Ethereum (ETH) has experienced a drop of more than 10% from its New Year peak, dipping below the $3,300 support level as the market undergoes a retreat. However, some analysts continue to be positive about Ethereum’s performance in Q1, predicting fresh highs in the near future.

Ethereum Forming Bullish Pattern

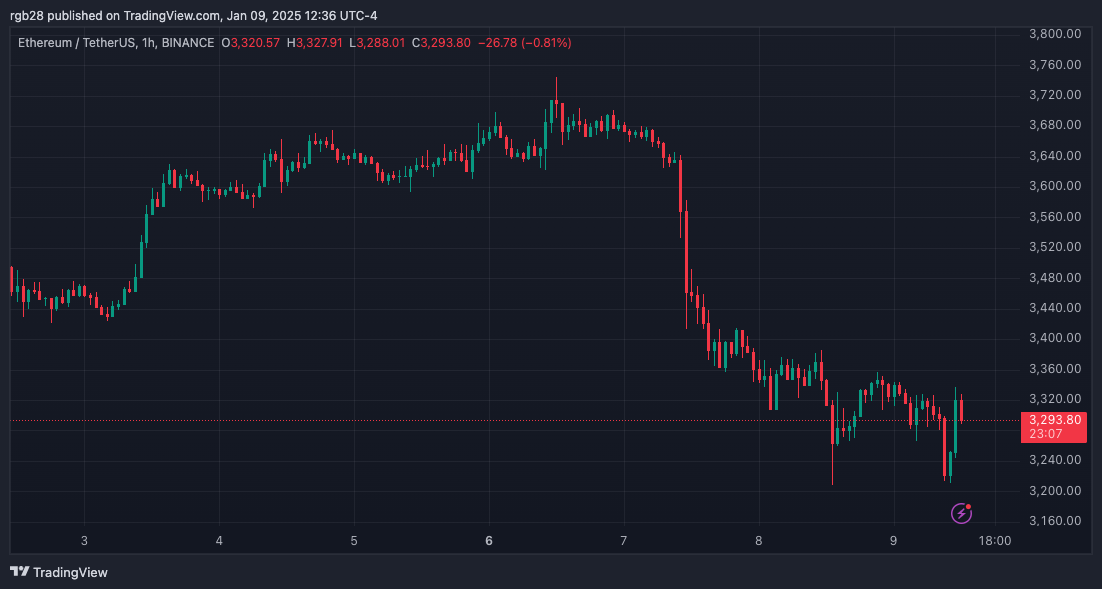

Today, Ethereum lost its New Year’s advance, dipping below the $3,320 threshold. After the broader market pullback, Ethereum, the second-largest cryptocurrency by market cap, experienced a 14% decline from its peak of $3,744 on Monday, dropping below the $3,300 support level.

At the beginning of the year, Ethereum’s price climbed back 20% from its lowest point during the correction, reaching levels it had not seen since before the retracement for the first time in about three weeks. However, a market downturn that caused Bitcoin to drop by 7.2% over a 24-hour period pushed Ethereum down to $3,210 on Thursday morning. Throughout December, the $3,200-$3,300 price range acted as a significant support for Ethereum.

Following its latest results, various experts believe Ethereum might be creating a significant turning point formation, potentially leading its value to reach unprecedented peaks. On Wednesday, crypto expert Rekt Capital pointed out that Ethereum could be shaping a multi-month inverse Head and Shoulders pattern in the 1-minute chart.

To the analyst, it’s evident that the range between $3,650 and $3,760 represents a significant barrier, emerging slightly beneath the $4,000 level. The price has been forming this resistance at a Lower High which could potentially function as a Neckline for the pattern, suggesting a potential reversal or continuation of a downward trend.

He mentioned that “the end point is psychologically around $3,000,” implying that if there’s a minor reversal near the $3,000 mark, Ethereum might form an upward trend known as a ‘right shoulder.’

Just as Ethereum touched its lowest point at around $3,200, Miky Bull pointed out a similar pattern suggesting that the price might reach approximately $7,000. According to the chart analysis, there could be an increase of about 87.53% in ETH’s price near the $7,400-$7,500 range due to this bullish setup.

No More ‘Major Retraces’ For ETH?

According to crypto expert Ali Martinez, he believes that a drop in ETH’s price to approximately $2,900 could be highly advantageous, as it may present an outstanding chance to purchase at a discount with the potential of reaching $7,000 later on.

It’s important to keep in mind that the bullish pattern could lose its validity if Ethereum drops below $2,800 – the level at which the left shoulder was created.

As a researcher, I’ve noticed a striking resemblance between Ethereum’s (ETH) market behavior at the start of 2024 and 2025. Remarkably, ETH dropped below its yearly opening in January 2024 only to recover and rise the following month.

He emphasized, “It’s crucial not to mix up short-term price fluctuations with long-term biases. In my view, this is a yearly market correction following some overzealous traders taking on excessive leverage too soon. I remain optimistic about the first half of 2025.

As an analyst, I, Crypto Wolf, am of the opinion that we may have reached the point where there is minimal potential downside remaining in Ethereum’s current market trajectory. A further retreat of up to 4% to 7% could be on the cards before ETH potentially reaches its all-time high (ATH) again.

As of this writing, ETH is trading at $3,255, a 2.15% decrease in the daily timeframe.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-01-10 14:10