As a seasoned crypto investor with a deep understanding of the Ethereum network, I’m keeping a close eye on recent developments that could impact this leading altcoin. While Ethereum’s price has shown some signs of recovery, the underlying network dynamics are shifting in significant ways.

As an analyst, I’ve noticed some encouraging signals from Ethereum in the past few weeks. Despite the overall downtrend in the cryptocurrency market, Ethereum has shown some subtle signs of recovery by following Bitcoin‘s modest price increase.

Although Ethereum’s price has risen by 0.2% in the past day, there’s a hidden development taking place that could potentially have a substantial impact on Ethereum’s economic structure.

Decline In Network Activity Reduces ETH Burn

As a researcher studying the Ethereum blockchain, I observed that the ETH burn rate reached a yearly minimum during the month of April. This trend can be largely attributed to a noticeable decline in transaction fees across the network.

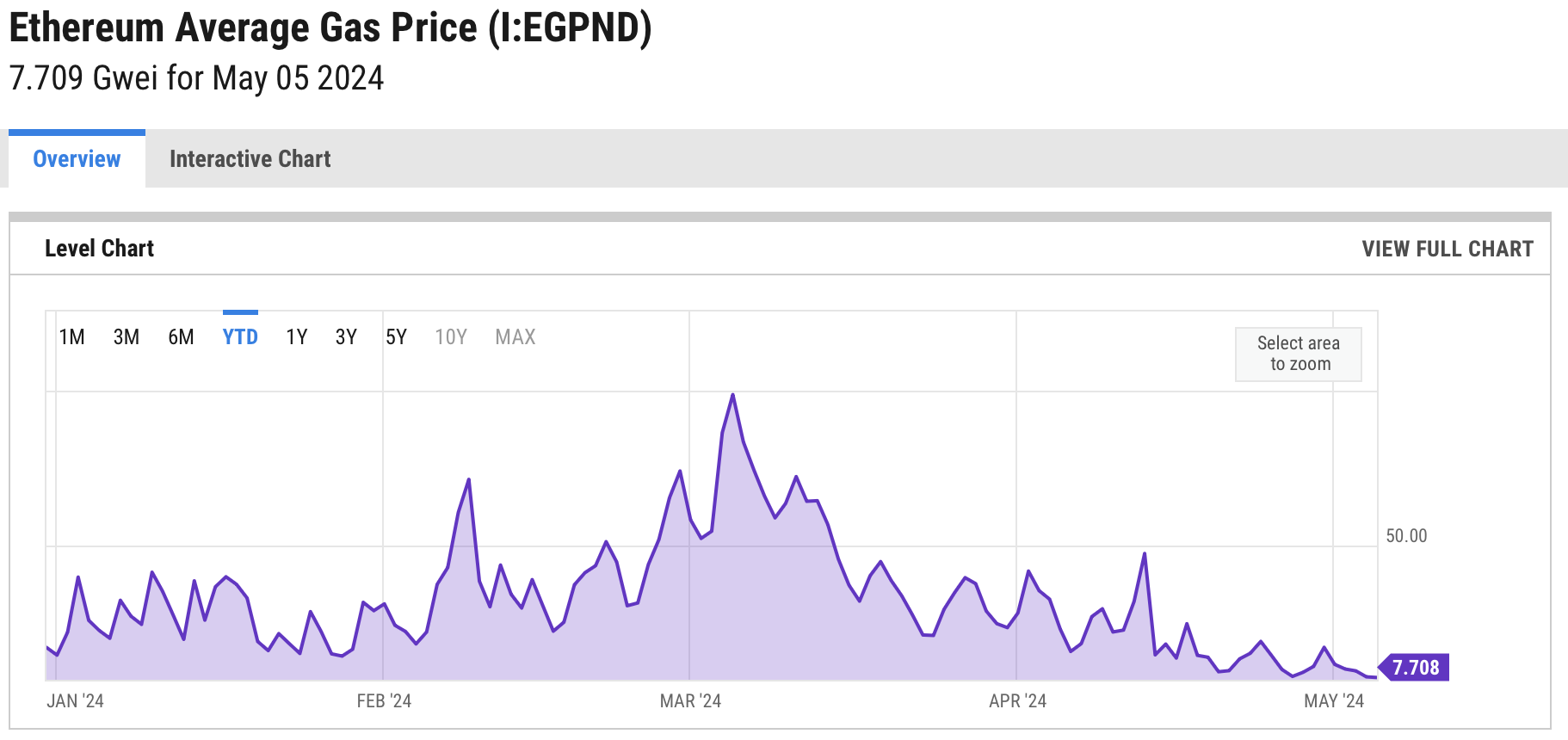

As a researcher studying Ethereum transaction fees, I’ve noticed that they have generally hovered around the 10 gwei mark throughout most of this year. However, in the past few weeks, these fees have taken a significant downturn and reached some of their lowest points. This trend has had a direct impact on the rate at which Ethereum is being burned as fewer transactions are occurring due to the lower fees.

As a researcher observing Ethereum network activity, I’ve noticed an intriguing development: the daily burned Ethereum has dropped significantly, reaching a minimum of 671 ETH in the last day. This is a considerable decrease from the daily consumption of 2,500 to 3,000 ETH that was common earlier this year.

As a researcher studying the Ethereum network, I’ve noticed an intriguing trend – the decline in burn rate isn’t just a random statistical fluctuation, but rather a mirror of deeper changes happening within the network.

The shift towards using Layer 2 solutions for network activities has been a major reason for the decrease in gas fees recently. These Layer 2 solutions not only make transactions faster, but they also reduce costs.

Additionally, advancements such as blob transactions, introduced in Ethereum’s latest Denascan upgrade, have enhanced cost efficiency on secondary layers.

Significantly, Blobs are a new capability added to improve Ethereum’s compatibility with Layer 2 platforms such as zkSync, Optimism, and Arbitrum. They effectively address data storage requirements through the Deneb update, which incorporates proto-danksharding via Ethereum Improvement Proposal (EIP) 4844.

These advancements in technology that help lower transaction costs for Ethereum come with complications for its built-in deflationary features.

As a crypto investor, I’ve noticed that the recent upgrade brought about a new fee structure for Ethereum transactions. Now, a portion of every transaction fee, which is referred to as the base fee, gets burned instead of going to the miner. This burning process could potentially decrease the total ETH supply in circulation.

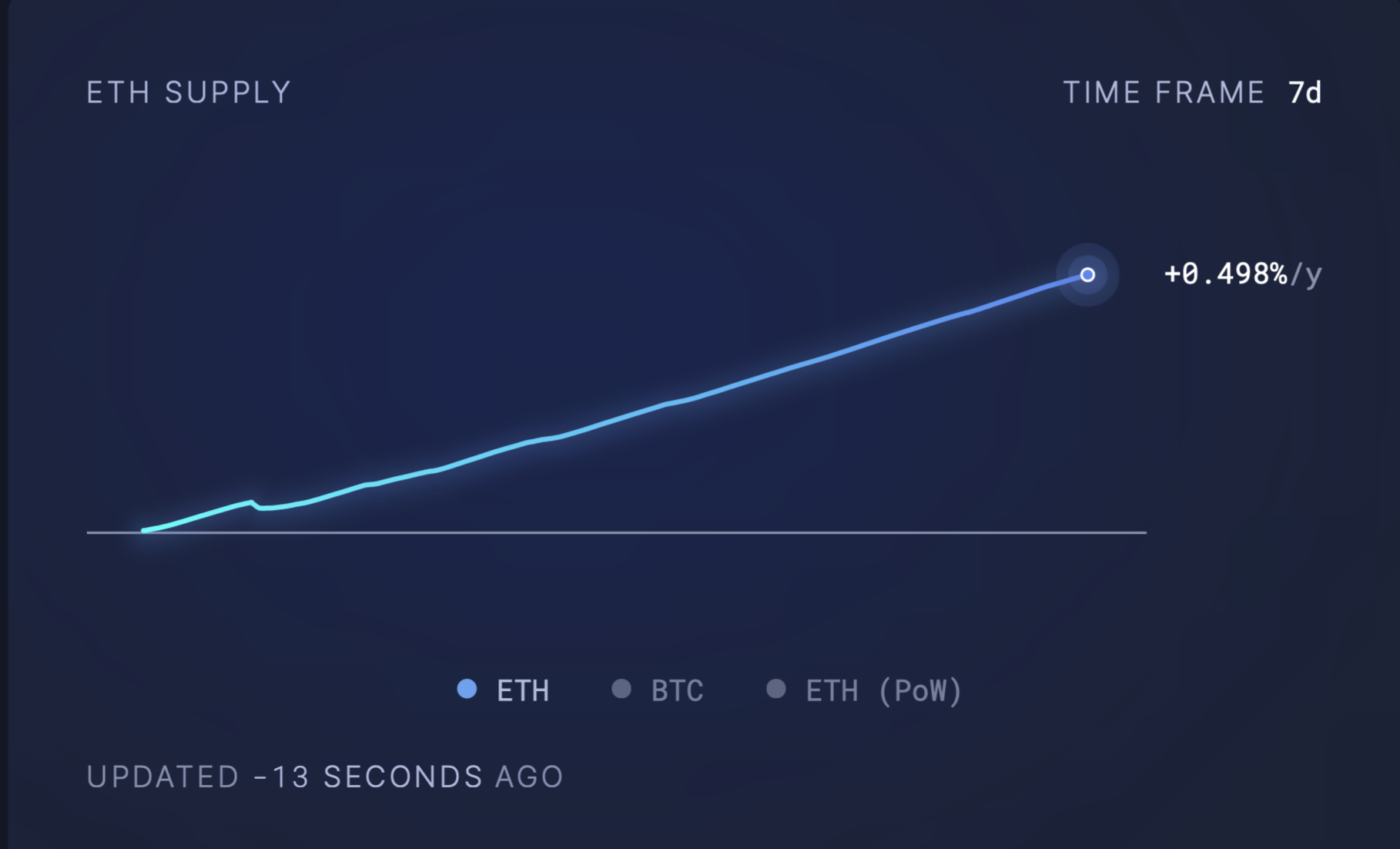

Based on Ultrasoundmoney’s analysis, the Ethereum supply is experiencing gentle inflation with a yearly increase rate of 0.498%. If network usage becomes more active, this trend could change as transaction fees rise and burn rates go up.

Ethereum Market Response

Although the complex workings of Ethereum’s network persist, the asset’s market value has yet to recover its previous peaks above $3,500. Currently, Ethereum is priced around $3,085, representing a slight decline from recent times.

As a crypto investor, I’ve noticed that recent price fluctuations reflect the larger market’s response to both internal and external influences. Internally, network changes have been a significant factor. Externally, regulatory issues from the US Securities and Exchange Commission (SEC) and broader economic uncertainties have left their mark as well.

As a crypto investor, I’m closely monitoring Ethereum’s gas fees trend and how it impacts the ETH burn rate moving forward. The economic viability of Ethereum hinges on the balance between these two factors.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-07 04:16