As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by the recent developments surrounding Ethereum (ETH). The surge above $2,600 is indeed a bullish sign, but the 50,000 ETH flowing into derivative exchanges is a double-edged sword.

During an optimistic trading period, the value of Ethereum (ETH) increased by more than 8%, reaching prices above $2,600. Nevertheless, during this upward trend, some market events have arisen that make some investors wonder about potential shifts in Ethereum’s future price trajectory.

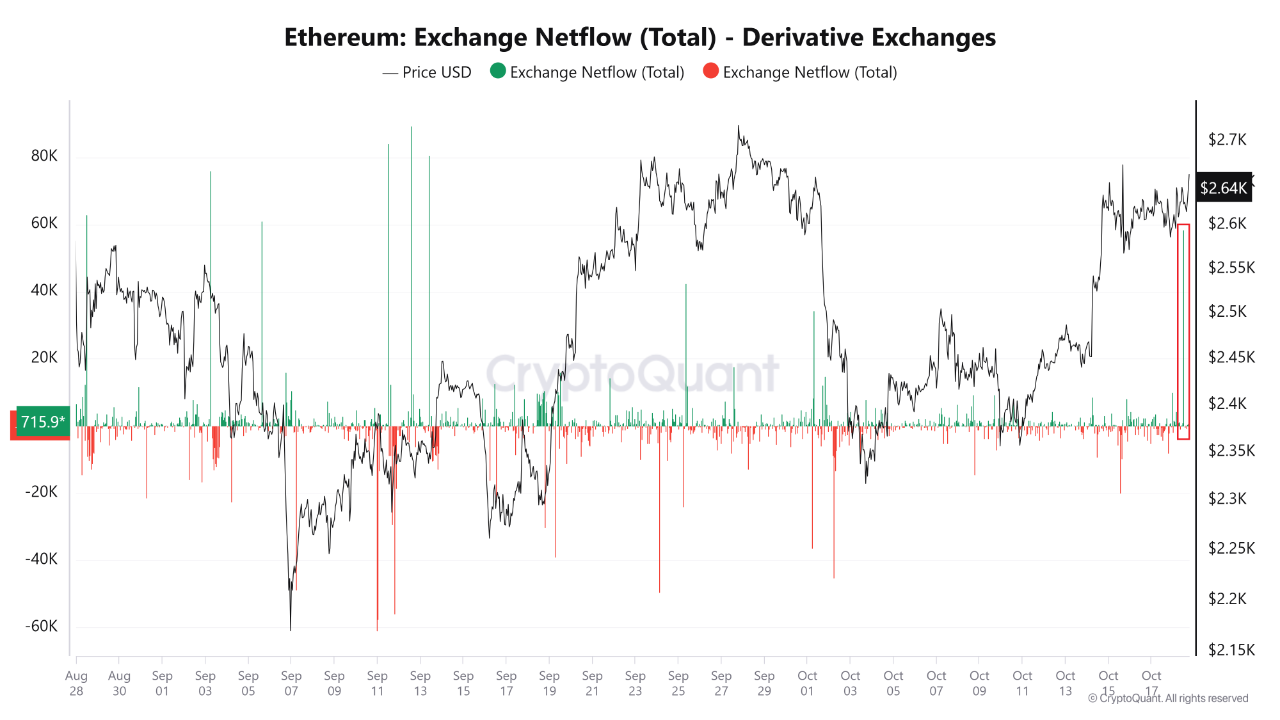

50,000 ETH Flow Into Derivative Exchange – Price To Rise Or Fall?

On CryptoQuant’s Quicktake post, user Amr Taha shared that more than 50,000 Ether, equivalent to approximately $132.12 million, has been moving into derivative exchanges, indicating a net inflow. Net flow here refers to the total amount of Ether deposited minus the amount withdrawn from these trading platforms, which deal with financial products like options and futures contracts.

Consequently, if more ETH is being deposited (net inflow) than taken out (net withdrawal) during the previous day, it means there’s an increased amount of ETH in storage. Pondering over this trend’s impact on Ethereum’s price, Amr Taha has proposed two scenarios:

Initially, it’s pointed out that a surge in the inflow of ETH to derivative platforms might hint at an increase in selling pressure. This is because traders could be aiming to dispose of their ETH by either opening a short position or setting a sell price for futures contracts. On the other hand, this increased flow could also suggest that traders are depositing ETH as collateral for margin or future contracts, demonstrating faith in the token’s potential profitability and expecting the price of ETH to rise.

As a crypto investor, I can’t help but notice the substantial inflow of Ether (ETH) that’s been happening lately. This surge in net flow carries a considerable weight, as it could potentially sway Ethereum’s price up or down, depending on how traders decide to act.

Ethereum Prepares For Encounter With Crucial Resistance

Additionally, it’s worth noting that Ethereum is currently being traded at approximately $2,636, marking a 1.11% increase in the past day. Over the last month, its value has risen by an impressive 12.89%. At present, the daily trading volume for this token stands at a significant $17.06 billion, representing a 12.89% boost.

Although these favorable statistics are present, information from CoinMarketCap indicates that the overall feeling towards the altcoin is mostly negative, possibly due to investors expecting a price decrease following ETH’s recent increase in value during the past week. Notably, the Ethereum daily chart suggests the token is approaching a significant resistance level at $2,700, which has previously acted as a strong barrier over the last two months.

Even though the Relative Strength Index hasn’t yet reached the overbought zone, it suggests that Ethereum’s price increase might not be nearing its end and could exceed its current resistance level. Furthermore, analysts have noticed an ascending triangle pattern on the ETH hourly chart, which implies a robust bullish tendency capable of propelling Ethereum prices above $2,700, potentially reaching up to $2,870 in the near future.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-19 20:10