As a seasoned researcher with over two decades of experience in the dynamic world of finance and technology, I find myself intrigued by the latest developments in the Ethereum market. The surge in Ethereum HODL addresses, as reported by MAC_D, is indeed a significant shift that warrants closer scrutiny.

Despite a broad decline in cryptocurrency market prices last week, Ethereum (ETH) experienced a significant drop of more than 19.5%, reaching a local minimum at $3,100. Since then, it has displayed minimal recovery, increasing by approximately 5% over the past two days. Nevertheless, recent activity data from wallets suggests a strong optimism for Ethereum’s long-term potential.

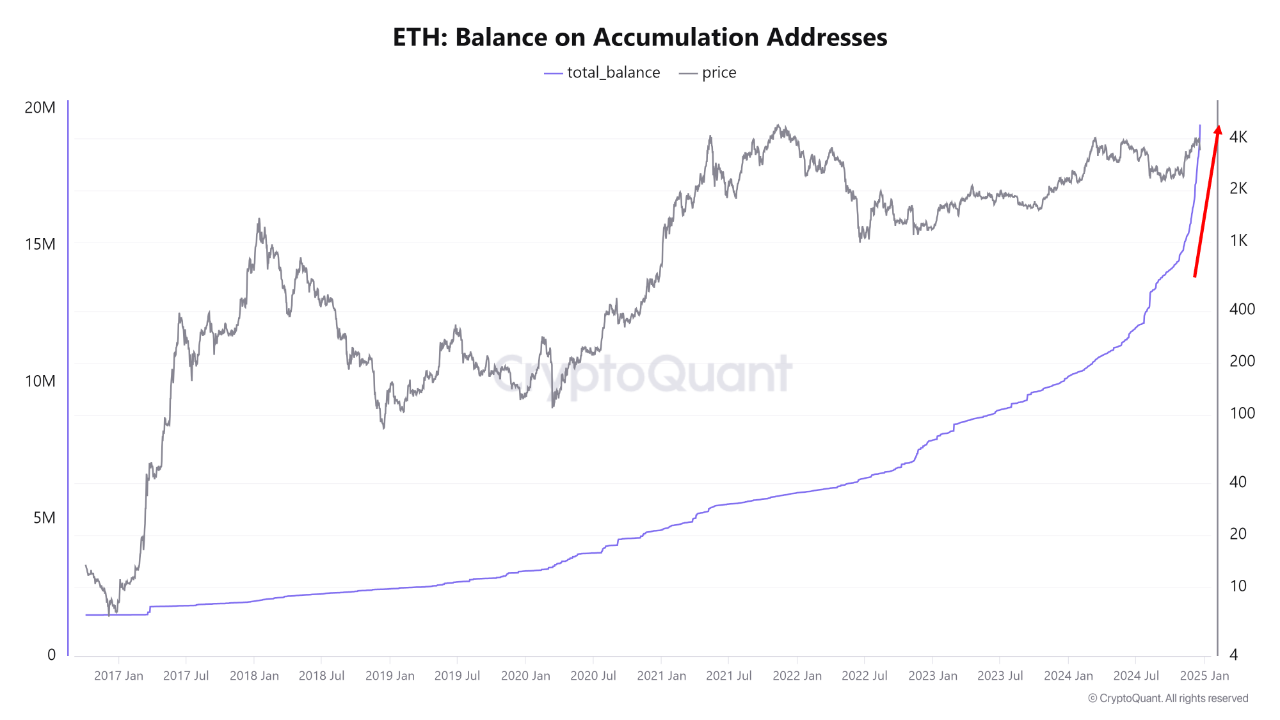

Ethereum HODL Addresses Increase Supply Dominance To 16%

Recently, as a curious crypto investor, I came across some optimistic views about the Ethereum market shared by analyst MAC_D in a QuickTake post.

According to the crypto market expert’s report, there has been a significant increase of around 60% in Ethereum Accumulation Addresses from August to December. These ‘HODL’ wallets have increased their share of Ethereum (ETH) supply from 10% to 16%, which equates to approximately 19.4 million ETH out of a total supply of 120 million ETH.

In simpler terms, Accumulation Addresses can be thought of as digital wallets where Ethereum is stored and seldom transferred or sold. These wallets signify a commitment to long-term investment and show confidence in the Ethereum network.

Based on MAC_D analysis, it’s a fresh trend in the growth of Ethereum HODL wallets’ assets that was not seen during past market upswings. This significant accumulation is believed to be driven by investors’ optimistic outlook toward the incoming Donald Trump administration in the U.S., who they anticipate will be favorable for cryptocurrencies.

As an analyst, I am observing that the expectations for the DeFi industry within the Ethereum ecosystem are leaning towards more favorable regulations. Consequently, it is plausible that these long-term investors, regardless of Ethereum’s current market fluctuations, will continue to accumulate their holdings, anticipating potential future price appreciation.

Moreover, MAC_D underscores the significance of these Accumulation Addresses as the value of Ethereum has never fallen beneath its real value at these points. Consequently, persistent buying from these wallets offers a substantial opportunity for long-term price growth.

What’s Next For ETH?

As for Ethereum’s imminent direction, it’s worth noting that economic factors might hold more sway over its price in the near future, based on MAC_D analysis. This is indicated by the recent downturn in ETH’s value, possibly due to speculations about fewer interest rate reductions in 2025.

Currently, the value of this altcoin stands at around $3,352, after experiencing a 3.07% drop over the last day. Simultaneously, Ethereum’s daily trading volume has decreased by approximately 53.25%, with a current value of about $31.15 billion.

After experiencing recent declines in price, Ethereum has shown negative growth on larger timeframes, with a 14.74% drop over the past week and a 1.05% decrease in the last thirty days. However, on the bright side, its current price is significantly higher than its initial point ($2,397) following the post-US elections rally, suggesting that long-term optimism remains high for this asset.

In terms of market value, Ethereum currently holds the position of being the second most significant cryptocurrency and the leading alternative coin (altcoin), with a worth of approximately $401 billion in the digital assets sector.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-12-22 16:34