As a seasoned analyst with over two decades of experience in traditional finance and crypto markets, I have witnessed countless price fluctuations and chart patterns that have shaped my understanding of market dynamics. Having closely monitored Dogecoin‘s journey from meme currency to top ten cryptocurrency, I can’t help but feel a sense of deja vu when observing the latest development in its price action.

The recent consolidation around $0.3 and the appearance of a Cup and Handle pattern on Dogecoin’s chart is reminiscent of other market cycles we have seen over the years, where periods of rapid growth are often followed by corrections. While I am not one to make hasty predictions, the potential for a significant price crash below $0.2 cannot be overlooked, especially given the current bearish sentiment in the broader cryptocurrency market and Bitcoin‘s declining price.

However, it is essential to remember that the Cup and Handle pattern often signals a final consolidation phase before a breakout, suggesting that the anticipated correction could pave the way for a powerful rebound. If this prediction holds true, Dogecoin may be gearing up for a potential rally towards its long-awaited $1 mark.

That said, as always in the volatile world of cryptocurrencies, nothing is ever certain. In the words of Yogi Berra, “It’s tough to make predictions, especially about the future.” So, let us wait and see how Dogecoin unfolds in the coming weeks. But if you ask me, I wouldn’t be surprised if this rollercoaster ride continues!

(Joke) And just like the Dogecoin price chart, my blood pressure graph these days looks a lot like the stock market during the 2008 financial crisis – up one minute, down the next!

The price of Dogecoin is currently holding steady near $0.3 following a drop of over 21% over the last month. A cryptocurrency expert has spotted a fresh Cup and Handle chart formation, hinting that the popular meme token could face further drops, potentially dipping below $0.2.

Chart Pattern To Trigger Dogecoin Price Crash

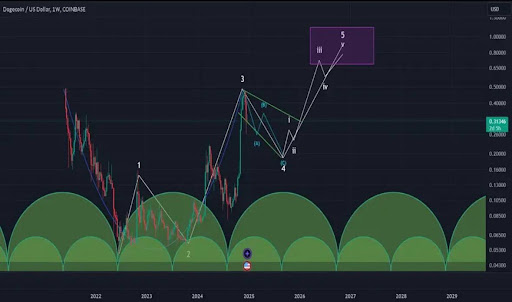

A TradingView user going by ‘Cryptechcapital’ has made public an Elliott Wave analysis chart for Dogecoin’s price trends over a long-term weekly timeframe. In his comprehensive report on Dogecoin’s current Elliott Wave configuration, he points out the emergence of a classic Cup and Handle pattern.

In simpler terms, a Cup and Handle pattern is a technical analysis tool that suggests a pause in price movement before a major shift. Usually, it’s seen as a positive sign extending an upward trend; however, its emergence on Dogecoin’s chart indicates a possible significant drop in price to reach new lows, according to the crypto analyst.

The analyst’s chart shows that Dogecoin’s price movement follows a five-part impulse, labeled as waves 1 through 5. At present, we are in wave 4 – a correction phase where the price may pull back and move sideways for an extended duration. Notably, this correction phase aligns with the ‘handle’ of the Cup and Handle pattern in Dogecoin’s five-wave structure.

As a seasoned trader with years of experience under my belt, I have seen the crypto market’s ups and downs. Based on my analysis, I believe that Dogecoin is about to take a significant dip once it finishes Wave 4. The Cup and Handle pattern suggests downward pressure for Dogecoin over the next week or so.

However, it’s essential to keep in mind that the broader cryptocurrency market might also face bearish winds, especially given the increasing market volatility and Bitcoin’s declining price. In my opinion, this is a perfect time for cautious investors to exercise patience and prudence when making decisions regarding their investments.

That being said, I always remind myself that past performance is not necessarily an indicator of future results, and it’s crucial to have a well-diversified portfolio and stick to a risk management strategy.

Although the exact degree of the analyst’s predicted drop isn’t mentioned, typical Wave 4 corrections often involve reclaiming considerable parts of the prior Wave 3 advancements. In other words, if Dogecoin undergoes a price decrease during Wave 4, there might be a possible dip below $0.2.

Dogecoin Crash First, Recovery Next?

Cryptechcapital anticipates a steep drop in Dogecoin’s price, but also suggests this predicted decline might lead to a strong comeback. According to their analysis on TradingView, once Wave 4 is finished, Dogecoin may transition into Wave 5, indicating the end of its downtrend and potentially setting off a price surge.

Previously stated, the Cup and Handle chart formation typically indicates the last period of consolidation prior to a significant price surge. Based on predictions from a TradingView analyst, Dogecoin might experience a steep decline in value before it rebounds towards the anticipated $1 price level.

As a crypto investor, I’ve noticed that the analyst’s price chart suggests that if Dogecoin manages to reach a local peak instead of following its anticipated correction, it could potentially invalidate the Cup and Handle pattern we’ve been observing. This unexpected move would necessitate a fresh outlook on Dogecoin’s future price trend.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-29 06:43