Dogecoin, the cryptocurrency that once made people believe a Shiba Inu could be a financial advisor, is back in the news. This time, however, it’s not because Elon Musk tweeted about it while eating a bagel. No, this time it’s because the so-called “whales” — those mysterious, deep-pocketed entities who probably own yachts named “To the Moon” — have decided to offload a staggering 1.32 billion DOGE in just 48 hours. That’s enough Dogecoin to buy a small country, or at least a very large pizza.

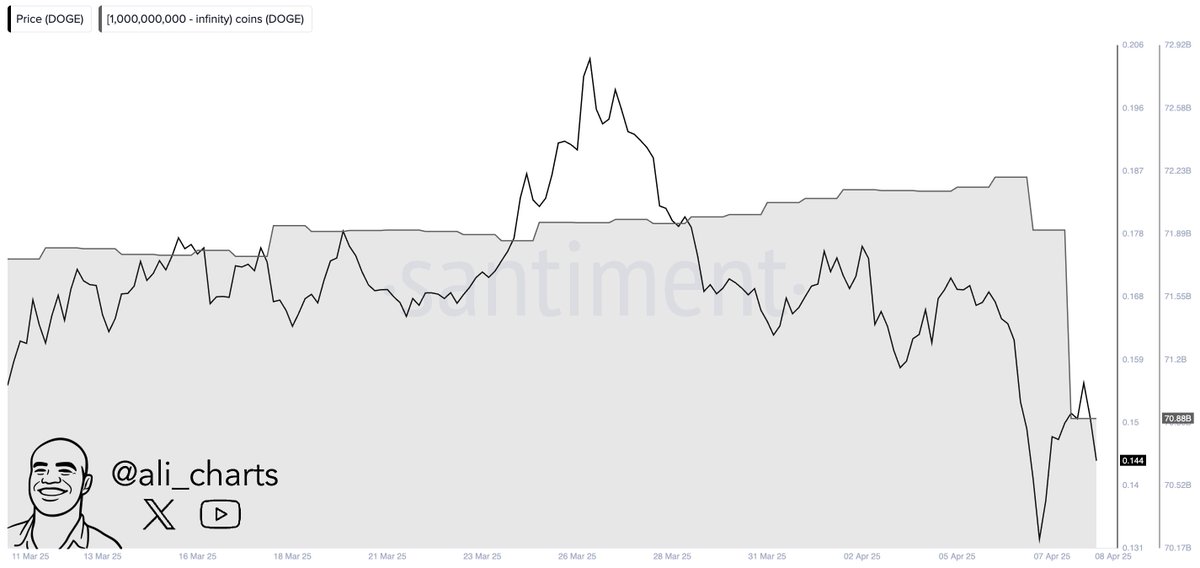

The market, already on edge due to global tensions and macroeconomic uncertainty, has reacted to this selloff with the kind of enthusiasm usually reserved for root canals. Dogecoin hit a fresh local low of $0.129, which is roughly the price of a cup of coffee, assuming you’re not buying it at an airport. The sentiment has shifted from cautious optimism to something resembling a group of people trying to escape a burning building while arguing about who left the oven on.

Is this a strategic move by the whales, or are they just panicking like the rest of us when we realize we’ve left the fridge door open? Whatever the reason, Dogecoin is now at a critical juncture. If buyers don’t step in soon, the path of least resistance could be lower, which is a fancy way of saying “things could get worse.”

Dogecoin has lost more than 70% of its value since December, which is impressive in a “how did we get here?” kind of way. The meme coin, once the darling of retail investors and people who thought “HODL” was a typo, is now leading the decline in the altcoin space. Global tensions, aggressive tariffs, and the general sense that the world is on fire have all contributed to this selloff. It’s like the financial equivalent of a bad day at the zoo.

Adding to the gloom, top analyst Ali Martinez shared data showing that whales have sold over 1.32 billion Dogecoin in just 48 hours. This is a clear sign of the risk-off sentiment dominating the market, or as it’s more commonly known, “everyone is freaking out.” Martinez suggests this behavior is driven by panic and the expectation of a prolonged bear market, which is like saying “winter is coming” but with fewer dragons.

Until sentiment shifts and macro conditions stabilize, Dogecoin’s path remains precarious. The combination of whale dumping, market-wide fear, and global economic strain may keep DOGE under pressure in the near term. Bulls will need to reclaim key levels quickly to avoid a deeper collapse — but for now, the trend remains firmly bearish, which is a polite way of saying “brace for impact.”

Dogecoin is trading at $0.14, nearly 75% below its 200-day moving average around $0.25. This is a striking indicator of how far the meme coin has fallen, like a meteor that missed the moon and landed in your backyard. The downtrend accelerated when DOGE lost support at the $0.25 level, and since then, bulls have failed to mount any meaningful recovery. Continued macroeconomic stress and weak investor sentiment have only added to the selling pressure, dragging prices lower with each passing week.

For Dogecoin to begin a potential recovery phase, holding above the $0.15 level is critical. This zone could act as a short-term support base, giving bulls a chance to regroup. However, merely stabilizing isn’t enough. A push toward the $0.20 mark is needed to reestablish momentum and break the current bearish structure. Reclaiming that level would also bring DOGE closer to its 200-day MA, a key technical milestone for trend reversal.

On the downside, losing the $0.14–$0.15 area could open the door to deeper losses. If support fails to hold, a quick move toward the $0.10 level is possible — potentially signaling a return to bear market lows. For now, DOGE remains under heavy pressure, with bulls on the defensive and time running out to avoid another breakdown. It’s like watching a slow-motion car crash, except the car is made of memes and the crash is happening in your portfolio.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Odd Jobs to Stardom: 13 South Indian actors who worked as Taxi driver, barber to backstage worker

- King God Castle Unit Tier List (November 2024)

- NVIDIA’s Jensen Huang shares details about the AI processors powering Switch 2

- Is There a MobLand Episode 11 Release Date & Time?

- List of All Apple iOS 26 Features Revealed in Leaks

- Who Is Emmanuel Macron’s Wife? Brigitte’s Age & Relationship History

2025-04-09 16:35