As a seasoned analyst with years of experience in the cryptocurrency market, I’ve seen enough bull runs and bear markets to understand that every trend has its own unique dynamics. Recently, Dogecoin has experienced a significant surge, but an on-chain indicator suggests this bullish trend might not last forever.

In simpler terms, Dogecoin experienced an increase of more than 12% within the last 24 hours, yet a developing pattern in one of its underlying indicators might suggest a downward trend ahead.

Dogecoin Investors Have Been Showing Signs Of FOMO Recently

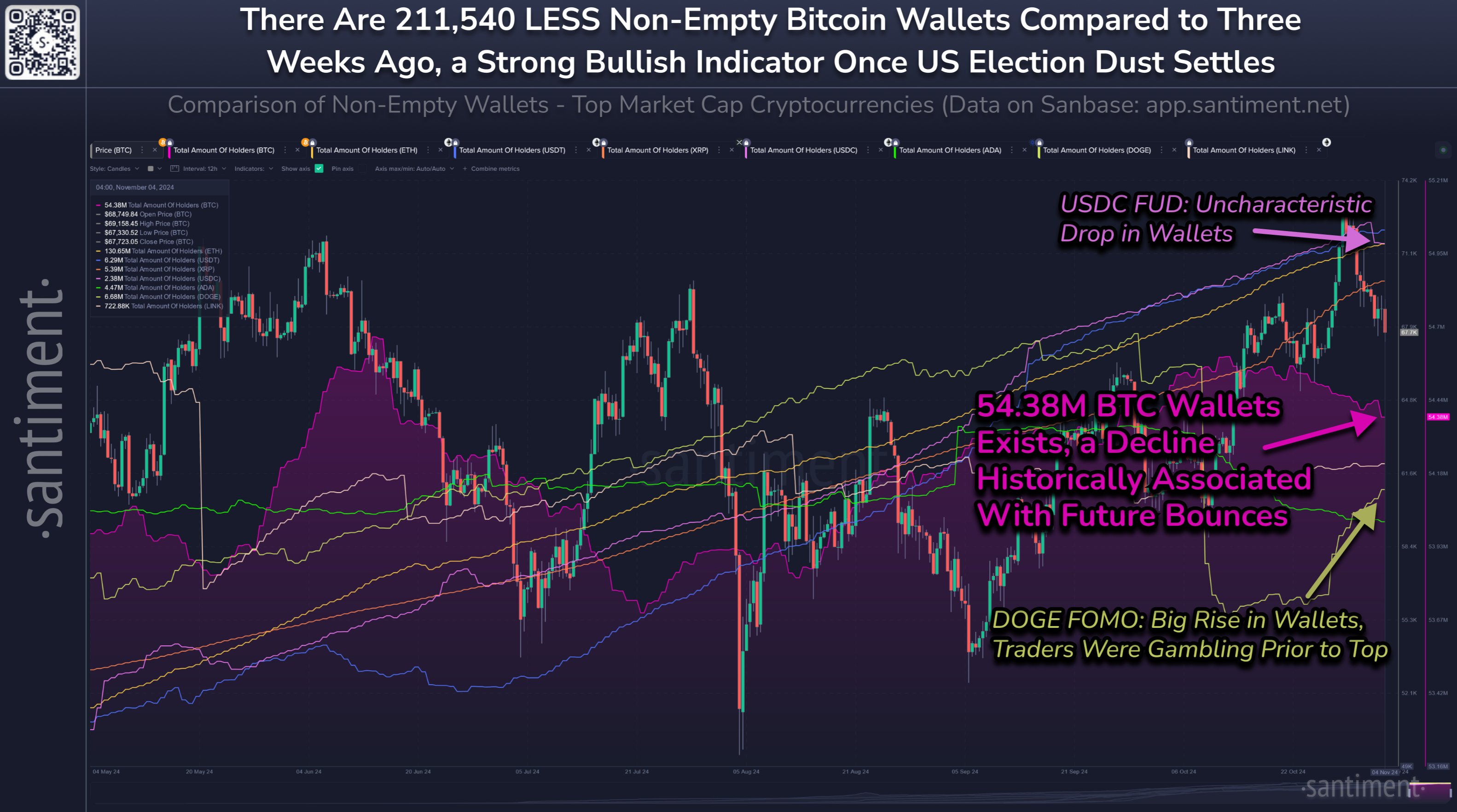

In their latest update on platform X, Santiment, an on-chain data provider, delves into the shifting patterns of the Number of Individual Owners for prominent cryptocurrencies across the market.

In this context, “Total Amount of Holders” is a term used for an indicator that, as the name implies, monitors and records the overall count of unique network addresses holding a non-zero value.

When the level of this metric goes up, it signals that either fresh investors are entering the blockchain market or previous sellers are re-investing in the coin again. Additionally, the indicator will show a rise when current users decide to spread their assets across various digital wallets, often for reasons such as privacy concerns.

Typically, these three elements are working concurrently when this pattern emerges, implying that there is likely a growing acceptance or adoption of the asset in progress.

Alternatively, a decrease in the indicator might imply that some owners are choosing to sell off their cryptocurrency holdings, possibly due to a desire to exit the market.

Here’s a visual representation displaying the progression of Total Ownership for Bitcoin, Dogecoin, and other leading cryptocurrencies:

According to the chart we see, the majority of assets have experienced a rise in the number of holders holding a significant amount recently. However, unlike others, the count of non-zero Bitcoin wallets has decreased instead.

Specifically, there are approximately 211,500 fewer active cryptocurrency wallets now compared to just three weeks ago, resulting in a current total of about 54.38 million addresses.

Some investors who own the asset feel that the ongoing surge won’t persist any longer, leading them to sell their shares at the latest market prices.

Historically, the investment sector has often responded oppositely to investor emotions. When fear, uncertainty, and doubt (FUD) prevail among investors, asset prices usually increase. Conversely, during periods of fear of missing out (FOMO), prices typically decrease.

In other words, the decrease in the number of Bitcoin holders might unexpectedly indicate a positive trend. While Bitcoin’s holder count is decreasing, Dogecoin has seen an increase, with over 46,400 new addresses containing a balance appearing on its network within the last week.

According to the analysis from the firm, this behavior by traders indicates they’re taking risks on meme coins, including Dogecoin, following a recent peak last week. Historically speaking, such fear of missing out (FOMO) might not bode well for Dogecoin.

DOGE Price

Over the past day, Dogecoin has persistently surged in a positive trend, exceeding the $0.168 barrier. The growing excitement among investors (FOMO) might sustain this momentum, but it could also prove to be unsustainable.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-11-06 07:16