar

According to crypto expert Doctor Profit, Ethereum’s price could experience a significant surge this year due to the anticipated influx of funds into the Ethereum ETF market.

As a researcher studying the impact of the Ethereum ETF launch on the market, I believe that while some investors may be expecting a correction due to the “sell the news” phenomenon, it’s essential to consider another perspective. The market might have already accounted for the ETF’s launch itself. However, what has yet to be factored in is the substantial inflows of US Dollars that will flow into these Ethereum ETFs over time. This could potentially lead to new trends and price movements that go beyond the initial launch effect.

Based on Ethereum’s market capitalization being approximately one-third the size of Bitcoin’s, Doctor Profit posits that each investment dollar in ETH carries three times the potential price influence as a Bitcoin dollar. This dynamic positions Ethereum as a potentially lucrative investment due to its relatively smaller market size.

The analyst argues that although the selling pressure from Grayscale’s Ethereum fund matches the Bitcoin ETF’s debut, the overall effect is anticipated to be milder.

Moving forward, Doctor Profit has outlined projected Ethereum prices for the upcoming months, which includes a possible price range of $4,500 to $5,500 by Q3 2024. This suggests a gradual and relatively subdued increase in value.

In the last two quarters of 2024 and the first quarter of 2025, Ethereum’s price range is projected to broaden from a range of $5,500 to $8,000. Notably, the second quarter of 2025 is anticipated to witness a considerable surge in Ethereum’s price, with potential targets reaching between $8,000 and $14,000.

Currently, ETH is priced at $3,444 during this update, exhibiting a flat trend as it remains relatively unchanged from the previous day’s value. The anticipated excitement over the upcoming Ethereum ETF market debut has yet to significantly impact its price.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-07-23 19:36