As a seasoned analyst with over two decades of experience in traditional finance and digital assets, I must say that the recent surge in Ethereum is truly captivating. The inflow of funds into Ether-based ETFs, particularly from heavyweights like BlackRock and Fidelity, is a testament to the growing institutional interest and confidence in this cryptocurrency.

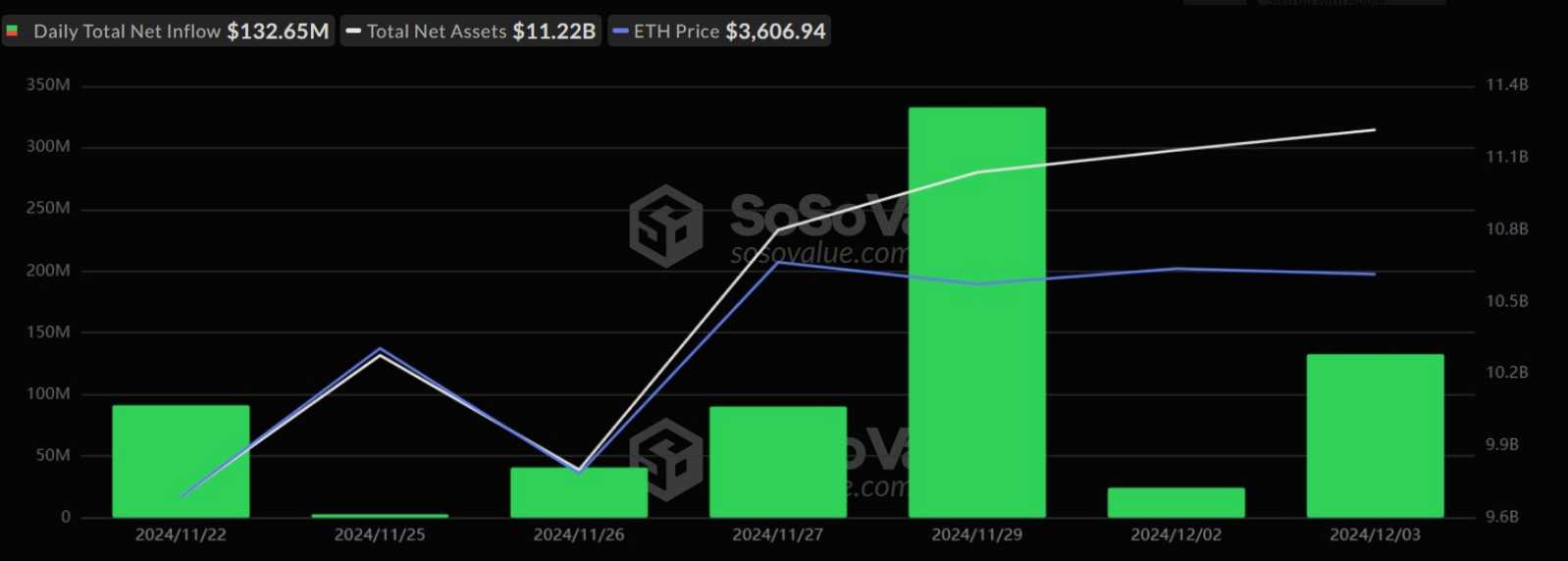

The growing significance of Ethereum is back under focus, as new data reveals a substantial surge in funds being poured into Ethereum-focused ETFs. Over the past week, these investment products have attracted $133 million in net inflows, suggesting a notable rise in institutional interest and investor confidence.

It’s not only Ethereum that’s bullish about Exchange-Traded Funds (ETFs). In fact, analysts are currently making significant price projections for this cryptocurrency. This optimism stems from the increasing use of its network in Decentralized Finance (DeFi) and technical indicators suggesting a further rise in its value.

On December 3rd, Ethereum spot ETFs recorded a total net influx of approximately $133 million, marking the seventh consecutive day of inflows. Specifically, Fidelity’s ETF (FETH) saw a net inflow of around $73.72 million, while BlackRock’s ETF (ETHA) recorded a net inflow of about $65.29 million on that day.

— Wu Blockchain (@WuBlockchain) December 4, 2024

Institutional Confidence And Strong ETF Inflows

There’s been significant interest in Ethereum spot ETFs recently, as over $714 million has flowed into it during the last week. This influx indicates that both institutional and individual investors are increasingly drawn to Ethereum. The ETHA ETF by BlackRock and the FETH ETF by Fidelity are spearheading this trend, collectively attracting approximately $140 million.

The growing backing from significant financial entities is fueling increased activity, showing that Ethereum is gaining traction within the traditional financial industry. This influx of funds signifies Ethereum’s potential role in bridging the gap between centralized and decentralized financial structures.

Analysts Anticipate Mid-Term Target Of $6,000 For Ethereum

Market specialists suggest that the support level for Ethereum is currently at approximately $3,300. This point offers investors a good entry point as it offers a decent mix of risk and reward. Analysts further predict an intermediate price goal of around $6,000 if Ethereum’s upward trend persists. Some analysts are even optimistic about a potential long-term price of up to $10,000 for Ethereum.

Should Ethereum’s $ETH value see a drop, be vigilant at the $3,300 mark as it could present a favorable purchasing chance.

Our mid-term target remains $6,000, with a long-term outlook of $10,000!

— Ali (@ali_charts) December 4, 2024

By January 4, 2025, CoinCodex anticipates Ethereum’s price will increase by approximately 6.17% to reach $4,052.34. With the Fear & Greed Index showing an Extreme Greed level of 78 and other technical factors at play, it seems many investors are preparing to make purchases.

Overconfidence in a market indicates there’s likely much room for expansion, but remember that cryptocurrencies have an innate risk of instability when investing.

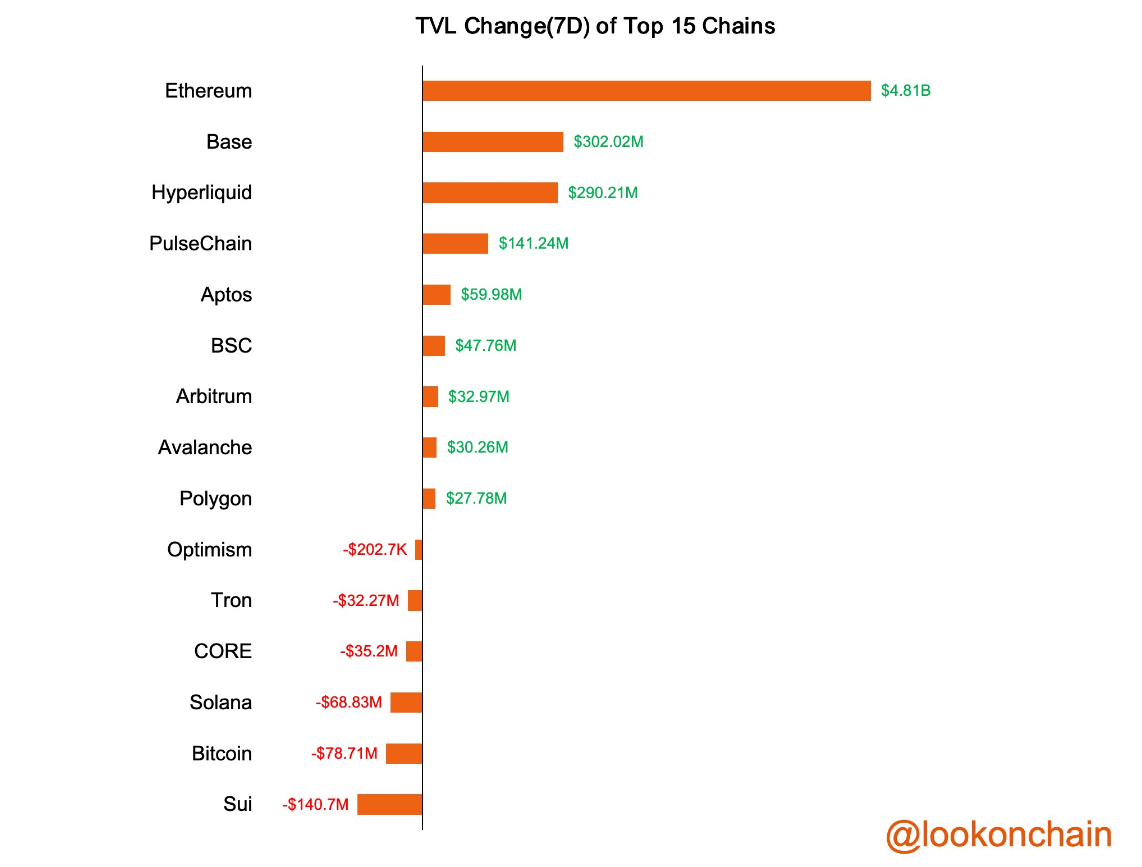

Over the last week, I’ve observed a significant growth in the Total Value Locked (TVL) for Ethereum, Base, and Hyperliquid. Specifically, Ethereum’s TVL has surged by approximately $4.81 billion, while that of Base has increased by around $302.02 million, and Hyperliquid’s TVL has grown by about $290.21 million.

Funds have flowed into #Ethereum, #Base, and #Hyperliquid.

— Lookonchain (@lookonchain) December 2, 2024

Additional Stimulus & Growth In TVL

In just a week, Ethereum’s supremacy in the Decentralized Finance (DeFi) market was reinforced as its locked total value increased by an impressive $4.81 billion. Yet, even though other networks like Base and Hyperliquid saw their Total Value Locked (TVL) grow too, Ethereum remains the undisputed leader in this sector.

The path of Ethereum looks promising, boosted by strong ETF investments, a positive technical forecast, and a growing Total Value Locked (TVL). While reaching $6,000 might take some time, the argument for its potential growth remains convincing because of institutional backing and consistent progress.

In simpler terms, Ethereum continues to play a crucial role within the world of digital currencies, offering both credibility for investors and innovative advancements.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-05 19:17