As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of promising projects that have either flourished or floundered. Ethereum (ETH) is one such project that has undeniably made strides in the blockchain space since its inception in 2015. However, as CoinShares’ report suggests, the long-term value proposition of ETH remains elusive to many investors.

According to a report by CoinShares, the primary factor fueling demand for Ethereum (ETH) lies in its utilization within on-chain applications and token transactions.

Ethereum’s Use-Cases Have Increased, But Long-Term Value Is Missing

According to a recent comprehensive analysis by CoinShares’ Matthew Kimmell, while Ethereum has the capability to accommodate prominent apps down the line, many investors find it challenging to discern a substantial value proposition in its underlying ETH currency.

From its start in July 2015, Ethereum has advanced significantly, consistently expanding its utility as it adopted new roles, starting from basic token transfers. Its applications have since grown to encompass on-chain programs, decentralized financial platforms (DeFi), and more recently, non-interchangeable digital items known as NFTs.

Starting in 2018, Ethereum started finding more practical applications. The primary purpose of Ethereum transitioned from just transferring tokens to encompassing simple on-blockchain programs, digital identity solutions, and on-chain withdrawal services.

Starting in 2020, Ethereum has supported more intricate applications like staking protocols, liquidity mining, MEV (Maximum Extractable Value), bridges, oracles, and second-layer technologies. While these additional uses might seem advantageous for Ethereum initially, the issue arises from the fact that a limited number of services tend to dominate ETH usage.

The report reads:

In reality, it’s important to acknowledge that a limited number of Ethereum services account for most of its usage. These predominant services often involve speculation or straightforward value transfers, rather than the intricate “real-world application” scenarios that were initially imagined by Ethereum’s founding developers.

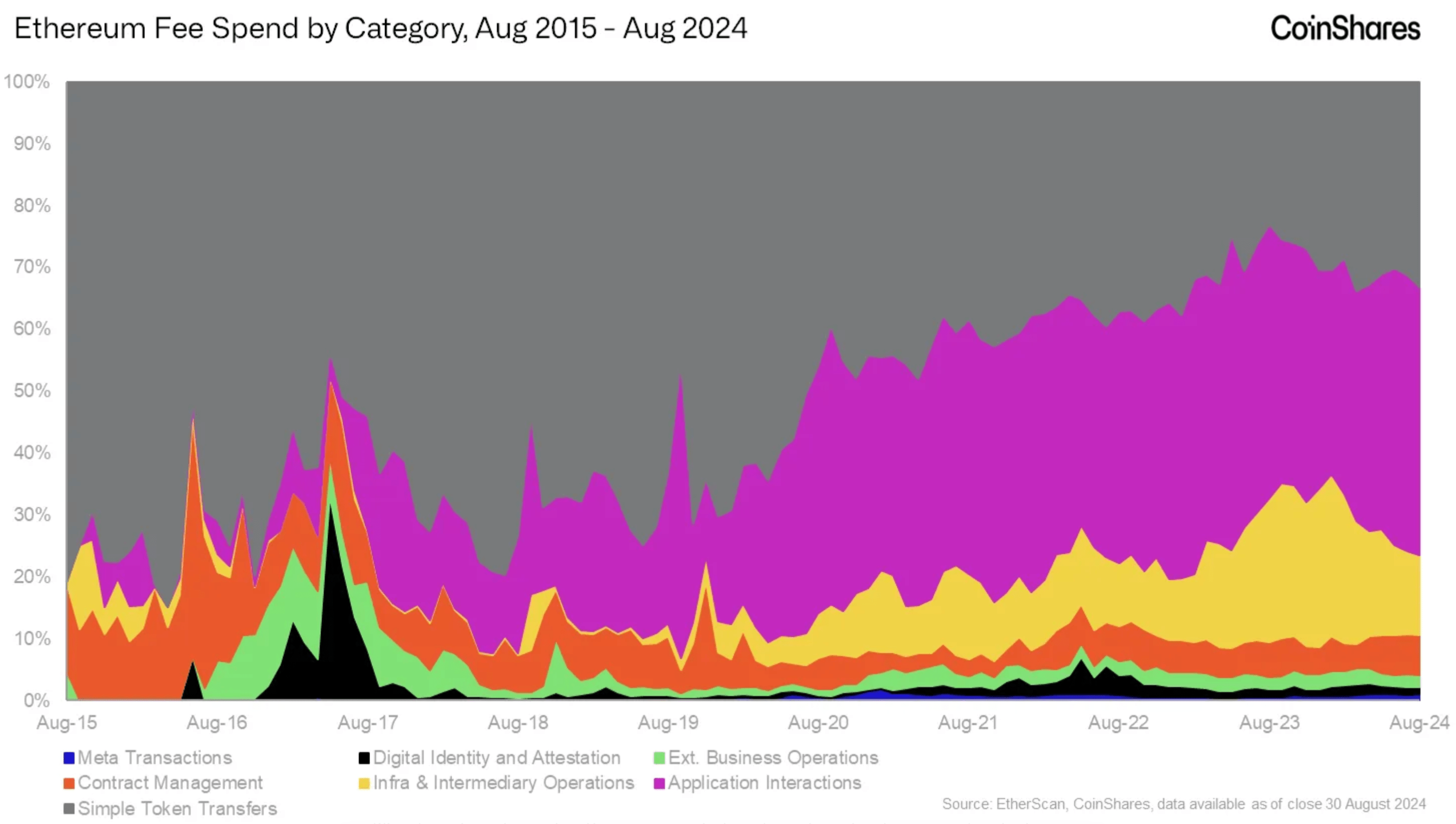

The graph we see here supports this notion, demonstrating that basic token transactions and app engagements make up the majority of Ethereum usage, with infrastructure, intermediary tasks, and contract administration coming in second place.

Marketplaces Dominate Application Usage, Stablecoins Lead Token Transfers

The report highlights that on-chain marketplaces – especially decentralized exchanges (DEXes) like Uniswap – dominate application interactions. Notably, over 90% of transaction fees originate from marketplace activity.

In the first six months of 2024, Uniswap accounted for roughly 15% of Ethereum’s total transaction fees. Given that it recently surpassed $50 million in earnings as the top decentralized exchange, this isn’t unexpected. Conversely, NFT trading platforms have experienced a significant drop in user transactions compared to their 2021 peak.

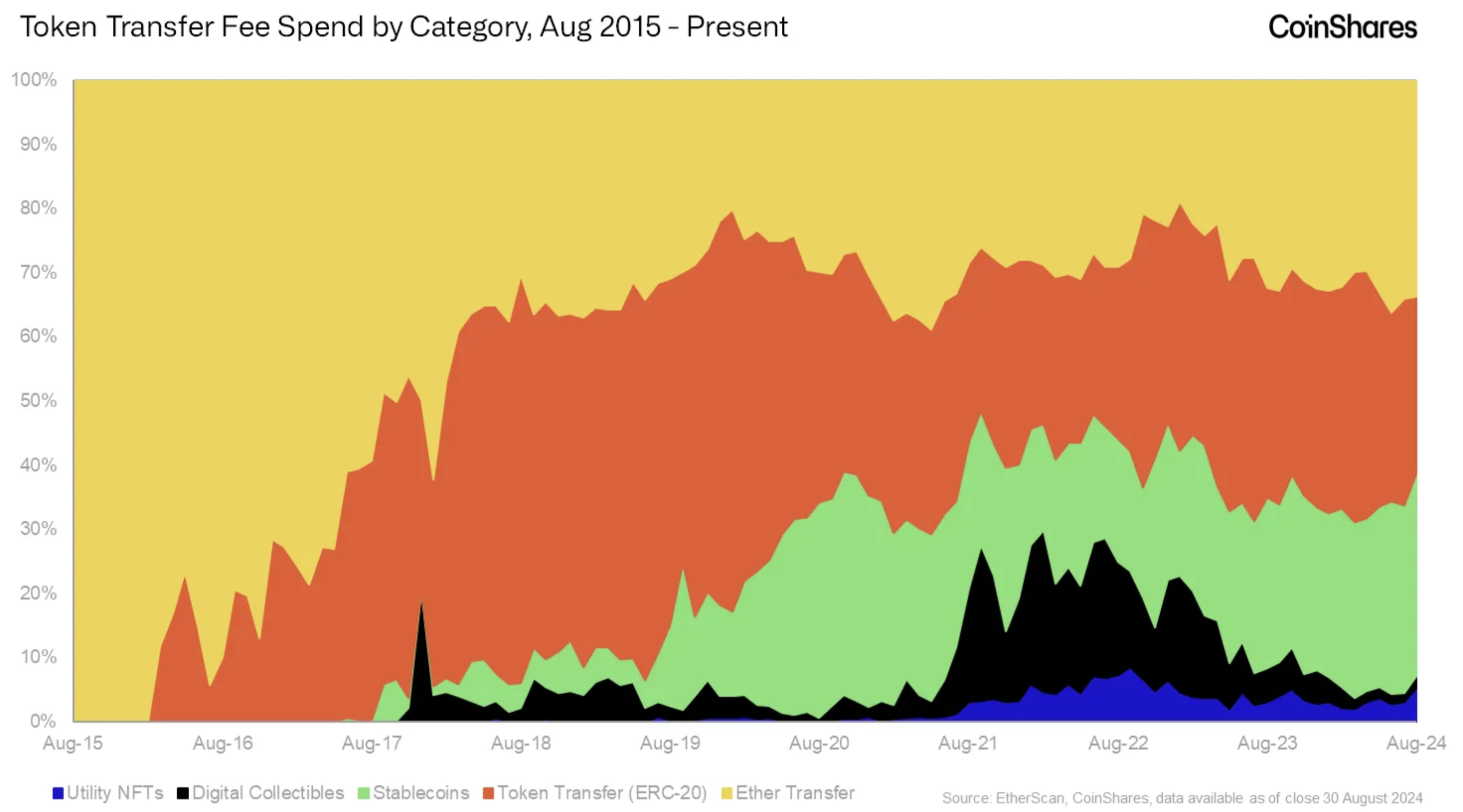

The transfer of digital tokens remains crucial in the Ethereum network’s operations. As the ecosystem broadens, the variety of tokens being moved around has grown. Yet, Ethereum (ETH) and stablecoins like Tether (USDT) and USD Coin (USDC) have become the most frequently used tokens when it comes to transaction costs.

The graph shows how the use of stablecoins, particularly USDT, significantly increased starting mid-2017, as it became a popular trading option for most ERC-20 tokens listed on cryptocurrency exchanges. The introduction of USDC by Circle towards the end of 2020 contributed further to the surge in stablecoin usage across the broader Ethereum network.

A notable point from the report highlights a rise in the application of Ethereum layer-2 alternatives. These solutions have helped alleviate some of Ethereum’s scalability challenges, but at the same time, they’ve unexpectedly decreased interest in Ethereum’s fundamental layer, as pointed out by Kimmel.

From our perspective, the recent significant shift, EIP-4844, that significantly boosted Layer 2 solutions, appears to be contradictory to the economic advantages offered by EIP-1559. The latter connects the worth of ether to its demand on the Layer 1 platform.

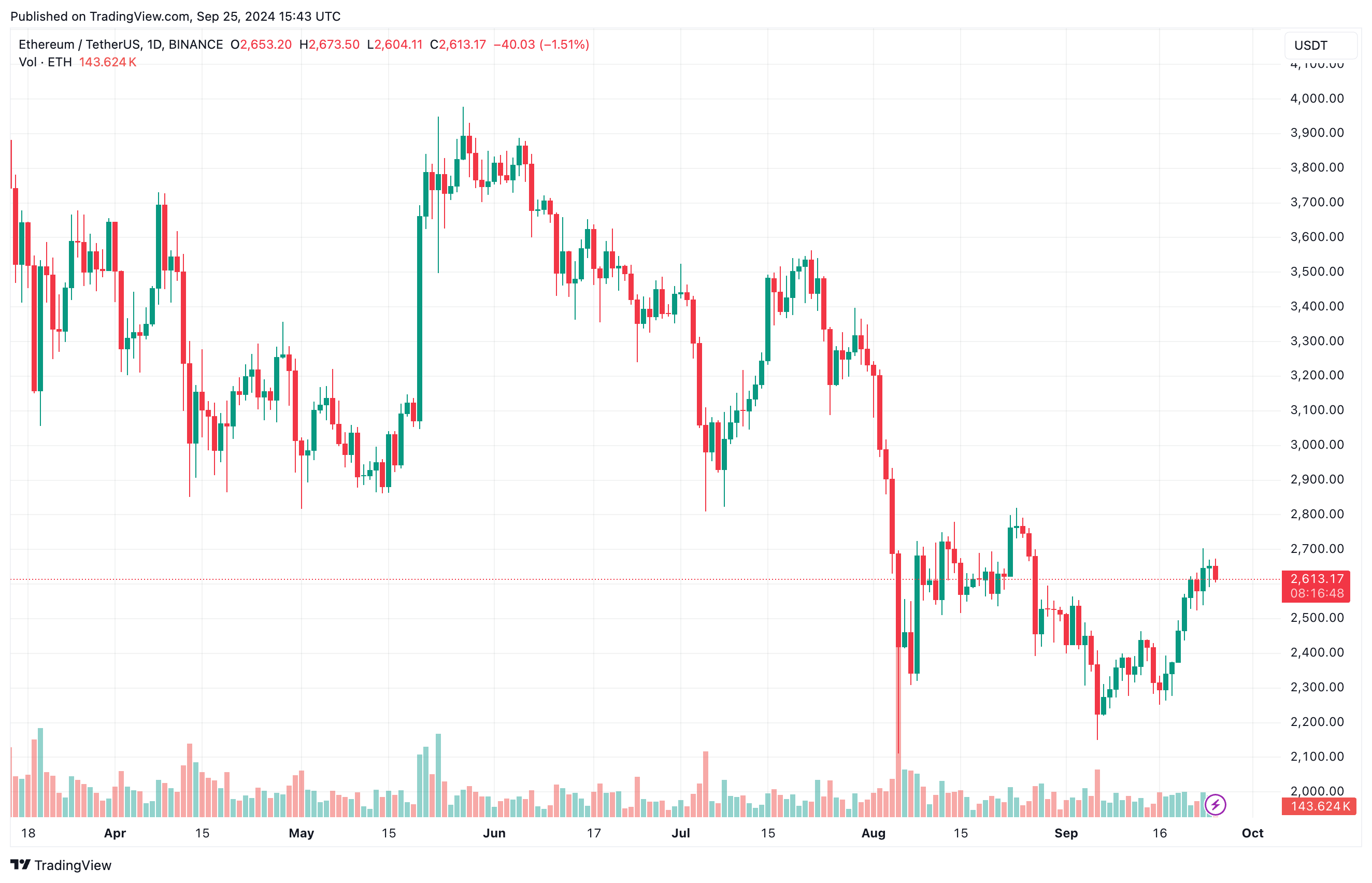

At this moment, ETH is trading at approximately $2,613, representing a 0.2% increase within the past 24-hours. The dominance of stablecoins like USDT and USDC is striking, with combined market caps totaling around $119 billion and $36 billion respectively in the current market landscape.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-09-26 08:46