As a seasoned crypto investor, I’ve seen my fair share of market swings and analysis from various experts in the field. Javon Marks’ recent bullish analysis on Ethereum (ETH) has piqued my interest, especially given his identification of several metrics pointing towards new all-time highs. The bull flag structure on the chart, higher lows, and a hidden bullish divergence in the RSI are all signs of a strong uptrend.

Expert here: Crypto analyst Javon Marks has pointed out various indicators indicating a positive outlook for Ethereum (ETH). Notably, one such indicator hints towards Ethereum potentially reaching its all-time high (ATH) once more.

Bullish Metrics For Ethereum

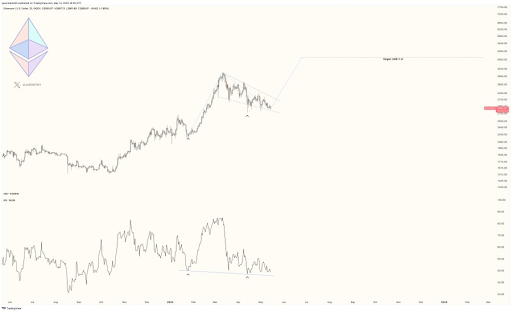

As a researcher studying cryptocurrency markets, I’ve noticed an intriguing development on the Ethereum chart. Marks, a respected analyst in the community, pointed out that Ethereum’s price action has formed a bull flag-like structure – a potential bullish signal. Additionally, he mentioned that higher lows are emerging in Ethereum’s price movement, which is another bullish indicator as it implies a robust resistance to bearish trends. Furthermore, Marks highlighted the significance of lower lows forming in Ethereum’s Relative Strength Index (RSI), suggesting a hidden bullish divergence with Ethereum’s price.

Mark suggested that Ethereum might see a new all-time high following a “bull flag breakout,” which could significantly influence the price movements of many altcoins. Previously, he predicted that Ethereum’s price could surge by approximately 63% to reach $4,811 after undergoing a substantial price increase.

Expert Michaël van de Poppe recently expressed his belief that Ethereum may make a significant price leap soon, potentially paving the way for altcoins to reach new peaks. He attributes this anticipated surge to developments surrounding the Ethereum Exchange-Traded Fund (ETF), which he believes will serve as a catalyst for altcoin growth.

Ethereum could experience a substantial decrease based on SEC’s potential rejection of Ethereum ETF applications, according to cryptocurrency analyst James Van Straten. This rejection might push the ETHBTC ratio down to approximately 0.03 from its current level of 0.047 as a long-term prediction.

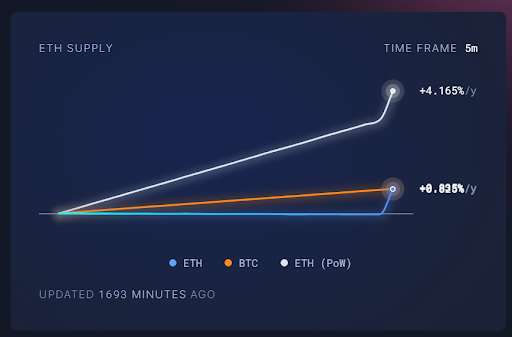

As an analyst, I noted one significant concern that contributed to my assessment that Ethereum’s price trend appeared bleak. This issue revolved around the decreased burning rate of Ether following the EIP-1559 (London) upgrade. Previously, transaction fees were paid entirely in Ether, which in turn led to a gradual decrease in the circulating supply through a process called “ether burn.” However, with the new upgrade, base fees are now paid in Ether and gas prices in Ether’s new unit, “Gwei,” leading to less Ether being burned per transaction. Consequently, Ethereum’s monetary policy has become more inflationary, which could potentially impact its long-term value proposition.

Things Aren’t Looking Good For ETH

As a researcher studying the cryptocurrency market, I’ve observed that Ethereum’s dominance and recent performance are trending towards their all-time lows, according to analyst Derek’s assessment. He explained that the focus has shifted back to Bitcoin due to the recent news about the potential rejection of the Ethereum ETF and its securities status. These developments have negatively impacted investor sentiment towards Ethereum, resulting in an unprecedented imbalance between Bitcoin and Ethereum’s market shares.

Derek pointed out that Ethereum’s lackluster price performance is negatively impacting other cryptocurrencies, causing their prices to stay low. He added that the prices of layer two coins are also experiencing significant pressure. The analyst warned that the situation could worsen as the ETH/BTC chart indicates a developing downward wedge pattern. According to him, altcoins can only regain momentum if Ethereum manages to break free from this trend soon.

Currently, Ethereum is priced approximately at $2906 based on market data from CoinMarketCap, reflecting a decrease over the past 24 hours.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-15 20:10