As a seasoned crypto investor with years of market fluctuations under my belt, I find myself observing Ethereum‘s current state with a mix of intrigue and cautious optimism. The recent pullback, while disheartening for short-term investors, is not unfamiliar territory to those who have weathered the cryptocurrency market storm.

Currently, the value of Ethereum (ETH) is witnessing a decrease after encountering a significant barrier at around $4,000 – a crucial psychological price point in the cryptocurrency market. This downturn has sparked some pessimism among investors on Binance.

According to an analysis by CryptoQuant’s Darkfost, there’s a notable pattern emerging in Binance’s trading of Ethereum. At around $4,000, the ratio between buyers and sellers for Ethereum on this exchange has become notably negative, indicating that most traders are currently choosing to sell rather than buy Ethereum on Binance.

Ethereum Tug of War

Since the beginning of November, as per Darkfost’s analysis, there has been a predominantly bearish attitude towards Binance, which aligns with Ethereum approaching a significant level of resistance.

As a researcher, I’ve noted an interesting twist in the Ethereum market: despite bearish sentiments often indicating a possible price reversal, Ethereum’s price action seems to be bucking this trend. This unexpected behavior appears to be driven by various influential factors beyond just sentiment.

Remarkably, there’s been a significant increase in the desire for Ethereum Exchange-Traded Funds (ETFs), indicating a rising institutional fascination. This interest is helping fuel Ethereum’s market dynamics.

An increase in interest for Ethereum ETFs suggests that the market is moving towards greater control by institutional investors, who now play a significant role in determining price fluctuations.

It appears that the persistent investments into Ethereum-related financial products by institutions have significantly counteracted the selling force originating from individual traders on Binance.

ETH Market Performance And Outlook

Currently, Ethereum has experienced a substantial drop in value, with its price reaching a low of $3,616 at this moment. As I’m writing this, the asset is being traded for approximately $3,621, representing a decline of around 6% over the past day.

Significantly, the decline in this asset’s performance has led to a decrease in its market capitalization by more than $40 billion. Last Friday, it stood at over $490 billion, but as of today, it’s down to approximately $434 billion.

It’s intriguing to note that while Ethereum’s price has fallen, its daily trading volume has shown a contrary pattern, climbing from approximately $60 billion on December 6 to currently standing at $72 billion. Considering the present market scenario, it seems plausible that this surge in ETH’s volume may be due to sell-offs.

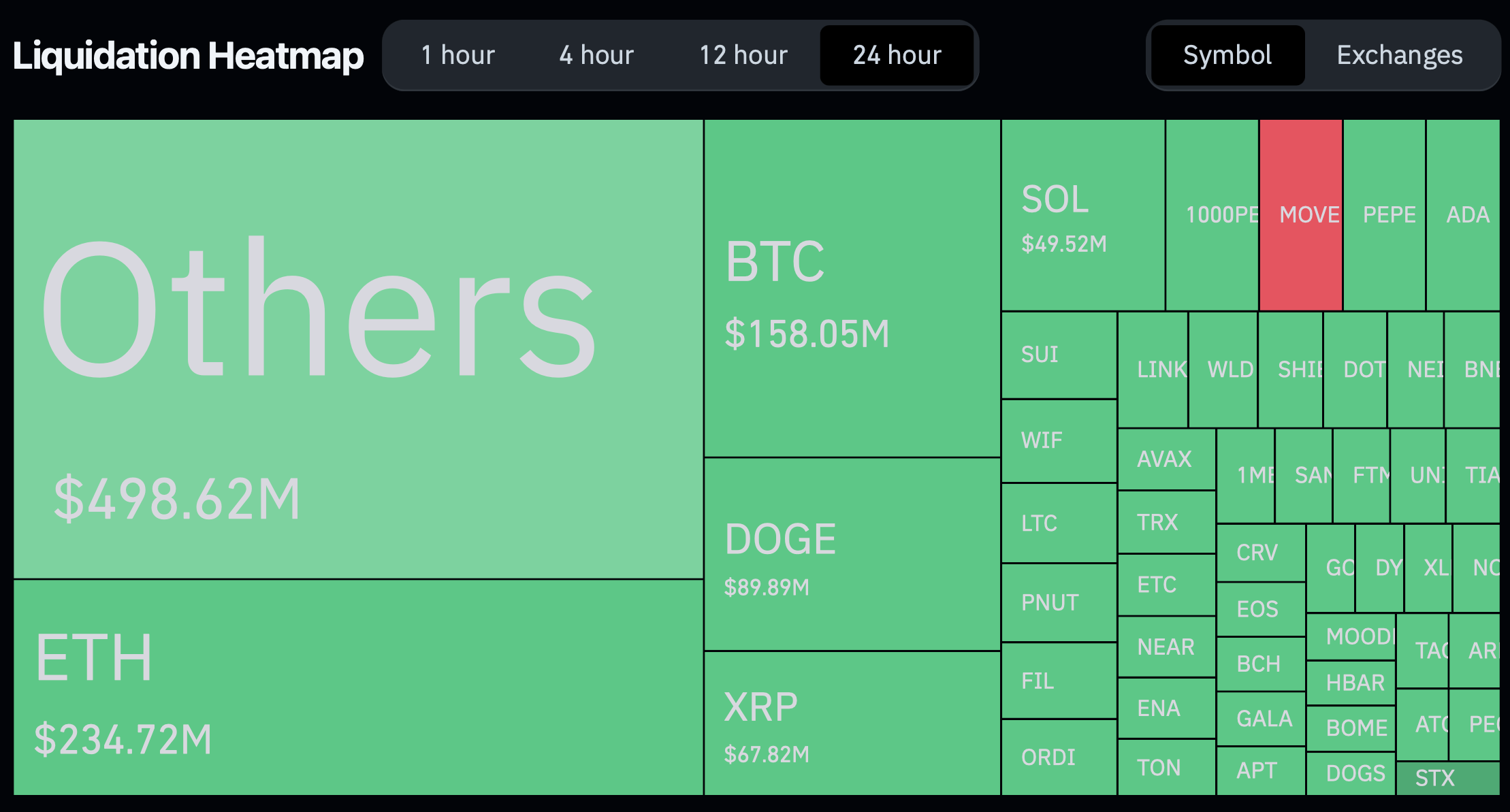

Based on information from Coinglass, over the past day, approximately 526,828 traders have had their positions closed (liquidated), with a combined value of around $1.58 billion being liquidated. Out of this total, about $234.72 million was tied up in Ethereum-related trades.

In simpler terms, large amounts of assets being sold off (long liquidations) totaled approximately $208.83 million. On the other hand, short sellers incurred losses equivalent to about $25.89 million in Ethereum liquidations.

Despite the recent downturn, experts remain hopeful about Ethereum, believing that the current price drop is actually beneficial for Ethereum’s market.

Ethereum is holding firm in the long term! Expect a brief retest before another robust surge!

— EᴛʜᴇʀNᴀꜱʏᴏɴᴀL (@EtherNasyonaL) December 10, 2024

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-12-11 03:40