As a seasoned crypto investor with over a decade of experience navigating market fluctuations and political uncertainties, I find myself intrigued by the current dynamics between Ether (ETH) and Bitcoin (BTC). The approaching US presidential election has undeniably stirred up sentiments in both the traditional and digital asset markets.

As the US presidential election on November 3 draws near, there’s a noticeable split in opinions among investors regarding two significant cryptocurrencies: Ether and Bitcoin. While Ether is currently trading at $2,418 with a 24-hour volatility of 0.6% and a market cap of $290.53 billion, Bitcoin stands at $61,146, boasting a 24-hour volatility of just 0.1%, a market cap of $1.21 trillion, and a daily trading volume of $31.56 billion. This divergence in sentiment seems to be impacted differently by the shifting political landscape, as Republican Donald Trump increases his lead over Democrat Kamala Harris in prediction markets.

Currently, Ether is showing a stronger bias towards bearish trends compared to Bitcoin, as suggested by recent data from the options market. Based on information from Amberdata and Deribit, Ether’s 25-delta risk reversals have moved further into negative territory than those for Bitcoin. This indicates that put options (options to sell) for Ether are more in demand and costlier compared to call options (options to buy), reflecting a higher perceived risk of price decrease for Ether compared to Bitcoin.

ETH Risk Reversals Hit -7.3% amid Election Volatility

Traders who deal with options often employ risk reversals as a means to assess market sentiment and protect their investments in both the current and future markets. Essentially, when the risk reversal is negative, it indicates that traders are ready to spend more on downside protection compared to potential profits from an upward move. As of now, Ether option contracts expiring on October 11 exhibit a risk reversal rate of -7.3%, with Bitcoin currently trading at -5.8%. This suggests that the market is leaning towards pessimism for Ether and slightly less so for Bitcoin.

Photo: CoinMarketCap

Currently, Ether is being traded at $2,415, signifying a 1.30% rise in value over the past day. Meanwhile, on CoinMarketCap, the community sentiment leans slightly bullish, with 33% expressing optimistic views, while a majority of 67% appear bearish towards Ether.

After the election on November 8, it’s interesting to note that Bitcoin’s risk reversals show a positive trend, indicating an anticipated increase in its volatility. On the other hand, Ether’s sentiment doesn’t appear to brighten until late December, suggesting that traders are preparing for continued volatility in Bitcoin immediately following the election results, with potential stability for Ether coming later.

In September, it was observed on Derive, a prominent decentralized exchange, that Ethereum call options were being sold nearly three times more than they were being bought, at a ratio of 2.5 to 1. This trend suggests that traders are less optimistic about Ether’s immediate price growth and instead prefer to protect themselves from potential future price declines by selling these options as a form of hedging.

Nick Forster, founder of Derive, highlighted this cautious stance in his exclusive report, noting:

The imbalance in Ethereum’s open interest, where roughly 2.5 times more call options have been sold compared to those bought, indicates that traders expect the potential growth to be capped at the moment. Keeping an eye on this disparity between call and put options as we approach election day will be crucial.

Political Influence on Crypto Market

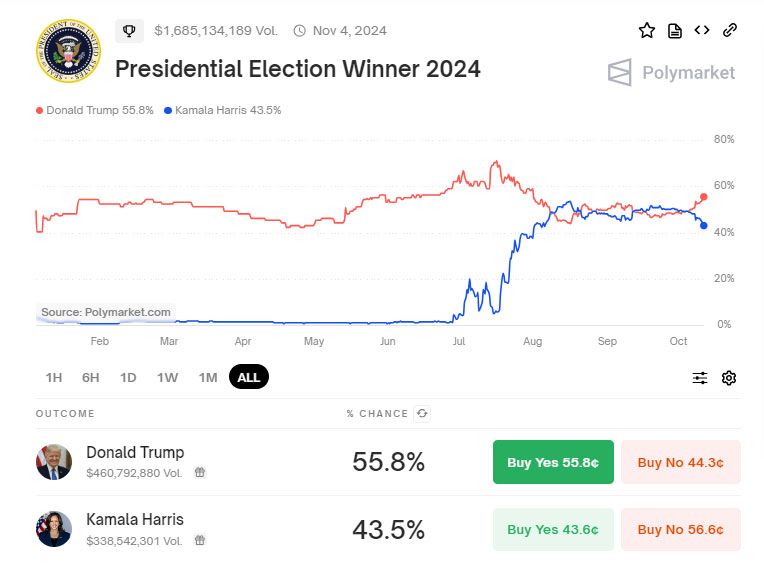

In this election cycle, the connection between politics and public opinion is very noticeable. Trump’s chances of winning have soared to a two-month high of 55.8%, as per Polymarket, which puts him well ahead of Harris at 43.8%. His campaign has become closely linked with financial markets, most notably through the launch of the DeFi protocol World Liberty Financial in September.

Photo: Polymarket

Some financial experts, such as those from Standard Chartered, hypothesize that a Trump presidency might lean towards Ethereum alternatives like Solana. However, overall, opinions are divided. A Trump victory could be advantageous for cryptocurrencies in total because his administration is perceived as open to embracing blockchain advancements within the financial system.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-10-11 14:42