As a seasoned crypto investor with battle-scarred fingers from countless market swings, I find myself looking at Dogecoin’s recent rally with a mix of excitement and caution. The 16% surge over the past week has been impressive, but Maartunn’s Risk Indicator flashing red is a reminder that history tends to rhyme more than it repeats in this rollercoaster world of cryptocurrencies.

Over the last seven days, Dogecoin has experienced a significant 16% surge. Let’s examine how this analyst’s “Risk Indicator” assesses Dogecoin following this upward trend.

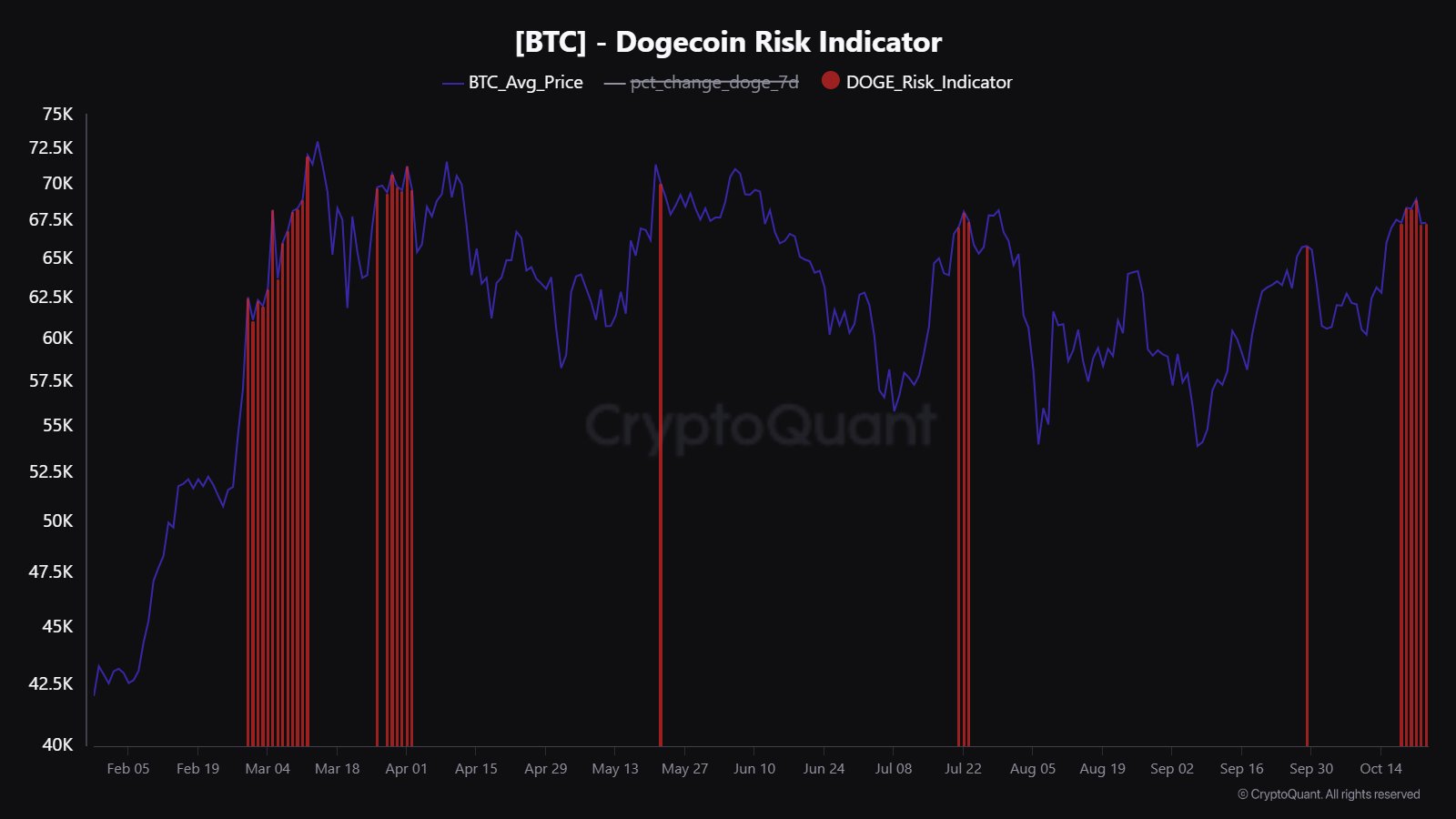

Dogecoin Risk Indicator Has Given A Red Signal Recently

In a new post on X, CryptoQuant community manager Maartunn has shared a “Risk Indicator” for Dogecoin. As for what the metric does, the analyst has explained,

I calculated the percentage change over the last 168 hours (one week). When the percentage change exceeds a specific threshold, it indicates a potential risk zone.

The risk here is toward Bitcoin and since the rest of the sector usually follows in its lead, it would also be toward cryptocurrencies as a whole. Below is the chart for the indicator posted by Maartunn.

Over the last few days, it’s clear that the Dogecoin Risk Indicator has signaled an increase, coinciding with a significant surge in the Dogecoin price, which rose by approximately 16%.

It’s additionally clear from the graph that whenever the indicator has been activated recently, it’s likely that the price of Bitcoin reached a peak.

Since the recent surge in Bitcoin (BTC), there seems to be a sudden halt following the emergence of the latest signal. This could suggest that rapid increases in the value of meme coins might yet again foretell trouble for the crypto sector.

What makes this pattern occur, you may wonder? Typically, when memecoins detach themselves from Bitcoin and its original company, it’s often indicative of excessive greed dominating the market.

Over time, it’s been observed that cryptocurrencies tend to follow the general sentiment of the public. This means when expectations are overly optimistic or greedy, the result is usually a downturn in the market.

Recently, investors have been anticipating rapid gains from meme-based cryptocurrencies such as Dogecoin. However, if past trends hold true, these memecoins might need to cool off for the market to maintain its upward trend.

Meanwhile, let’s discuss a fresh piece of information. The data analytics platform, IntoTheBlock, recently disclosed insights about the average holding duration across significant cryptocurrency networks in a recent blog post.

According to the table shown earlier, Bitcoin stands out as the cryptocurrency that investors typically hold onto for approximately 4.4 years before moving their coins elsewhere.

These digital currencies – Ethereum, Dogecoin, and Shiba Inu – are all neck-and-neck in second place, with a duration of approximately 2.4 years for each. Despite the speculative hype surrounding meme coins, they have successfully built user bases that are just as tenacious as those found within Ethereum’s community.

DOGE Price

In recent times, the momentum of Dogecoin’s surge seems to have eased off, with its current value hovering approximately at $0.142.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-25 14:46