As a seasoned researcher with over two decades of experience in the cryptosphere, I must say that the current surge in Ethereum’s Blobs usage is nothing short of fascinating. The data we are witnessing this November is reminiscent of the early days of the internet, where the world was still discovering the infinite potential of decentralized networks.

It’s clear that there’s been a significant increase in the utilization of Ethereum‘s data management tool, “Blobs”, introduced earlier this year. This points to a rising trend towards the acceptance of Layer 2 scaling options, which provide faster and economical transaction processing.

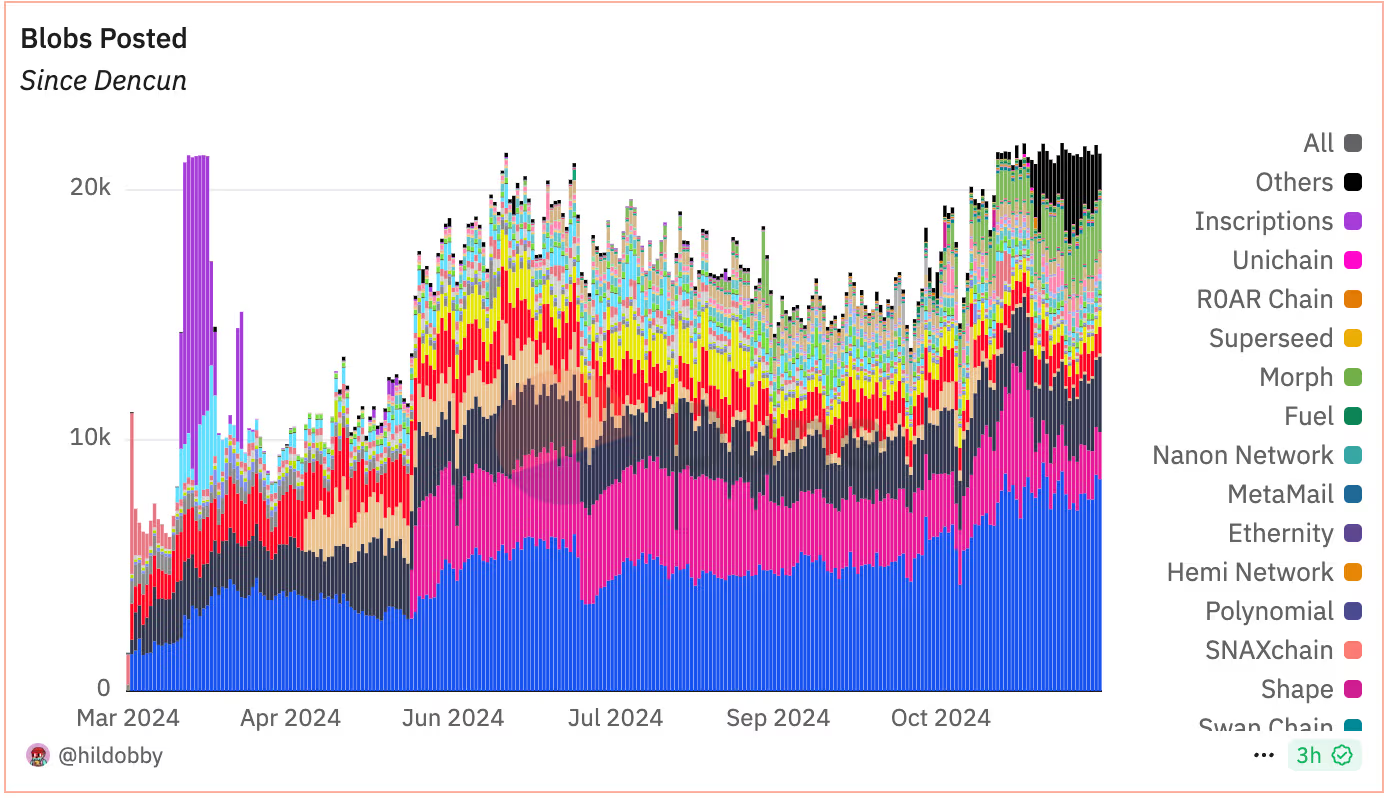

It’s been found that, this November, the daily average number of blobs or binary large objects being uploaded to Ethereum surpasses 21,000. This high level of activity on the Ethereum network is a record-breaking first since March 2024.

For the first time, Ethereum introduced blobs with the Dencun upgrade. These are large data chunks attached to regular transactions, which store data off-chain and prevent mainnet congestion.

Courtesy: Hildobby / Dune Analytics

The increasing frequency of blob postings suggests a rising trend in the utilization of Layer 2 solutions such as BASE, Arbitrum, Optimism, and others. These systems utilize blobs to group transactions, process them off-chain, and subsequently forward them to the Ethereum network for validation. In relation to this progression, Matthew Sigel, head of digital assets at VanEck, commented:

“The number of transactions for Ethereum and its layer-2 solutions are hitting record levels, up around 40% compared to the summer period. Simultaneously, there’s been a roughly 20% rise in the average ‘blob count’, pushing layer-2’s blob fees to a 30-day peak.

Rising Demand for Ethereum Blobspace

As an analyst, I’d rephrase the statement as follows: Within Ethereum’s block structure, there exists a specific area known as Blobspace, which temporarily houses data for Layer 2 protocols. These temporary storage fees, paid in Ether, contribute to the reduction of circulating ETH supply by being burned, much like transaction fees. This mechanism counters the notion that Layer-2 protocols have hindered Ethereum’s growth and advancement.

On Monday, the blob base submission fee surged to $80, the highest since March, while the average number of blobs posted per Ethereum block increased to 4.3. More notably, blob fees have burned over 166 ETH, valued at around $560,000, in the past seven days. In its newsletter, Artemis noted:

As a researcher studying the evolution of blobs in EIP4844, I’ve noticed that historically, blob fees have been relatively low due to the independent fee market they possess, which hasn’t seen significant price discovery. However, with an increase in onchain activity lately, there’s been a surge in demand for L1 blobspace. This surge has propelled the blob fee market into the process of price discovery.

Courtesy: Dune Analytics

ETH Price Action

In response to Donald Trump’s declaration about increasing import tariffs, the cryptocurrency market, including Bitcoin, is experiencing significant downward pressure from sellers. Today, the price of Ethereum dropped by 5%, reaching levels around $3,300.

Here’s the plan: Bullish on $ETH until May, aiming for 10k. Then, take profits and step back. The real play is for 20k by the end of 2025. Ride the early wave, then let the long-term gains roll in.

— Wolf 🐺 (@IamCryptoWolf) November 25, 2024

In spite of current conditions, crypto market experts remain optimistic regarding Ethereum (ETH), anticipating a significant surge towards $10,000 by mid-2025. Furthermore, analyst Crypto Wolf envisions ETH reaching $20,000 by the end of 2025.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-11-26 15:19