As a seasoned researcher who has navigated through the tumultuous seas of the cryptocurrency market since its inception, I find myself once again captivated by Ethereum’s latest surge above $3,900. The rhythm and patterns in this market are much like a symphony to my analytical ears – complex, intricate, yet beautiful when deciphered correctly.

Ethereum (ETH) surpassed the $3,918 mark and is now inching closer to its 52-week high of $4,093. With a strong push, it’s currently trading at approximately 4% below its yearly peak. In the last 24 hours, Ethereum has shown a volatility of 5.3%, and its market capitalization stands at an impressive $474.12 billion, with a 24-hour trading volume of $69.17 billion.

This third consecutive rise in Ethereum prices has seen an approximately 28% increase. Moreover, it strengthens the likelihood of a “triple white soldier” formation, which is a bullish trend pattern, on the weekly price chart.

As an analyst, I’m observing a significant milestone in the Ethereum market: its current market capitalization has soared to an impressive $472 billion. In addition, over the past 24 hours, the trading volume has hit a staggering $65.92 billion. With these figures painting a positive picture, there’s a growing anticipation among analysts that this rally could establish a fresh 52-week high this week, despite the ongoing whale sell-off.

Justin Sun Offloads 41,630 ETH Since November

With Ethereum’s surge in value, several major investors (referred to as whales) are now cashing out their holdings. The term “trending name” refers to Justin Sun, the creator of the Tron blockchain platform, who has recently transferred 20,000 Ether tokens to the HTX exchange.

The value of the deposit is now $76.3 million due to Ethereum’s market price climbing above $3,800. The crypto market has been buzzing about Justin Sun’s series of sales since the early November rally, which amounted to 41,630 ETH valued at approximately $146 million.

Approximately $137 million in Ether, totaling about 39,000 units, was transferred to HTX, while around $8.76 million worth of tokens were sent to Poloniex. The average cost per unit during this selling spree was approximately $3,505.

Even though there’s been a decrease in holdings (sell-off), the surge in Ethereum continues to strengthen and seems poised for a powerful advance, with ETFs signaling growing interest from institutions.

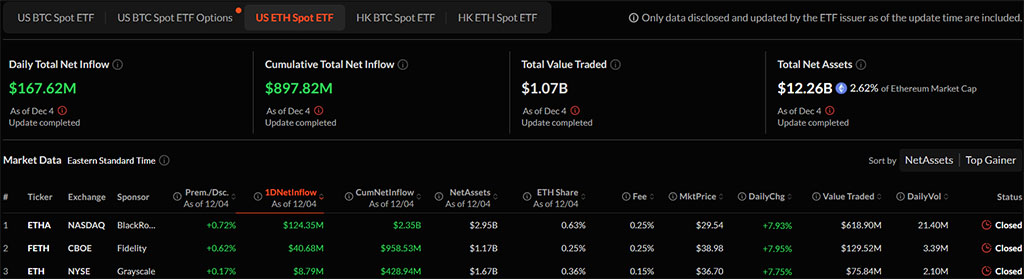

Ethereum ETFs Record $167M in Daily Inflows on December 4

Currently, Bitcoin (BTC) is hovering just under the $103,000 mark and has seen a daily volatility of 6.7%. With a market cap of approximately $2.03 trillion and a 24-hour trading volume of $168.35 billion, Bitcoin’s total daily net inflow stands at an impressive $556.82 million. Notably, BlackRock’s Bitcoin ETF has been the top performer, recording a net inflow of $571.71 million.

With a growing optimism in the cryptocurrency sector, there’s been a steady rise in institutional interest towards Ethereum. This trend is clearly seen in the significant daily net inflow recorded on December 4, amounting to $167.62 million for US-based Ethereum ETFs trading on the spot market.

Just like Bitcoin experienced a surge after its ETF was introduced, the introduction of BlackRock’s Ethereum ETF has led to an increase in demand, with a significant inflow of $124.35 million in a single day. The price action suggests that Ethereum could soon reach a new 52-week high.

Ethereum Rally Targets $4,000 Breakout

On the weekly chart, the price of Ethereum demonstrates a trend suggesting a bottom reversal that’s picking up speed. After a retreat in Q2, the price of Ethereum regained its bullish trend in Q3, bouncing back from the 200-week moving average at $2,355.

Source: Tradingview

The price of Ethereum has surged by nearly 66% over the past 30 days. This results in four bullish candles in the weekly chart, with a minor red candle.

Currently, the Ethereum price graph indicates a weekly candle moving beyond the significant resistance area just beneath the $3,900 mark. Additionally, Ethereum’s price is aiming to test the 100% Fibonacci level at its 52-week high of approximately $4,093.

This week saw a significant 5.78% increase, boosting the potential for a fresh record high. The rising trend momentum is indicated by this upsurge, as evidenced by a slight upward movement in the weekly ADX line and a consistently optimistic position of the VI line within the DMI indicator.

Therefore, this technical indicator suggests a strong bullish trend that’s picking up speed. Notably, the 100-week and 200-week simple moving average lines have crossed over, signaling a shift in Ethereum’s long-term price behavior. This development increases the likelihood of an uptrend or bull run.

Based on the Fibonacci ratios applied to the range between Ethereum’s 52-week high and low, possible future price targets can be found at approximately $4,631 and $5,316. This suggests that Ethereum may have a 35% upward momentum in its weekly price movement.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-12-05 15:17