As a seasoned crypto investor with a knack for spotting trends and understanding market dynamics, I can’t help but feel a sense of déjà vu when observing Dogecoin‘s current predicament. Having ridden the DOGE rollercoaster since its inception, I’ve learned to appreciate the ebb and flow of this meme-turned-digital currency.

Currently, Dogecoin (DOGE) is experiencing a downtrend, dropping approximately 16% from its November 23 peak of $0.4795. As the pioneer meme cryptocurrency finds it challenging to regain crucial technical points, some analysts suggest that DOGE’s potential for stabilization or recovery could heavily depend on one primary external factor: Bitcoin‘s price trend.

Dogecoin Price At Risk Of Another Slump

Based on technical analysis, it appears that the upward trendline established in mid-November, previously viewed as strong, has transformed into a significant resistance point. After breaking through this support level earlier in the week, Dogecoin bulls have repeatedly tried to push the price above it, but so far, these attempts have been unsuccessful.

Crypto analyst Kevin (@Kev_Capital_TA), keeping a close eye on the daily DOGE/USD chart, observes that DOGE is facing resistance when retesting a trend line it has held for nearly a month. Moreover, this trend line coincides with the .786 Fibonacci level, a technical area frequently linked to significant price changes and possible reversals.

Moving beyond the current trend, technical indicators within the Dogecoin market suggest a potentially difficult situation. Kevin highlights that the daily MACD for DOGE is showing “significant downward momentum,” a technical hint implying the market’s short- to mid-term inclination might tilt towards decreasing unless there’s a significant change in the broader crypto market conditions.

According to him, if Bitcoin doesn’t increase in value, it’s likely that Dogecoin will decrease in the near and medium term. A rise in Bitcoin could potentially prevent this scenario though. He considers $0.32, which was the starting point of the previous upward trend, as a significant downward target. If Dogecoin can’t maintain its value above this level, traders might aim for the $0.29 to $0.26 price range as potential future drops.

In a different discussion about X, Kevin highlighted that Dogecoin’s price is stuck between two significant long-term Fibonacci levels. He referred to DOGE as being in a range between the “macro golden pocket,” approximately at $0.47, and the macro 0.5 Fib level close to $0.39. As he sees it, a decisive breach above or below these key levels may initiate what he terms a “chain reaction” of “intense price action.

He states: “I believe that DOGE is currently beyond its own control, with its destiny heavily influenced by BTC at the present time. Thus, spending too much time scrutinizing the asset may not be productive. I don’t see any signs indicating the cycle has ended, so I expect it to rise in value soon enough, disregarding short-term distractions. As a long-term holder who purchased early like myself, there’s not much else we can do but remain patient and wait.

On the other hand, it’s important to point out a positive aspect: Kevin highlights a possible hidden bullish divergence on the Dogecoin daily chart. A hidden bullish divergence is a situation where prices keep rising over an extended period, while indicators such as the Relative Strength Index (RSI) show a downward trend. This can be seen as a positive sign for potential price increases in the future.

Occasionally, this pattern might suggest that a market’s true resilience is more substantial than what meets the eye. As an analyst explains, “it’s quite typical” right now, but it remains crucial for Bitcoin to collaborate for any assurance, as Kevin notes, “We still need BTC to play along; nothing is guaranteed yet.

What About Bitcoin?

Kevin highlights that Bitcoin is finding itself “caught” between an ascending trend line acting as support and a macro golden pocket, which are based on the high points of the previous bull market and low points of the bear market. This tight price movement indicates that a resolution is approaching quickly. In essence, he foresees that Bitcoin will not stay confined within this area for much longer. A clear breakout, either upward or downward, seems imminent, and the potential impact could be significant. Thus, Kevin anticipates a “pop” in either direction very soon.

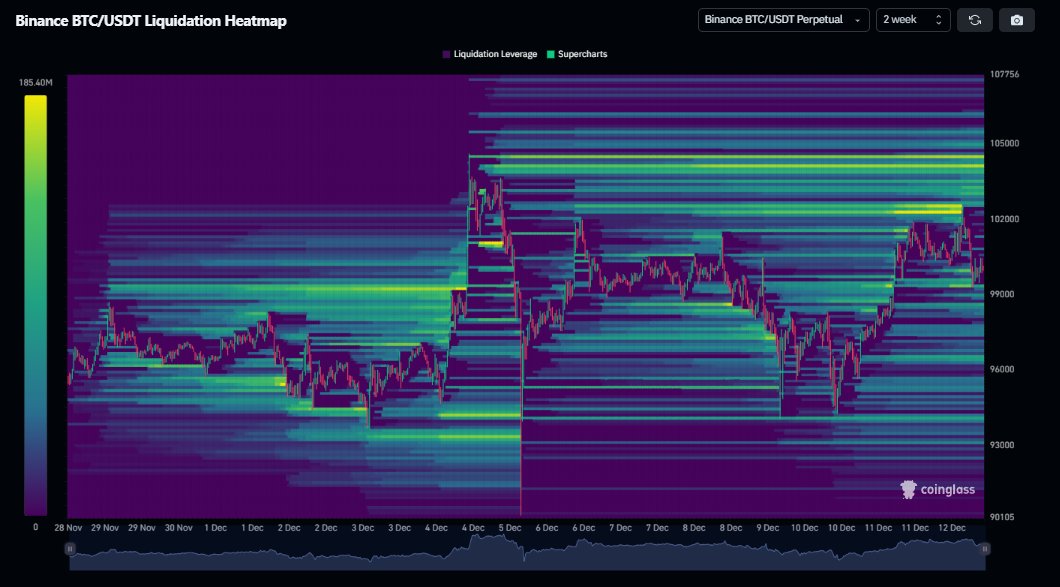

Regarding liquidity aspects, Kevin anticipates substantial potential for Bitcoin’s liquidity to increase significantly over the next few days, as the accumulated liquidity observed recently coincides with a key Fibonacci level (1.703). Furthermore, he has noticed data suggesting large whales have been buying options contracts for MicroStrategy (MSTR) stock. This could possibly indicate a prediction of Bitcoin’s price rise, considering MicroStrategy’s renowned Bitcoin reserves.

At press time, DOGE traded at $0.405.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2024-12-13 16:34