As a seasoned researcher with a penchant for deciphering cryptocurrency trends, I find the recent decline in Mean Dollar Invested Age for Dogecoin and XRP particularly intriguing. It’s like watching an old dog learn new tricks, but in this case, it’s an old coin showing signs of renewed activity.

According to the blockchain analysis company, Santiment, Dogecoin (DOGE) and Ripple (XRP) are showing positive signs based on a frequently underestimated indicator.

Dogecoin, XRP, & Bitcoin Recently Saw A Decline In Mean Dollar Invested Age

On their latest blog post about X, Santiment delves into the current wave in the Average Age of Coin Holder statistic for several leading cryptocurrencies within the market.

The “Mean Dollar Invested Age” keeps track of the average age of every dollar the holders have invested into the cryptocurrency. This metric is similar to the Mean Coin Age, an indicator that measures the average age of tokens in the entire circulating supply.

In simpler terms, Mean Coin Age tracks when each coin was last used within the network and calculates the average age for all coins. On the other hand, Mean Dollar Invested Age does the same but also considers the value of the coins in U.S. dollars based on the price at the time they were last moved.

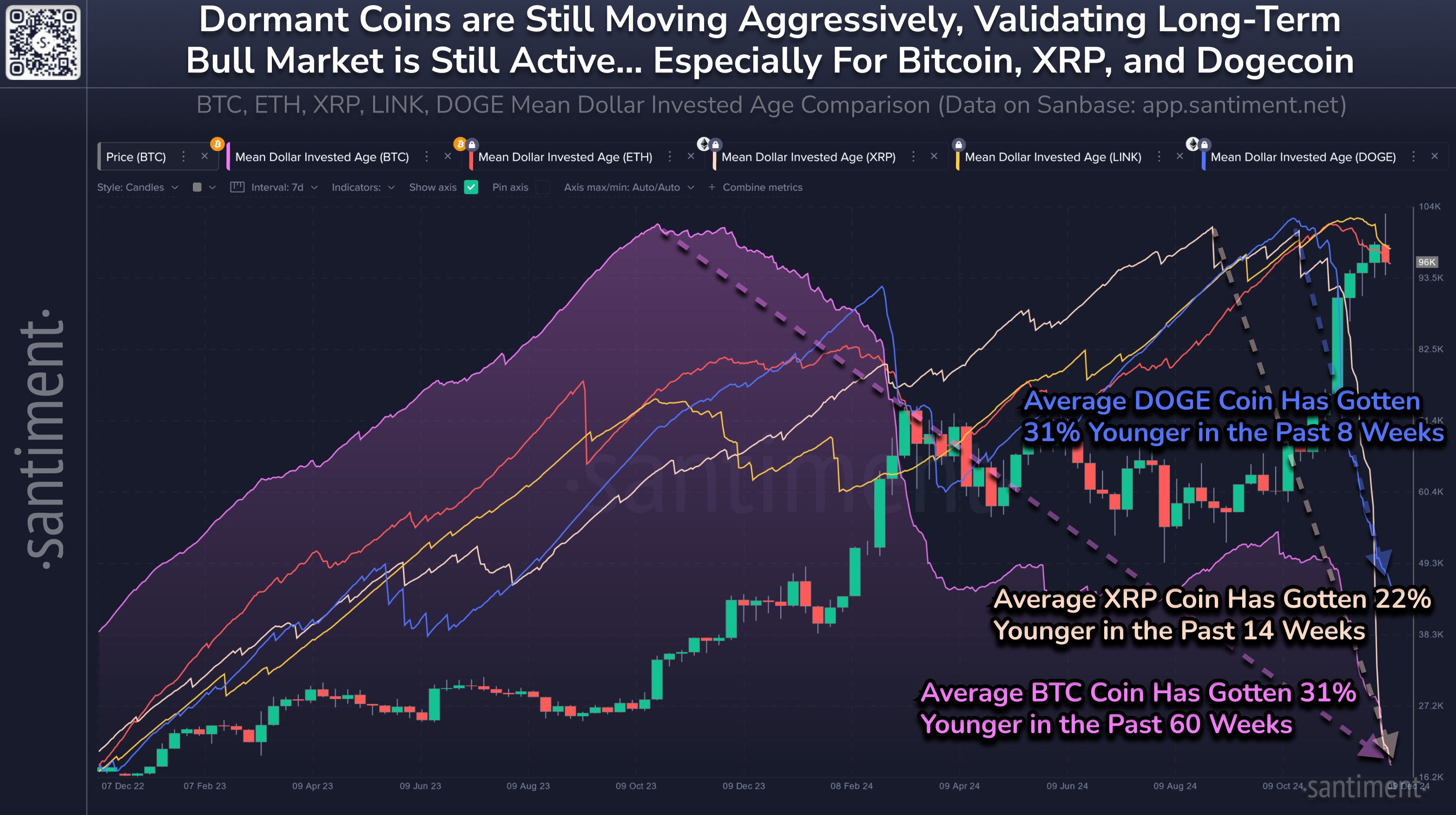

Here’s a visual representation displaying the progression of Average Dollar Investment Age for the leading five digital currencies: Bitcoin (BTC), Ripple (XRP), Dogecoin (DOGE), Ethereum (ETH), and Chainlink (LINK).

Over the past while, the Average Dollars Invested Age has seen a decrease across all five cryptocurrencies, however, the reduction has been relatively minor for Ethereum and Chainlink compared to others.

On the other hand, Bitcoin, XRP, and Dogecoin have witnessed a very significant decrease in the indicator. As for what it means when this metric trends down, Santiment explains:

When the Line of Average Dollar Investment Age in a network is descending, it signifies that previously inactive wallets, especially those belonging to significant investors, are transferring their idle cryptocurrencies back into circulation, thereby boosting overall network interaction.

An alternative perspective is that instead of indicating old hands might be involved in trading, it could also mean fresh funds are entering the market, purchasing the inactive coins and thus lowering the average age of ownership.

Historically, the trend appears to have been upward, according to the findings of the analyst firm.

One crucial sign across the duration of any coin’s life is its ability to confirm that a prolonged bull market remains viable. In the cases of both the 2017 and 2021 bull markets, they persisted until the average age of assets began increasing or “rising” once more.

Among the three investments experiencing a significant drop in the Average Dollar Age, it’s worth noting that Dogecoin has been exceptionally prominent due to both the magnitude and pace of this decline. Over the past eight weeks, the typical dollar invested in Dogecoin, often referred to as a meme coin, has become approximately 31% younger.

DOGE Price

At the time of writing, Dogecoin is floating around $0.403, down almost 2% in the last seven days.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-12 07:34