As a seasoned crypto analyst with over a decade of experience in the industry, I have seen my fair share of market volatility and memecoin mania. Dogwifhat (WIF), the Solana-based memecoin that took the crypto world by storm earlier this year, has once again grabbed my attention.

As a seasoned cryptocurrency investor and follower of memecoins, I’ve seen my fair share of market fluctuations. This week, I’ve been closely watching Dogwifhat (WIF), the popular dog-themed token built on Solana. After dipping below the crucial $2 support level, WIF has bounced back with impressive strength.

WIF Puts Its Hat Back On

In the opening three months of 2024, Dogwifhat, a memecoin, gained significant popularity and astonishing returns of more than 2,000%. The price surge reached its peak when the token’s value hit $4.8 in March. However, since then, there has been a downturn, with the Dogwifhat token losing approximately 45% of its value.

In spite of recent setbacks, investors continue to express optimism towards the memecoin, with some noting its resilience during its most severe corrections. Asad Saddique, CTO of Cryptonary, pointed out that the token managed to bounce back from five or six corrections exceeding 70%. For Saddiqui, Dogewhatsit demonstrated robustness and maintained its position amidst the competition for the memecoin market dominance.

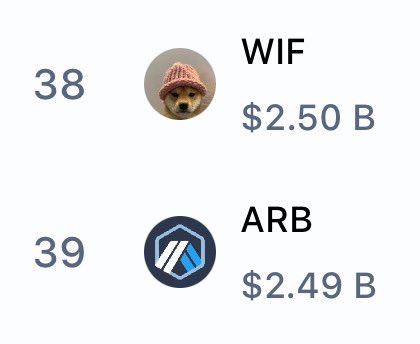

Significantly, WIF surpassed Arbitrum as the cryptocurrency with the 38th largest market capitalization today, amounting to approximately $2.5 billion. This milestone was initially met on March 31 when WIF attained its all-time high and a market cap of $4.57 billion.

Approximately a month ago, crypto analyst Bluntz, who had previously made optimistic predictions for WIF during the first quarter, expressed a pessimistic view regarding the memecoin. According to Bluntz’s assessment, the Solana token was on a downward trend and was likely to reach the $1 price range.

Despite the earlier optimistic assessment, WIF‘s predicted trajectory involves a significant correction followed by another potential all-time high (ATH). According to Bluntz’s perspective, this interim downturn might be considerable.

After the recent market decline, I observed that the memecoin with a dog theme experienced a significant price decrease of more than 43%. Just this past month, its value dipped from around $2.6 to reach as low as $1.51 on July 11th.

Despite this, its performance was quite impressive this past week. The token successfully bounced back from the $2 support level and now shows positive signs across various timeframes.

Will It Shred Another 40% Soon?

In the past 24 hours, WIF experienced a notable gain of 8%, currently priced at $2.54. This marked improvement signifies a substantial 60% rise within the last week and a significant 25% hike over the past month.

In more natural and easy-to-read language: The token’s recent price movements have renewed optimism among bullish investors, according to crypto expert Hornhairs. He considers the memecoin to be robust and believes that if it maintains its current price above $2.2, it could challenge the $3 resistance level again.

Another market analyst, namely CrediBull, has issued a cautionary note to investors regarding Dogwifhat. According to this analyst, the recent rebounds in altcoins, including Dogwifhat, are often perceived as a sign of resilience. However, CrediBull argues that this perception is misleading. Instead, they assert that altcoins, particularly meme coins like Dogwifhat, are merely more volatile versions of Bitcoin.

To the analyst, the recent rebound in Bitcoin (BTC) is “pleasing,” but Dogecoin (DOGE) is likely to mirror Bitcoin’s price fluctuations more intensely or forcefully.

As a researcher analyzing memcoins, I’ve noticed that our token of interest recently formed a triple bottom pattern on higher timeframes, following a lower high. This technical indicator often signals a potential reversal in price trend. Consequently, it’s reasonable to expect the token could experience a significant correction, potentially dropping by approximately 40% to reach and close below those three support levels (the triple bottom) before any potential recovery.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-07-20 07:35