In Q1 2024, Ethereum (ETH) experienced a remarkable price surge of almost 100%, leading to significant gains. Beyond the price increase, Ethereum’s blockchain produced impressive earnings, amounting to approximately $369 million. This unanticipated profitability has sparked curiosity about how a blockchain network like Ethereum can become profitable.

Ethereum Revenue Potential

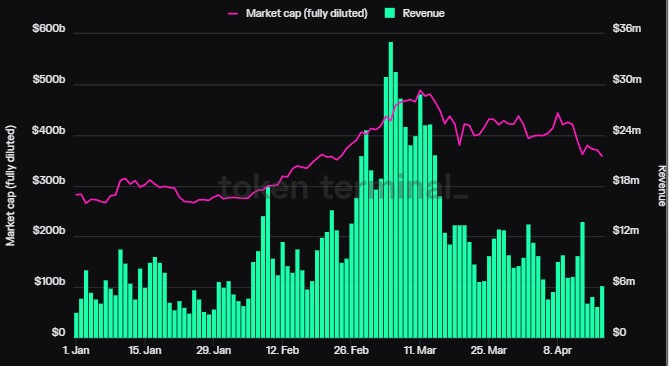

According to Token Terminal’s latest study, Ethereum’s approach to gathering transaction fees is a significant part of its commercial strategy.

When using apps on the Ethereum blockchain, every network participant must pay fees in ETH. This fee system is significant because it generates income for Ethereum.

After transaction fees are settled, a certain amount of ETH gets destroyed and taken out of circulation forever. This action, often called “ETH buyback,” is advantageous for current ETH owners since the decreased supply leads to increased scarcity and value of the remaining ETH tokens. Consequently, the daily elimination of ETH supports the economic well-being of Ethereum holders.

Instead of destroying Ethereum tokens through mining, Ethereum generates new tokens as incentives for validators who successfully add new blocks to the Ethereum blockchain.

The rewards function much like conventional stock incentives and serve to motivate validators in ensuring the network’s stability and security.

Despite this, it’s essential to remind you that creating new ETH tokens reduces the value of the Ethereum held by current owners.

In simpler terms, Token Terminal calculates the gap between the amount of USD value from burned Ethereum (earnings) and newly issued Ethereum (costs) each day. This difference represents the income for existing Ethereum owners or those who own a part of the Ethereum blockchain. By performing this calculation daily, we can assess Ethereum’s profitability.

Reduced Transaction Costs Drive $3.3 Billion Growth

At the beginning of 2024, Ethereum underwent a major revision in its income structure. This was followed by the long-awaited Denas upgrade to Ethereum’s ecosystem towards the end of the first quarter. This update introduced several notable modifications, among which is a groundbreaking data storage system called blobs.

The update has eased traffic pressure on the Ethereum blockchain and noticeably lowered transaction fees for platforms like Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base.

With the introduction of the Dencun update and the use of blobs and Layer 2 networks, Ethereum’s income has experienced a notable boost.

Based on Token Terminal’s figures, the blockchain’s income has grown by 18% yearly, equating to a substantial $3.3 billion. This income surge is largely due to lower transaction fees, making Ethereum a more enticing choice for both users and developers.

Although we experienced an uptick in earnings during the second quarter of 2024, it’s important to note the influence of market adjustments and waning investor enthusiasm at this time.

In the last month, Ethereum’s earnings have dropped by more than half (52%). The primary causes of this decrease are the current market trends and a short-term loss of interest from investors.

Over the last month, the fully diluted market capitalization of Ethereum, as seen in the data, has dropped by 15.2%, amounting to $358.47 billion. Likewise, the circulating market cap has also decreased by the same percentage, resulting in an identical value.

The trading volume of tokens for the previous month was $712.93 billion, representing a decrease of 18.6% or $126.79 billion in comparison.

The current price of Ethereum (ETH) is $3,042, marking a 0.4% rise over the past 24 hours. However, it remains uncertain if these modifications and fee reductions will yield similar results in Q2, or how increased trading activity could further boost ETH prices to new heights.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

2024-04-19 10:23