As a seasoned crypto investor with over a decade of experience navigating the rollercoaster that is the cryptocurrency market, I can confidently say that this latest dip in Ethereum prices has left me both intrigued and concerned. Having seen similar situations unfold numerous times before, I’ve learned to remain patient and adaptable.

Over the past few days, Ethereum has experienced a 15% decrease since reaching its peak of $2,729 last Friday, causing some analysts and investors to express disappointment with the price movement. Given earlier predictions of a bullish trend, it seems that Ethereum has been finding it challenging to sustain positive momentum.

Worry is growing as certain analysts foresee a more significant drop, potentially reaching annual lows near $2,150, should the current support not endure. This resurgence of apprehension and doubt is sweeping through the market due to Ethereum’s price fluctuations sending ambiguous messages.

Lately, the drop in performance has unsettled trust, and market players eagerly look forward to a definitive trend emerging. Analysts are keeping a close eye on Ethereum’s impending action and if it can regain its support points to continue on an uptrend path.

In the upcoming times, Ethereum’s price movements could be significant as investors prepare for increased market turbulence due to changing circumstances.

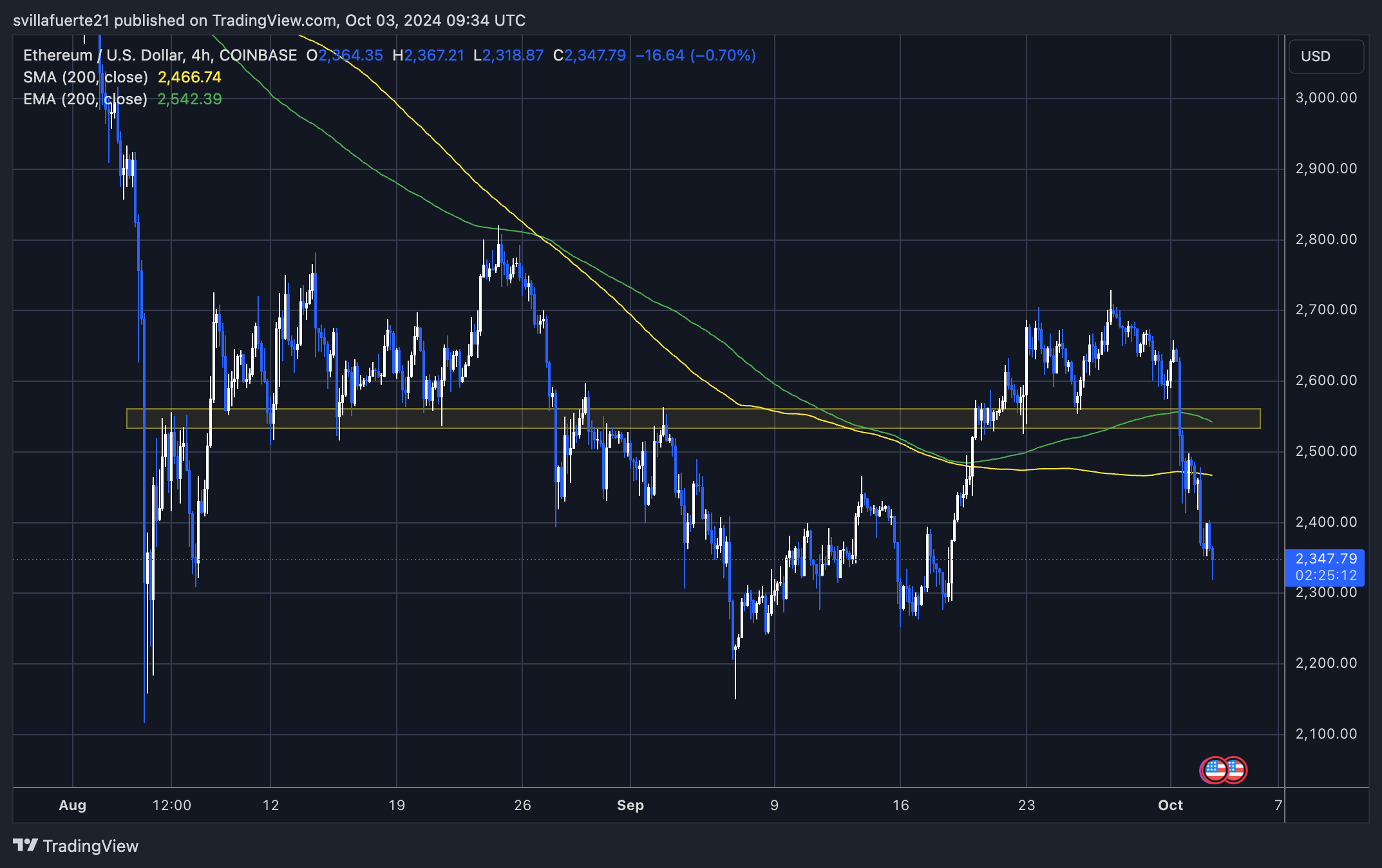

Ethereum Testing Crucial Support Line

Currently, Ethereum is at a crucial point that may shape its movement in the upcoming week. The next few days’ price fluctuations will likely be significant for Ethereum and the broader altcoin sector. Analysts are keeping a close eye on whether Ethereum can keep its momentum as the second-largest cryptocurrency by market capitalization. If it fails to maintain its position above critical support levels, this might indicate a possible downturn across the market.

Investment experts and financial backers are excitedly looking forward to Ethereum’s potential recovery since it currently rests above a significant level of support that could trigger an upward surge towards fresh record-breaking peaks. Notably, prominent analyst Carl Runefelt has recently discussed X, emphasizing the current trendline sustaining the price of ETH.

Runefelt’s technical assessment indicates a possible substantial decrease in Ethereum’s price if it can’t sustain this current trend. Should the price break through this support level, he anticipates that $2,150 could be the next likely price point.

A drop to these lows could make several investors question the ongoing bullish trend in the coming days. Should ETH fail to maintain this crucial support, it might result in doubt and increased market turbulence. This decline would leave market players apprehensive as they wait for the next price action.

ETH Price Action Details

Currently, Ethereum (ETH) is being traded at approximately $2,350, as it couldn’t maintain a peak above $2,820 – a development that has left crypto bulls feeling disheartened. The latest price movement has seen ETH lose significant support points, such as the 4-hour 200 moving average (EMA) at $2,542 and the simple moving average (SMA) at $2,466.

These markers play a crucial role in forecasting short-term movements, and their disappearance as a prop has sparked worries about potential additional dips.

To help the bulls reassert their power, Ethereum (ETH) needs to surpass its 4-hour 200 Exponential Moving Average (EMA) and Moving Average (MA), and then maintain these levels as a solid base. If ETH manages to recapture these markers, it would indicate regained strength and open up the opportunity for another price increase endeavor.

Should Ethereum not regain its current levels, a more substantial correction may ensue. The crucial support around $2,100 looms large, and there’s a possibility that prices could dip further. As an analyst, I’m keeping a close eye on these levels, as the next few days will be decisive in predicting whether Ethereum can recover its momentum or continue its bearish trend.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-04 03:40