During a broader cryptocurrency market uptrend, Ethereum‘s price increased by 8.07% over the past week, putting it back into the $3,600 price range. However, Ethereum Spot Exchange-Traded Funds (ETFs) experienced a net outflow of approximately $38.2 million this week, ending a five-week streak of positive inflows. It’s worth noting that this drop in Ethereum ETF investments occurred concurrently with Bitcoin Spot ETFs recovering and reporting their lowest positive influxes in the past five months.

Ethereum Spot ETFs Open 2025 On Negative Note

After the U.S. elections in November, there was a surge in investor interest in Ethereum Spot ETFs and other cryptocurrency markets, driven by hopes for a crypto-friendly administration under President-elect Donald Trump.

Even though there was a substantial decrease of 23% in the value of cryptocurrencies, particularly Ethereum, there was a continued high level of interest in Ethereum Spot ETFs. This is evidenced by approximately $2.11 billion being invested in these funds over the course of the month.

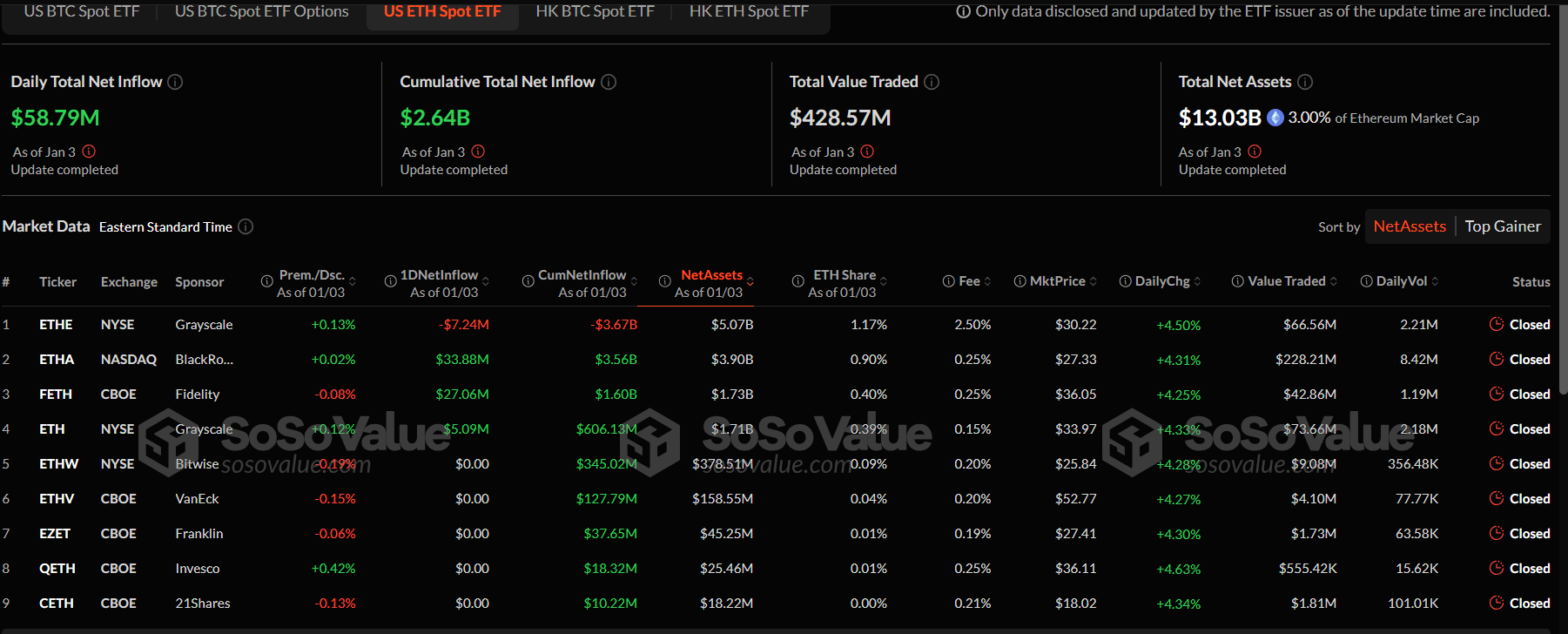

In contrast, data from SoSoValue reveals that Ethereum ETFs saw a total withdrawal of 38.20 million during the initial week of 2025, suggesting a shift in the attitudes of American institutional investors towards these investments.

In this scenario, Bitwise’s ETHE had the highest value of outflows at approximately $56.11 million, with Grayscale’s ETHE coming in second place at around $51.62 million in withdrawals. Additionally, Franklin Tempton’s EZET experienced outflows totaling $3.11 million.

Last week, Fidelity’s FETH fund received the highest inflows totaling $38.42 million, while BlackRock’s ETHA followed closely with investments of $33.88 million. Grayscale’s ETH had more moderate inflows amounting to 1.10 million dollars, whereas CETH from 21 Shares and VanEck’s ETHV saw no new deposits at all.

Currently, BlackRock’s ETHA is the most appealing Ethereum Spot ETF, amassing a total cumulative inflow of $3.56 billion. Nevertheless, Grayscale’s ETHE holds market supremacy with net assets amounting to $5.07 billion. Despite experiencing weekly net outflows recently, these Ethereum Spot ETFs have witnessed remarkable growth over the past few months, accumulating a combined total net asset value of $13.03 billion, which equates to 3% of Ethereum’s market capitalization.

Bitcoin ETFs Register $245 Million Inflows As 2025 Begins

As a researcher, I’ve observed an interesting dichotomy this week: while Ethereum Spot ETFs continued to experience negative returns, Bitcoin Spot ETFs witnessed a significant surge. Specifically, there was a weekly inflow of approximately $244.99 million into Bitcoin ETFs, with a staggering $908.10 million invested on Friday alone, driving this positive trend.

The total worth of all assets in the Bitcoin Spot ETF market currently stands at approximately $111.46 billion, with BlackRock’s IBIT holding a significant 48.68% share. As we speak, Bitcoin is being traded at around $97,638, while Ethereum’s market price hovers near $3,660.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-01-05 10:34