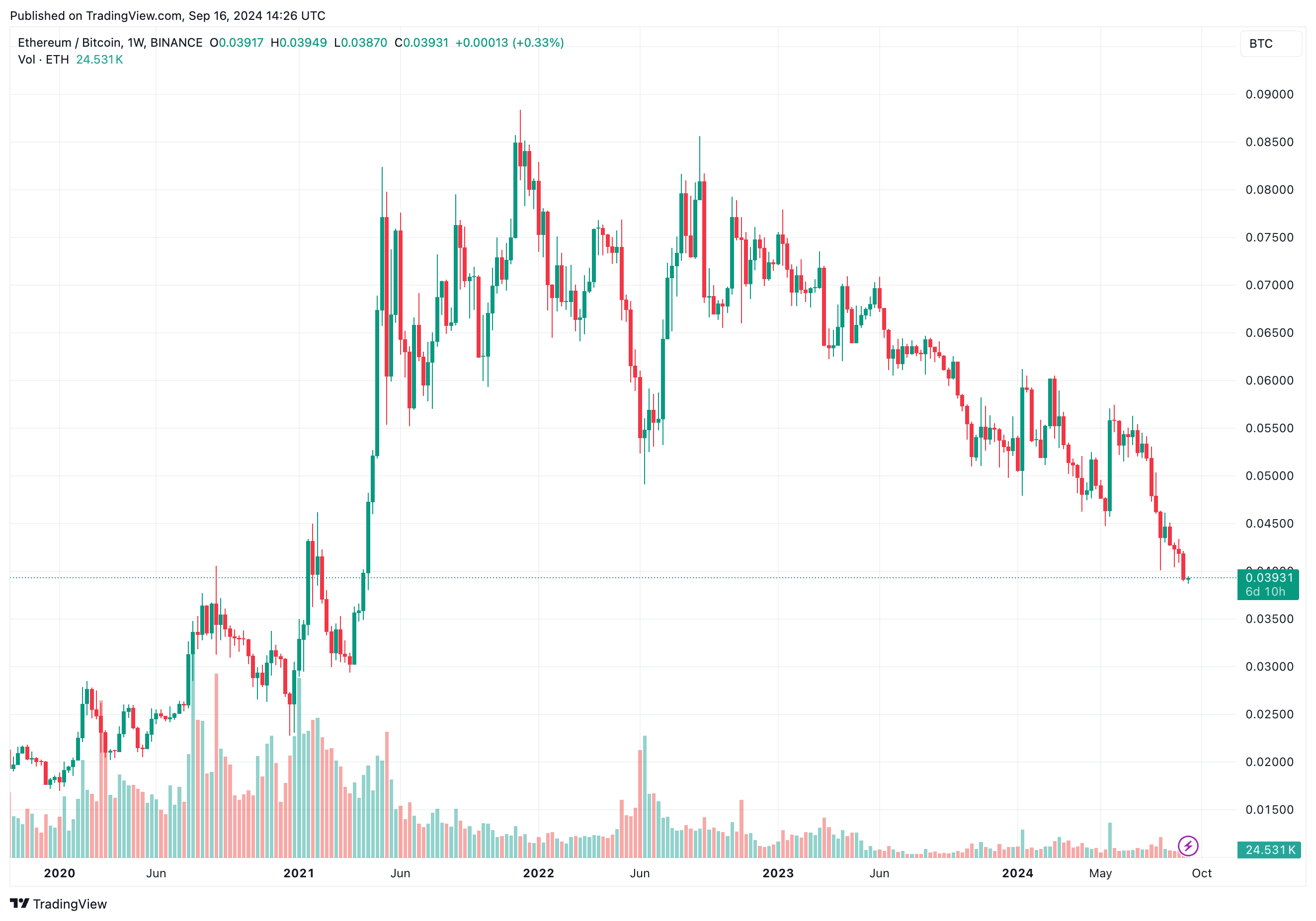

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of ups and downs, bull runs, and bear markets. Today’s ETH/BTC ratio sliding below 0.04 is reminiscent of the April 2021 dip, a stark reminder that this market never sleeps.

Today, the value of one Ethereum relative to one Bitcoin dropped below 0.04, a level not reached since April 2021. This downward trend in the Ethereum-to-Bitcoin exchange rate might have various effects on the broader altcoin market.

Altcoins Might Suffer Due To Weak Ethereum

One of the key indicators to gauge the resiliency of the altcoin market is the ETH/BTC ratio. The ratio essentially tracks the relative price strength of Ethereum against Bitcoin and is widely considered a metric that could indicate the future potential price action of altcoins.

By September 16, 2024, the Ethereum to Bitcoin (ETH/BTC) ratio stands at approximately 0.039, which is where it was last seen in April 2021, three years ago. Notably, the ETH/BTC ratio reached a peak of 0.088 back in December 2021; however, since then, it has been on a prolonged downward trend, punctuated occasionally by brief recoveries (known as “dead cat bounces”), followed by further losses in value.

Looking at the relationship between altcoin prices, an increasing Ethereum to Bitcoin (ETH/BTC) ratio means Ethereum is doing better compared to Bitcoin. On the flip side, a decreasing ratio implies that Bitcoin is outperforming Ethereum and other altcoins, which might lead investors to favor Bitcoin over Ethereum.

Consequently, there could be a wave of selling in various alternative cryptocurrencies, as investors may choose to move their funds towards assets that are more stable and offer better returns.

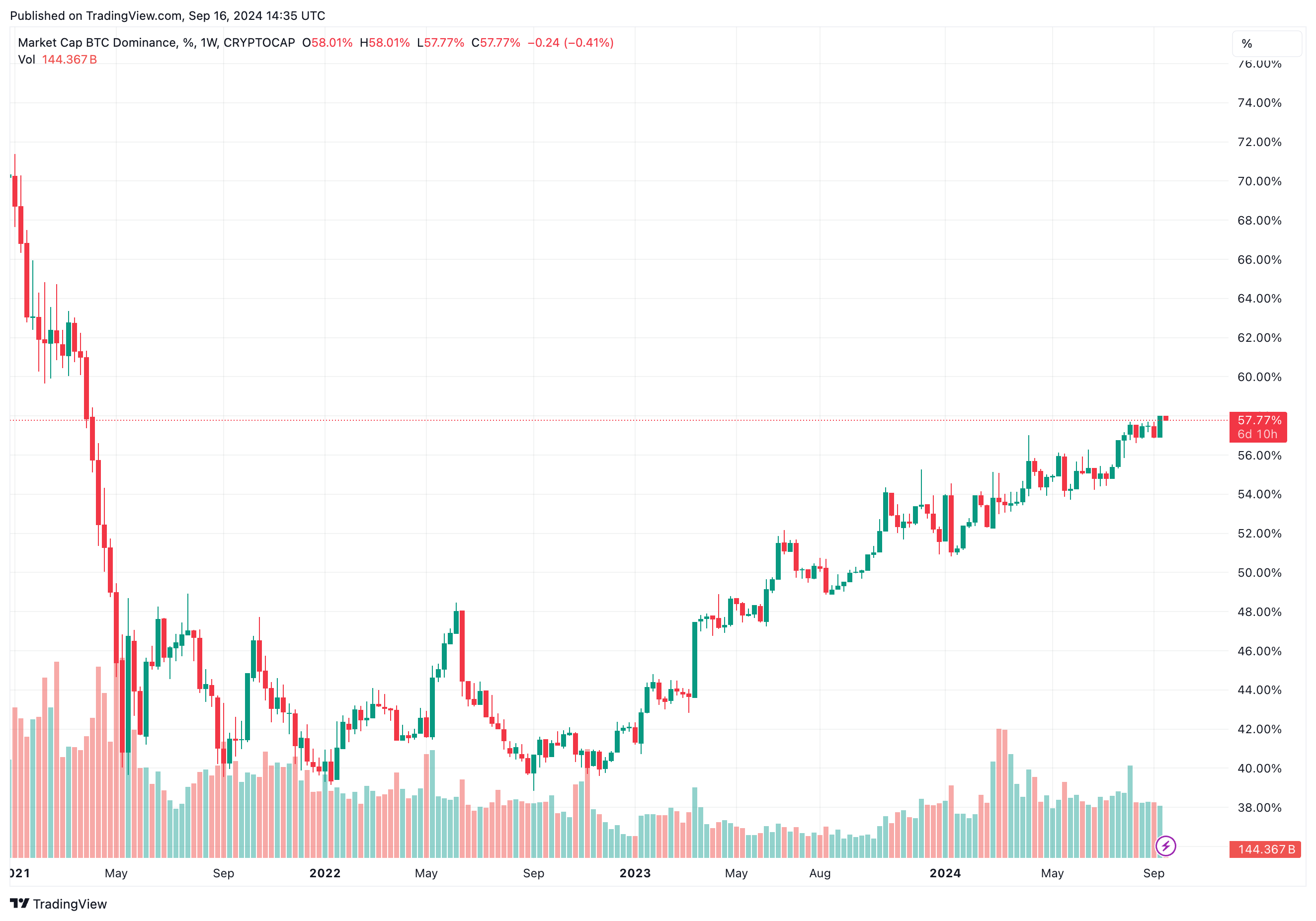

At the moment, Bitcoin’s dominance (represented by BTC.D) stands at approximately 57.78%. This figure has been gradually rising since November 2022, indicating a trend. An upward shift in BTC.D suggests a diminishing altcoin market, implying that liquidity is shifting away from smaller cryptocurrencies. This could potentially cause price fluctuations and swift drops in value for these tokens.

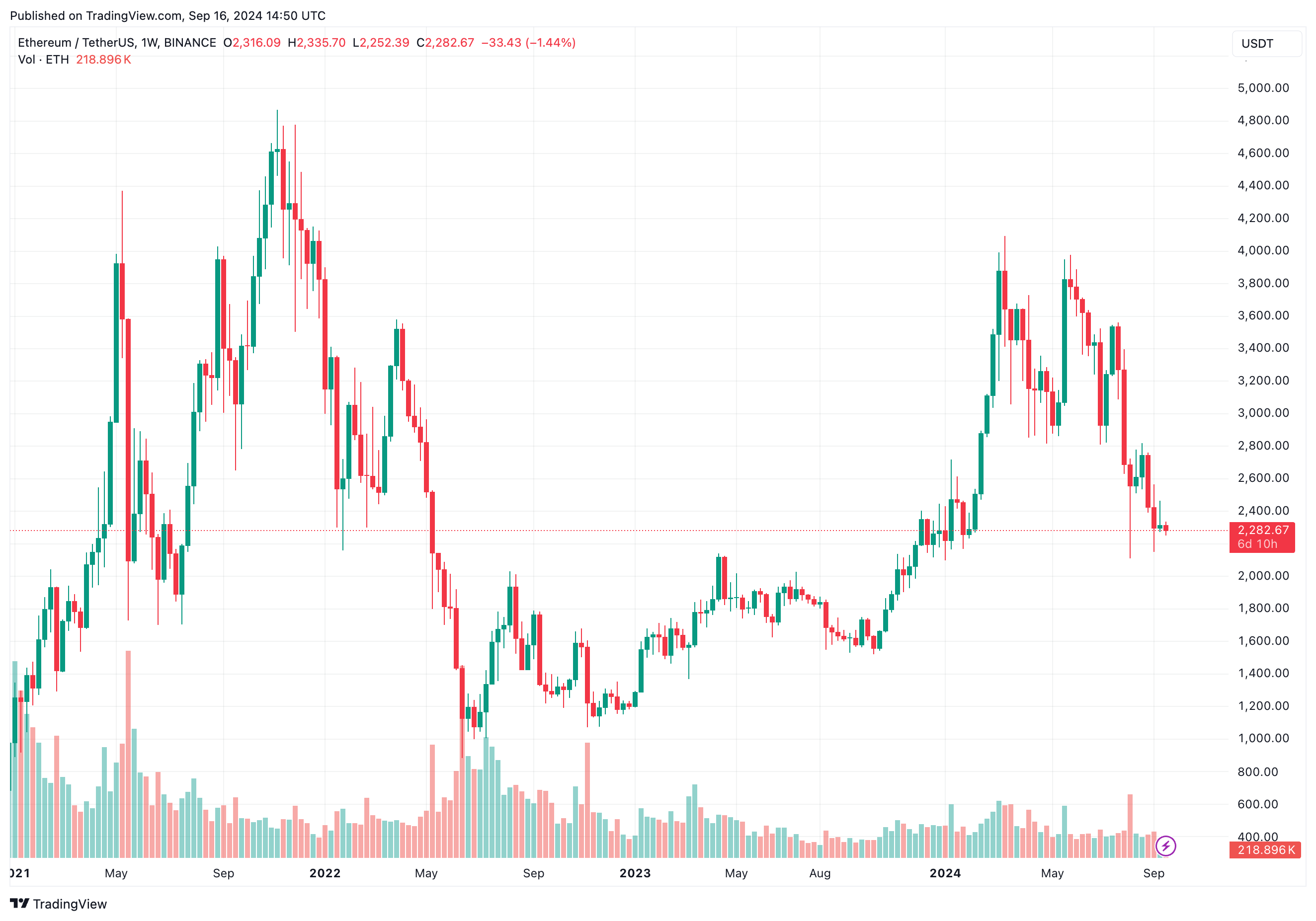

It’s noteworthy that the SEC’s decision to approve Ethereum exchange-traded funds (ETFs) didn’t have the same impact on Ethereum’s price as it did on Bitcoin’s.

As I delve into the world of cryptocurrency exchange-traded funds (ETFs), data from SoSoValue’s tracker reveals an intriguing trend. Specifically, US Ethereum ETFs have seen a cumulative net outflow amounting to $581 million, while US Bitcoin ETFs have experienced a net inflow of a staggering $17.3 billion. This suggests that investors are more inclined towards Bitcoin than Ethereum in the US market at this point in time.

Can Ethereum Price Change Its Momentum?

Currently, Ethereum is being traded around $2,282, which is a price point it hasn’t been at since early January 2024. It’s worth mentioning that Ethereum momentarily reached the $3,900 value, but subsequently gave back all those gains.

More recently, there’s been news of approximately 112,000 Ether being transferred to cryptocurrency exchanges within a single day. This action could indicate that some investors may prefer to sell their Ether rather than keep it as the value of Ether compared to Bitcoin appears to be decreasing.

According to some analysts, it could be advantageous to swap Bitcoin for Ethereum, as they anticipate an increase of approximately 180% in the value of Ethereum relative to Bitcoin, suggesting a potential improvement in the Ethereum-to-Bitcoin ratio.

The persistent downward demand for Ethereum has pushed it into an oversold state, providing optimism among ETH holders that the digital currency may have reached its lowest point and could soon undergo a robust price surge.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Brody Jenner Denies Getting Money From Kardashian Family

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

2024-09-17 11:10