As a seasoned researcher with years of experience in the crypto-sphere, I must say that the recent spike in Ethereum’s transaction volume and whale transfer count is indeed intriguing. The rise in transaction volume, as shown by the graph, indicates an increase in investor interest, which is a positive sign for the asset’s sustainability.

Recent on-chain data indicates an increase in network activity measurements for Ethereum, potentially signaling a continuation of its upward trend.

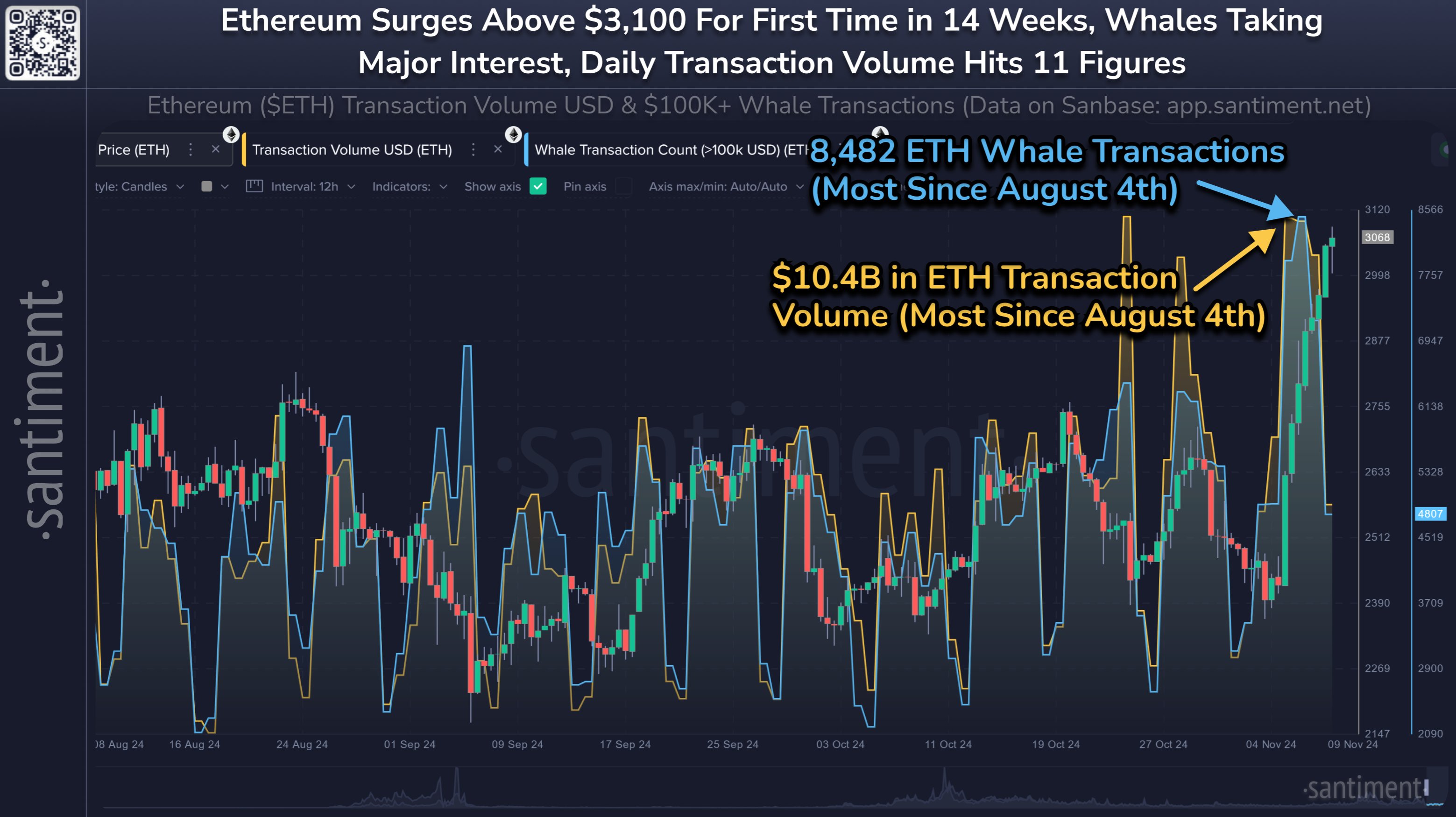

Ethereum Transaction Volume & Whale Transfer Count Have Spiked Recently

Based on information from the blockchain analysis company Santiment, it’s been observed that Ethereum has experienced a boost in two metrics related to network activity. These specific metrics are the number of Transactions and the count of Large Transactions by major investors (Whales).

In simpler terms, “Transaction Volume” refers to the overall sum (in US dollars) of the cryptocurrency being transferred by users on the Ethereum network as part of their transactions. This metric helps monitor the activity level within the network.

When the level of this metric is substantial, it indicates that the Ethereum blockchain is currently handling a significant amount of coin transfers. This pattern implies that investors are actively engaging in asset trading at present.

Conversely, a low indicator suggests that the current level of interest in the cryptocurrency might be relatively low, as those holding it seem to be transacting with a minimal quantity of Ether at present.

Currently, I’d like to share a graph illustrating the transaction volume evolution for Ethereum during the recent period:

Over the past period, I’ve noticed an impressive spike in Ethereum Transaction Volume as depicted in the provided graph. This trend suggests that investor enthusiasm for this asset is escalating concurrently with its rising price.

It’s possible to view this as a positive step forward for cryptocurrencies, since a growing level of network activity is usually necessary to keep price rallies stable over time.

historically, certain price fluctuations have spiked dramatically, yet the corresponding transaction volume didn’t show significant growth. Typically, these rapid changes tended to subside quickly.

The chart also contains the data for the other metric of relevance here, the “Whale Transaction Count.” This indicator measures the total amount of ETH transfers valued at more than $100,000.

In simpler terms, when we see such large transactions, we typically attribute them to major investors. So, the number of Whale Transactions indicates how active these high-value investors are in the market.

It’s clear from the chart that the indicator for Ethereum has risen significantly lately, suggesting that the surge in trading volume isn’t solely due to smaller investors but also large-scale players as well.

It’s not possible to determine if investors are buying or selling simply by looking at these indicators, as both types of transactions appear similar when viewed from this perspective. Given Ethereum’s recent surge, it’s likely that the observed activity is for accumulation purposes thus far.

The analytics firm explains,

During this current bull market, it’s likely that gains made on Bitcoin will shift towards Ethereum, possibly driving it closer to a new record high. This prediction is backed by the strong health of its network activity.

ETH Price

Over the past week, Ethereum experienced an increase of over 27%, surpassing the $3,150 mark.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2024-11-12 11:13