As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous cycles of bull and bear runs. The recent performance of Dogecoin has been intriguing, to say the least. While its 12% surge in September was impressive, the lackluster October performance seems to be a common theme among many cryptocurrencies this month.

Dogecoin saw a surge of over 12% in value during September, a typically challenging month for cryptocurrencies. However, it hasn’t quite managed to maintain its impressive performance in October. Lately, the price of Dogecoin has been struggling under bearish market pressure, mirroring the general slowdown in the crypto market over the past week.

Recently, significant insights from the blockchain have suggested that the decline in Dogecoin’s price may not last much longer. This is due to a surge in activity among major investors of this meme currency, which could potentially influence its price trajectory.

Are Dogecoin Whales Positioning Themselves For A Bullish Breakout?

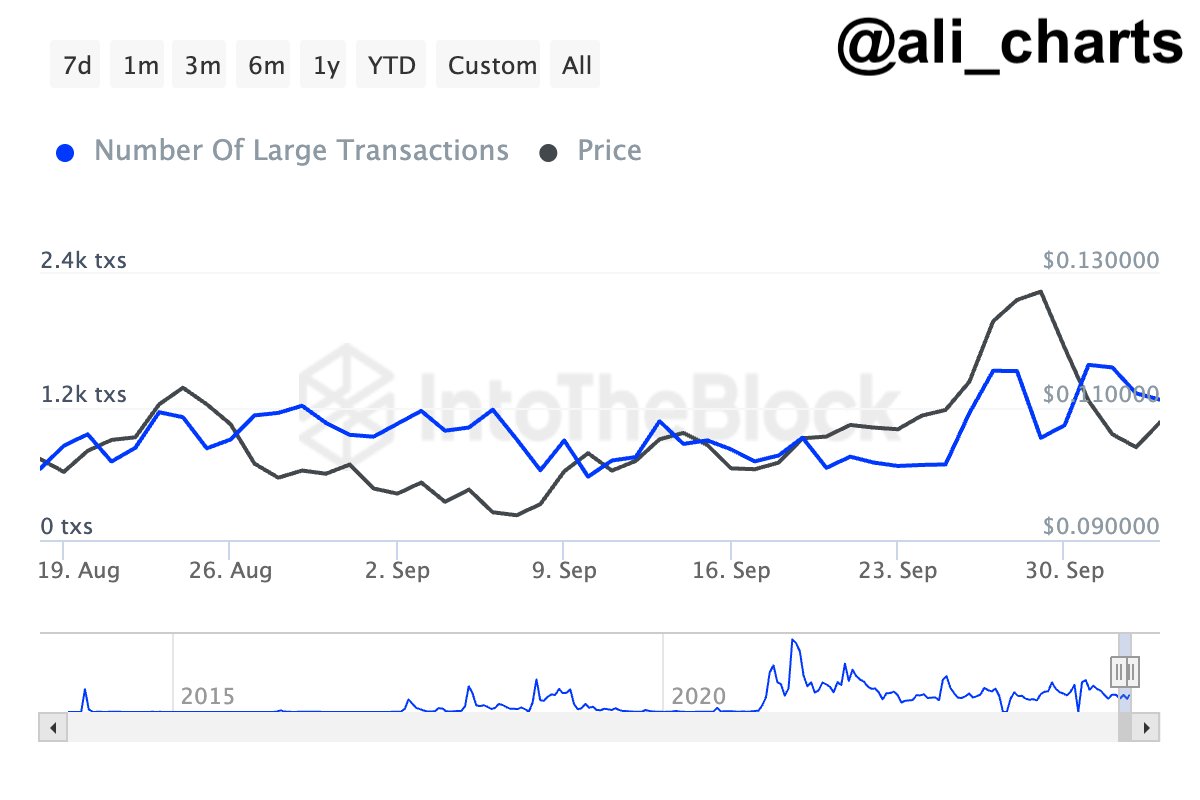

Known crypto expert Ali Martinez utilized the X platform to discuss a captivating on-platform observation concerning the trading activities of significant investors like whales recently. The key metric in this context is the IntoTheBlock “large transactions” statistic, which tallies up transfers exceeding $100,000 in value.

As a crypto investor, I find myself part of a group that includes whales and institutional players when analyzing this data point, given the scale of these transactions. The term ‘whales’ refers to individuals or organizations who hold large quantities of a specific cryptocurrency, giving them considerable power over market trends. In essence, they swim in deeper waters than the rest of us.

As reported by Martinez, there’s been a consistent increase in significant Dogecoin transactions. Such an uptick in big trades frequently suggests that major investors or “whales” are either stockpiling before a potential price hike or dispersing their holdings. It’s important to mention that the IntoTheBlock large transactions metric doesn’t provide clear information about whether these transfers represent accumulation or distribution of assets.

It’s worth noting that Dogecoin whales (those with over $10 million in assets) purchased approximately 1 billion DOGE, equivalent to around $108 million, within a single day. This indicates that these major holders have been actively stockpiling the cryptocurrency. However, this move has raised questions among other investors about what information they might be privy to.

Despite increased involvement from large institutional investors and prominent players (known as “whales”), there’s a strong possibility that Dogecoin could see optimistic predictions due to this trend. This belief in its future prospects would be bolstered, potentially leading to increased market turbulence and the potential for substantial price hikes.

DOGE Price At A Glance

Currently, Dogecoin’s value is approximately $0.1088, showing a minor decrease of 0.6% over the past day. However, if we look at the weekly trend from CoinGecko, Dogecoin has fallen by more than 16%.

At present, the rebound of the meme coin appears to be decelerating, but it could be beneficial for investors to stay vigilant for encouraging signs in the blockchain activity. It’s also worth noting that October has traditionally been a favorable period for Dogecoin.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-06 16:16