As a seasoned crypto investor with a knack for deciphering market trends, I find the recent analysis of Ethereum by CryptoQuant particularly intriguing. The patterns in accumulation and ETF inflows provide an interesting perspective on Ethereum’s potential trajectory, especially considering its underperformance relative to Bitcoin in this cycle.

It appears that Ethereum (ETH), the cryptocurrency with the second-largest market value, is gaining interest among analysts, as they examine market indicators suggesting potential future direction for ETH.

Recent data from CryptoQuant has highlighted patterns in accumulation and exchange-traded fund (ETF) inflows, providing a detailed look at Ethereum’s potential trajectory as it underperforms relative to Bitcoin in the current cycle.

Analyzing Trends in Accumulation and ETF Inflows

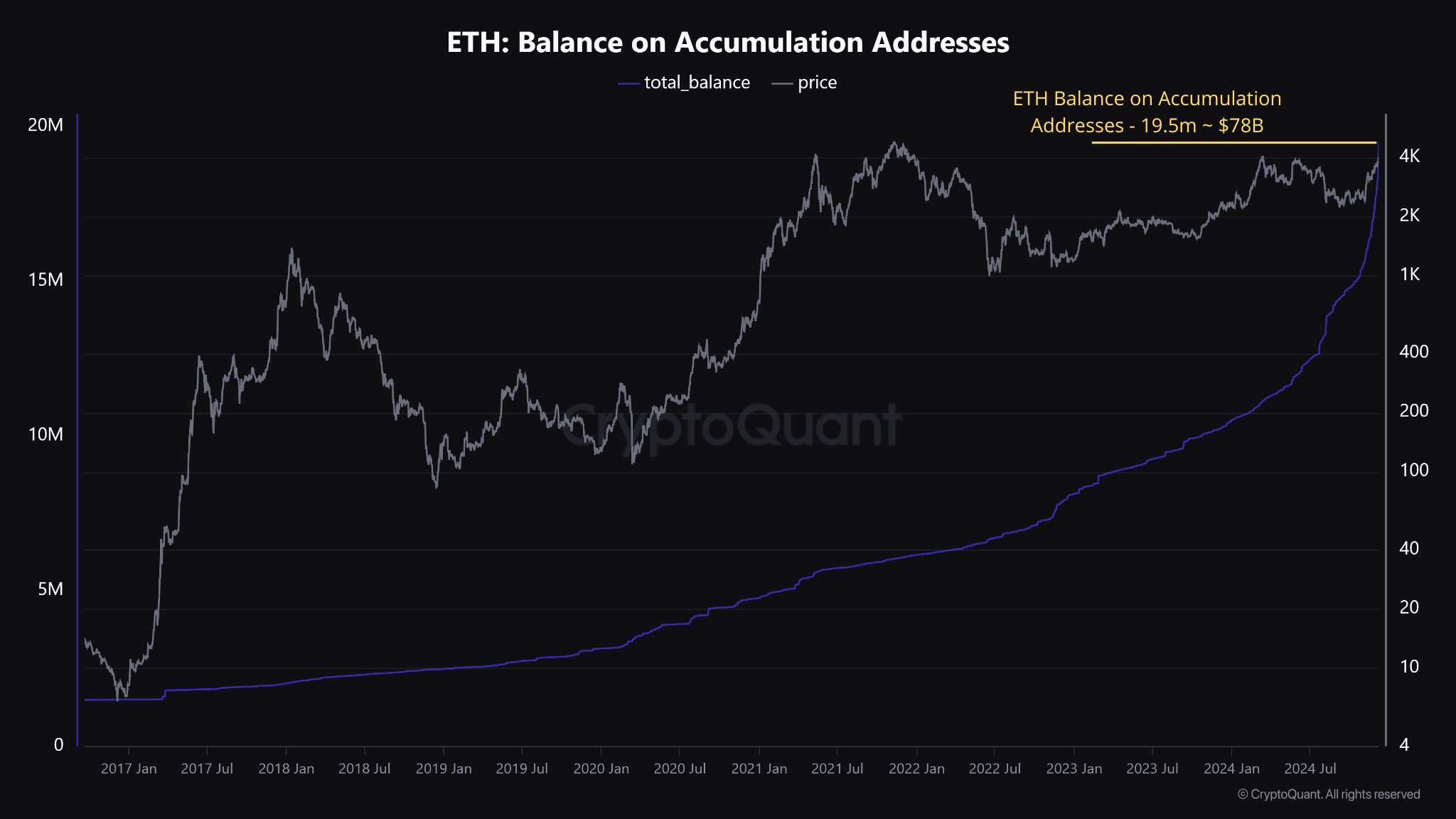

On social media platform X, posts from CryptoQuant analysts detailed an analysis of Ethereum’s crucial metrics. One notable finding was the amount of Ethereum stored in accumulation addresses, currently totaling about 19.5 million ETH, which is roughly equivalent to $78 billion in value.

The wallets used for holding Bitcoin contain approximately 2.8 million Bitcoins, which are currently worth around $280 billion. This is four times as much as the dollar value of Bitcoin held by investors compared to Ethereum. However, this disparity mirrors their respective market capitalizations, suggesting that investor behavior might be influenced by these differences in size.

A significant focus has been placed on the consistent increase in investments towards Ethereum-related ETFs over the last few months. Remarkable peaks were observed on certain important dates, such as a whopping $1.1 billion on November 11 and $839 million on December 4, in the year 2024.

Based on the analysis by experts at CryptoQuant, these persistent deposits suggest high levels of institutional investment in Ethereum, further highlighting its increasing attractiveness to large-scale financiers.

The Ethereum ETF has seen steady inflows in recent months.

Key spikes on:

11th November, 2024: $1,100 million

These inflows reflect strong buying pressure.

— CryptoQuant.com (@cryptoquant_com) December 10, 2024

As a researcher examining the cryptocurrency market, I’ve observed that while Exchange-Traded Funds (ETFs) are showing significant demand, Ethereum’s price fluctuations haven’t been as intense as Bitcoin’s this cycle. In fact, historically, Ethereum’s peak prices have followed behind Bitcoin’s, as was the case during the 2021 bull run.

Back then, Bitcoin reached its maximum ever value (all-time high) in March, increasing by an impressive 480%. On the other hand, Ethereum followed suit a few months later with a staggering growth of approximately 1,114%. Yet, as we navigate this new market cycle, it seems that Ethereum is not keeping up as well as before, hinting at a change in market trends.

Taker Volume and Potential Growth

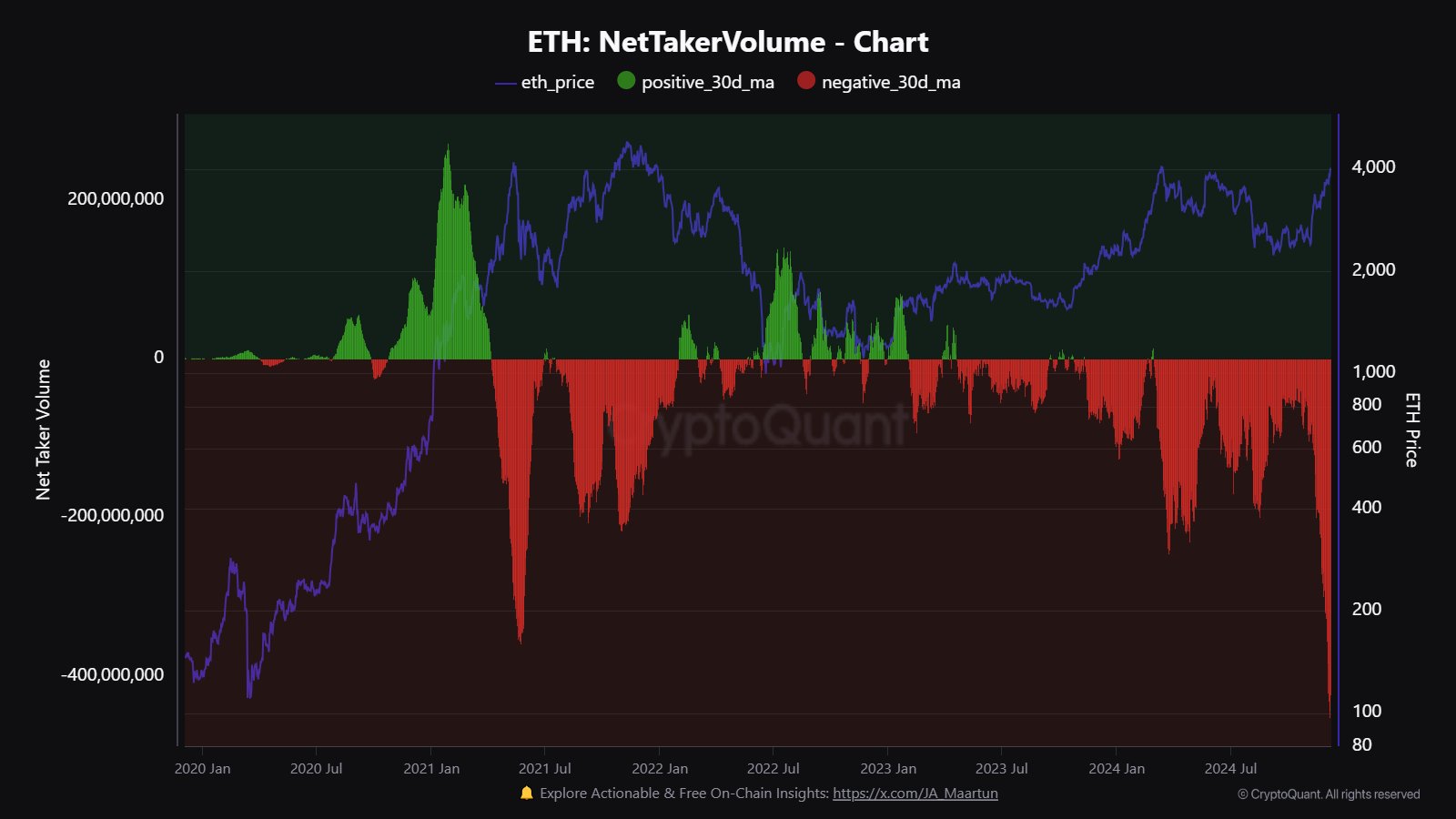

Additionally, one aspect that caught the analysts’ attention is the level of trading activity on Ethereum, specifically the taker volume. This figure offers insights into market sentiment as it measures both intense buying and selling actions.

According to CryptoQuant, Ethereum’s buy-sell activity has dropped to an all-time low of -400 million, showing intense selling activity. This heavy selling resembles patterns seen prior to its all-time high (ATH) in 2021. Although the current downward trend might appear bearish, it could also suggest a market approaching a crucial turning point.

Ethereum Taker Volume is at its lowest level on record.

The low Ethereum prices are likely because of a high number of sellers compared to buyers right now, with this ratio reaching an all-time low of -400 million, suggesting heavy selling activity.

A similar pattern occurred before Ethereum’s peak in May 2021. Despite this, there may still…

— CryptoQuant.com (@cryptoquant_com) December 10, 2024

The experts highlighted that Ethereum’s relatively poor performance during this cycle doesn’t rule out the potential for substantial future growth.

Observing the interaction among accumulation trends, Exchange Traded Fund (ETF) investments, and trading volumes indicates that Ethereum may continue to exhibit a bullish trend.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-12-11 09:04