As a seasoned analyst with over two decades of experience in the financial markets, I must admit that the recent bullish trends in cryptocurrencies have brought back memories of the dot-com bubble days. However, unlike the internet stocks, these digital assets seem to have more substance and potential for long-term growth.

After a surge in the market, the top cryptocurrencies are showing exceptional progress. Currently, Bitcoin is trading over $64,000, and Ethereum (ETH) has increased by 9% in the past week, maintaining its position above an essential support point.

Despite the bullish sentiment, some crypto investors remain cautious about ETH’s performance as the second-largest cryptocurrency faces the next crucial resistance level.

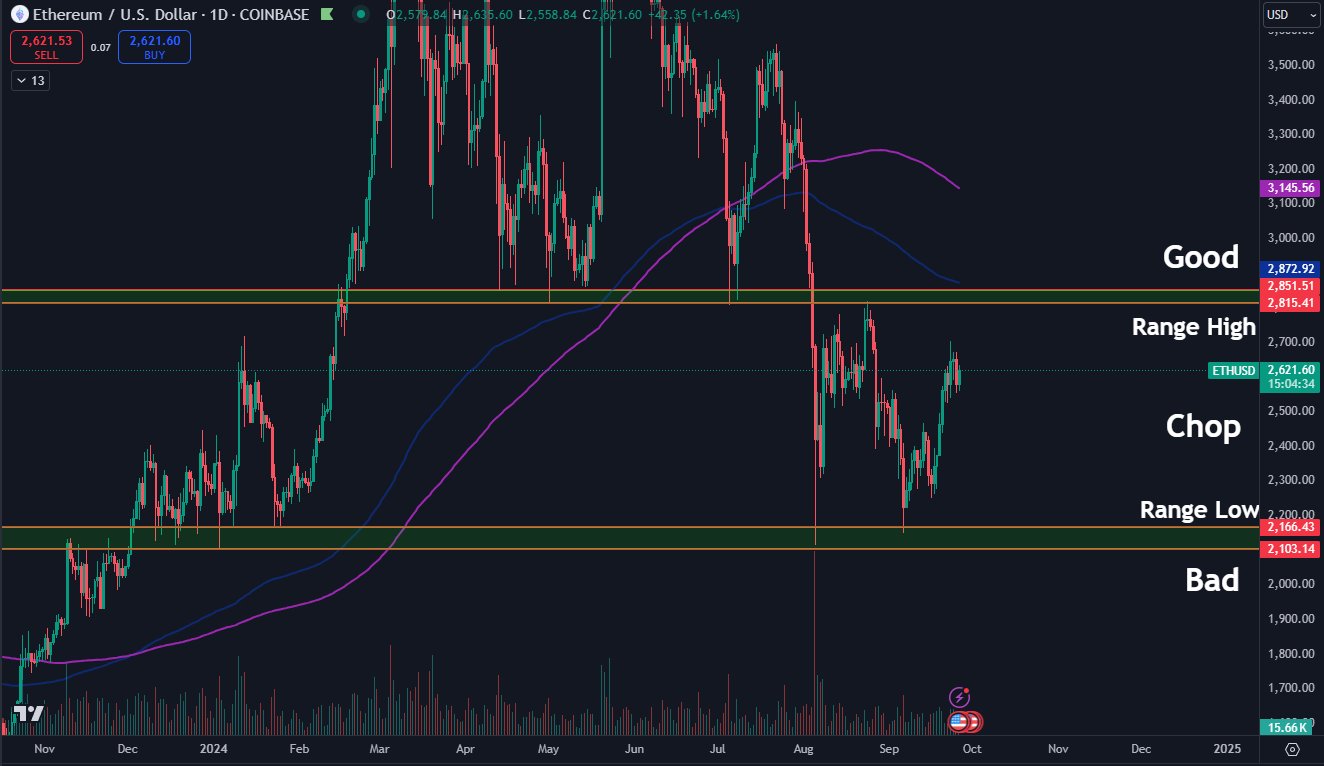

Ethereum Consolidates Above $2,600

In the past week, Ethereum experienced a significant 13% increase in value following the US Federal Reserve’s (Fed) decision to reduce interest rates by 0.5%. This move invigorated the market, causing Ethereum’s price to reach levels not seen in over a month. As a result, many investors have become optimistic about the coin’s prospects.

Over the weekend, the “Leader of Alternative Coins” experienced a significant jump from its $2,300 base to reach $2,500. At the start of the week, it managed to overcome the $2,600 barrier that previously acted as resistance. Since then, this digital currency has been fluctuating between approximately $2,600 and $2,684. On Wednesday afternoon, there was a brief dip below its crucial support level.

Despite bouncing back from a dip to $2,500, Ethereum has encountered obstacles today due to encountering significant resistance at around $2,650 on its daily chart. According to market analyst Crypto Yapper, ETH has been unsuccessful in breaking above this level since Tuesday.

Some investors expressed concern because the performance didn’t surpass a certain level, fearing that this lack of progress might halt the cryptocurrency’s advance and cause its price to drop back towards its earlier support levels.

In the past hour, Ethereum’s price has risen by 1%, now trading above $2,650. Currently, it is being traded at approximately $2,660, marking a 2.1% rise over the last day and a 9.3% increase in its weekly value.

ETH To Reach New Highs In October?

Daan, a crypto trader, pointed out that Ethereum’s price has formed a new low point (HL) but hasn’t reached a higher peak (HH) yet. He explained that a higher peak would be seen above the $2,820 level, which was lost over a month back, and such an occurrence would indicate a change in Ethereum’s trend direction.

This stage aligns with the horizontal line that initiated the upward trend towards $4,090 during February-March, following the breakout. Moreover, it falls in proximity to the Daily 200 Exponential Moving Average (EMA) in that region, making it a “significant level to keep an eye on.

Crossing this threshold might boost Ethereum’s value even closer to the $3,000 price barrier, as suggested by Julien Bittel, Head of Macro Research at Global Macro Investor (GMI). His analysis indicates that Ethereum’s chart bears a striking resemblance to a 2023 repeat.

According to the chart, the pattern of the cryptocurrency’s current market trends seems strikingly similar to its movements in 2023. If Ethereum’s past bullish trend is anything to go by, it appears that Ethereum’s price might soon surge and reach a new record high (peak) sometime between mid-October and late October.

Furthermore, the graph indicates that, assuming it maintains its bullish trajectory, Ethereum’s value could possibly hit between $10,000 and $20,000 by Q1 2025. This would equate to a significant increase of approximately 669% from its current price and a substantial boost of around 300% over its all-time high.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-27 13:16