As a seasoned researcher with over a decade of experience in the cryptocurrency market, I can confidently say that the recent surge in Ethereum’s DeFi Total Value Locked (TVL) and USDT dominance is nothing short of remarkable. Having closely followed the crypto market during the 2017 bull run and the subsequent bear market, I must admit that this resurgence feels like déjà vu.

Over the past two years, Ethereum‘s DeFi Total Value Locked (TVL) has surpassed $80 billion for the first time in that period. This significant increase in DeFi TVL is attributed to a substantial market upswing that boosted ETH‘s price to over $3,500 in November. The recent market surge can be linked to increased activity following President Donald Trump’s election win earlier this month.

Analyzing the Ethereum decentralized finance (DeFi) sector, Lido, a liquid staking system, stands out as the largest DeFi platform on Ethereum with an impressive $32.87 billion in assets secured (TVL). Following closely is Aave, a lending service, with approximately $26.7 billion, and EigenLayer, a platform for re-staking, holds around $14.2 billion. Together, these top three platforms dominate the value of Ethereum’s DeFi ecosystem.

The triumph of Donald Trump has sparked new hope for a possible bull run in the Decentralized Finance (DeFi) industry, which may boost interest in Ethereum (ETH). Furthermore, his election platform hinted at lessening regulatory hurdles in cryptocurrency, possibly leading to a more welcoming atmosphere for DeFi platforms within the United States. This development has led to increased growth in ETH and significant DeFi tokens since early November.

Ethereum Regains USDT Dominance

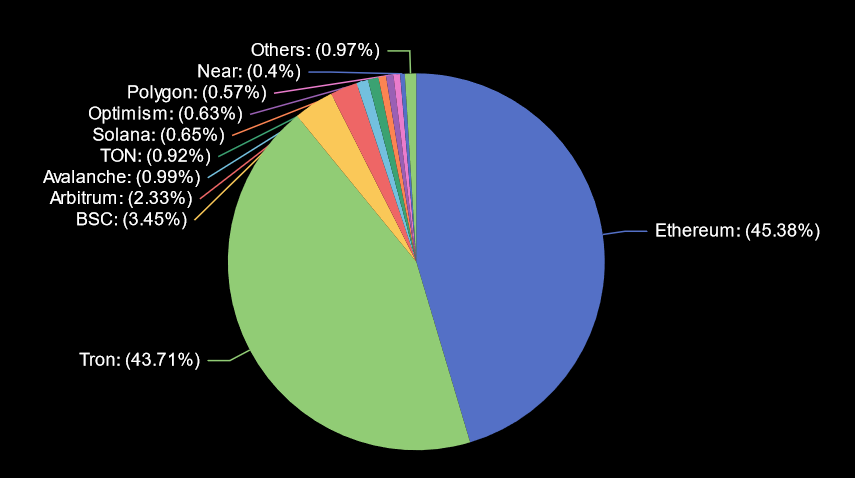

In a significant development, Ethereum has reclaimed its leading position as the host for Tether’s USDT stablecoin. This shift occurred following a 10% surge in USDT supply on Ethereum over the past week, pushing Tron aside. Here are some key details:

According to DeFiLlama’s data analysis, the Ethereum blockchain now holds over $60.3 billion of Tether (USDT) compared to Tron’s approximately $58.1 billion. In the past week, the USDT supply on Tron has decreased by 1.5%, whereas the USDT supply on Ethereum has increased by a substantial 9.3%. This recent trend has enabled Ethereum to regain its leading position in terms of USDT dominance, surpassing Tron for the first time since August 2022.

Last week, on November 21, I witnessed a significant shift in the cryptocurrency landscape as Ethereum surpassed Tron to claim the top spot for the first time. The gap widened even more on November 23, an interesting day marked by Tether minting a staggering $2 billion worth of USDT on the Ethereum blockchain, compared to only $1 billion on Tron’s network.

Courtesy: DeFiLlama

An increase in USDT supply suggests a positive outlook, as stablecoins play a vital role in maintaining liquidity and facilitating the movement of capital across the entire cryptocurrency market.

As a researcher, I’ve observed that Ethereum has become the go-to blockchain for financial institutions seeking to tokenize US dollar-backed real-world assets. On the other hand, Tron, with its low transaction fees and swift speeds, has gained traction as a preferred platform for stablecoin savings, particularly in countries grappling with high inflation rates.

ETH Price Action Ahead

In the past two days, the price of Ethereum (ETH) has rebounded from the $3,000 mark. At the moment of reporting, ETH is currently trading 4.17% higher at $3,457, with a market cap of $416 billion. Additionally, the open interest for CME futures on Ethereum has reached an all-time high, indicating that investors are optimistic about Ethereum’s future prospects.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-27 15:06