As a seasoned crypto investor with over a decade of experience in this volatile market, I have learned to never underestimate the power of technical analysis and historical trends. Tony Severino’s prediction of a potential Doji formation leading to a Bitcoin price rally in the new year resonates with me, given my own observations and interpretations of market patterns.

However, I would be remiss not to mention the cautionary tale of 2017-2018 when Bitcoin reached its all-time high at around $20,000 only to plummet shortly afterward. Therefore, while I am optimistic about the potential for a bullish reversal in January 2025, I would advise fellow investors to maintain a measured approach and not let their hopes run too wild.

As for the fundamental perspective, the potential of Donald Trump becoming a pro-crypto US president is an exciting prospect. If history repeats itself, as it often does in politics, we might just see another rally similar to the one that followed his election victory in 2016. But remember, politics and crypto are like oil and water – they don’t always mix!

Lastly, I find it intriguing that Ali Martinez suggests a potential price correction could be the most bullish thing for Bitcoin. If you ask me, I’d say that’s like saying the best way to make a cake is to drop it on the floor and hope for the best! But hey, who knows? In the world of crypto, anything can happen!

It seems that experts predict a positive change in Bitcoin’s price trend around January next year. Despite a relatively calm market behavior towards the end of this year, there is optimism for an upward momentum due to a potential Doji formation pointed out by crypto analyst Tony Severino. This pattern could signal a bullish reversal and potentially favorable movement for Bitcoin in 2023.

Doji Formation Could Lead To New Year Bitcoin Price Rally

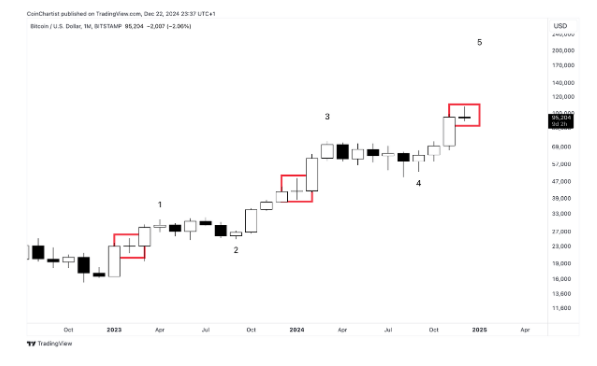

In a recent post, Severino proposed that a Doji pattern might initiate a surge in Bitcoin’s price during the initial two months of the upcoming year. He hinted that Bitcoin might conclude December with a Doji formation, followed by a robust uptrend for the digital currency in January. His accompanying graph indicated that this upward trend could persist into February as well.

The crypto expert clarified that a Doji symbolizes a moment of uncertainty in the market as both buyers and sellers are undecided. He further noted that the subsequent candlestick gives insight into the market’s choice, whether it’s a firm continuation or a turnaround. Here, Severino predicts that the upcoming candlestick will indicate a robust continuation for the Bitcoin price increase.

In simpler terms, Severino observed that a similar pattern in Bitcoin’s price chart (Doji) at comparable subwaves has historically indicated an additional two months of upward movement before a peak was reached. If this trend repeats, we might expect Bitcoin to rise for another two months between January and February 2025. From a practical standpoint, the re-election of Donald Trump could potentially trigger such a strong continuation.

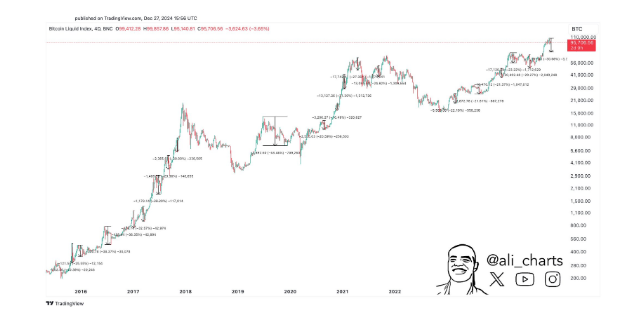

In my research, I’ve observed an intriguing trend: The price of Bitcoin surged beyond $100,000 following Donald Trump’s victory in the 2016 U.S. presidential elections. Given his pro-crypto stance, it’s plausible that this upward trend could persist as he assumes the role of the first crypto-friendly U.S. president.

Furthermore, there are indications that President-elect Trump may establish a Strategic Bitcoin Reserve upon taking office. Such a move could potentially fuel additional bullish sentiment for Bitcoin.

BTC Needs To Hold Above $92,730

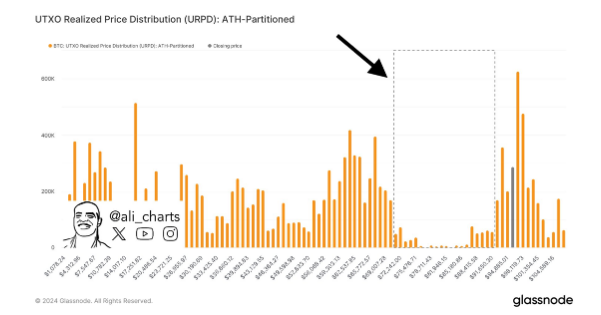

In a recent post on X, crypto expert Ali Martinez warned that Bitcoin’s price should not fall below $92,730. If this level is breached, Bitcoin could enter a downward spiral and potentially drop to around $70,000. His chart illustrates this possibility.

In a different post, Martinez expressed an opinion that a decrease in Bitcoin’s price, up to 30%, may not be detrimental. He even went so far as to say that this kind of correction could be the most advantageous event for Bitcoin. On the other hand, Martinez indicated that his bearish view on Bitcoin would only be invalidated if there was a sustained close above $97,300 and a daily close above $100,000.

Currently, as I’m typing this, Bitcoin’s price stands roughly at $94,400. In the past 24 hours, it has dropped nearly 2%. This information is derived from data provided by CoinMarketCap.

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-12-29 09:05