As a seasoned crypto investor with several years of experience under my belt, I have learned to pay close attention to market trends and indicators that can potentially impact the price movements of various digital assets. The recent development regarding Ethereum’s derivatives volume and the imminent launch of Spot Ethereum ETFs has piqued my interest.

The trading volume of Ethereum derivatives indicates that investors in Ethereum have low faith in upcoming Spot Ethereum ETFs, leading to a significant surge for the second-largest cryptocurrency by market capitalization. This news emerges as these ETFs are about to debut and are predicted to start trading soon.

Ethereum Futures Premium Highlights Little Confidence In ETH’s Price

Based on information from Laevitas, the annualized premium for Ethereum’s fixed-term contracts is presently at 11%. This figure indicates a relatively subdued outlook among crypto traders regarding Ethereum’s price growth. Data from the same source reveals that this indicator has not surpassed the 12% threshold during the past month.

It’s unexpected that the upcoming Spot Ethereum ETFs, potentially launching next week, may lead to a significant price increase for Ethereum. According to crypto analysts like Linda, Ethereum could reach prices as high as $4,000 due to the potential large-scale inflows these ETFs might attract.

As a researcher studying the crypto market, I’ve noticed some hesitance among traders regarding Ethereum’s potential to reach great heights in the near future. This reluctance might be attributed to the significant daily outflows of approximately $110 million projected by Kaiko from Grayscale’s Spot Ethereum ETF. Consequently, Ethereum’s price could potentially trade sideways for an extended period.

Additionally, the latest S-1 filings from Ethereum ETF applicants indicate that Grayscale will have the highest management fees. Grayscale intends to levy a fee of 2.5%, whereas the maximum fee among other Spot Ethereum ETF contenders is only 0.25%.

Grayscale’s approach with its Spot Bitcoin ETF was comparable to what other issuers had done, but it charged a higher management fee of 1.5%, while these competitors ranged from 0.19% to 0.39%. This pricing decision may have contributed to the notable withdrawals observed in Grayscale’s Bitcoin ETF post the introduction of Spot Bitcoin ETFs.

Making A Case For Ethereum’s Inevitable Price Surge

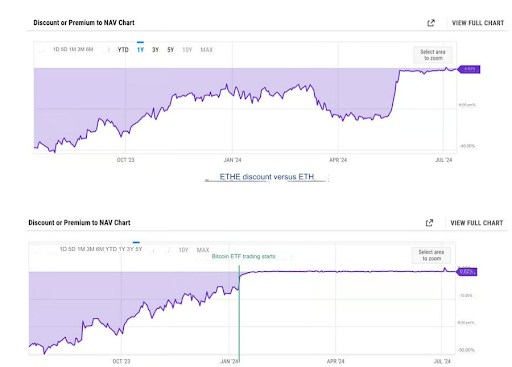

Expert: Crypto analyst Leon Waidmann has put forth a bullish perspective on Ethereum’s price and outlined reasons for increased optimism among investors. He highlighted that the price gap between Grayscale’s Ethereum Trust (ETHE) and Ethereum’s market value has noticeably decreased since the approval of Spot Ethereum ETFs in early May.

Waidmann pointed out that ETHE investors have had the opportunity to sell their holdings without substantial losses relative to Grayscale Bitcoin Trust (GBTC) due to this situation. Another probable cause of GBTC’s large redemptions was investors realizing profits from purchasing the trust at a lower price than Bitcoin’s current market value.

While GBTC and similar Spot Bitcoin ETFs initiated trading right away following approval, ETHE and other Ethereum Spot ETFs didn’t. Consequently, according to Waidmann’s perspective, anyone looking to capitalize on the price difference between ETH and ETHE has likely already done so. As a result, Grayscale’s ETHE might not experience the same level of profit-taking as Grayscale’s GBTC did post-trading approval.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-07-19 22:16