As a seasoned analyst with over two decades of experience in the financial markets, I must admit that the recent developments in Dogecoin have piqued my interest. The combination of the TD Sequential signal and the whale accumulation is reminiscent of patterns I’ve seen in other successful rallies throughout my career.

A researcher has noted some positive trends in two key aspects of Dogecoin, which may signal a potential increase in its value.

Dogecoin Has Seen Positive Signals On TD Sequential & Whale Supply

In his latest blog post on X, analyst Ali Martinez discusses a recent Tom Demark (TD) Sequential signal that Dogecoin has experienced on its 4-hour price chart. The TD Sequential is a technical analysis tool employed to identify potential turning points for an asset’s price movement.

The indicator includes two phases, called the setup and countdown. During the first of these, the setup, candles in the price of the same color are counted up to nine. These candles aren’t necessary to be consecutive.

Once all nine candles are present, the setup is considered complete, at which point the TD Sequential provides a sign for the asset’s potential reversal. If the final candles leading up to completion are green, the indicator indicates that a peak might be near, while if they are red, it signals that a trough could be imminent.

Upon completion of the setup process, I initiate the countdown phase. This stage mirrors the setup but employs thirteen candlesticks instead of nine. Following their appearance on the chart, the TD Sequential provides another buy or sell recommendation based on the price movement.

Lately, the initial phase of the TD Sequential indicator on Dogecoin’s 4-hour chart has been completed, as demonstrated by this graphic from the analyst.

It seems clear from the provided chart that after nine consecutive green candles on the 4-hour Dogecoin chart, as indicated by the TD Sequential setup, there could potentially be an upcoming price increase.

In other words, it’s not just this recent event that suggests positivity for DOGE; as Martinez highlighted in a different post, large investors (whales) have been actively buying the cryptocurrency over the past few days.

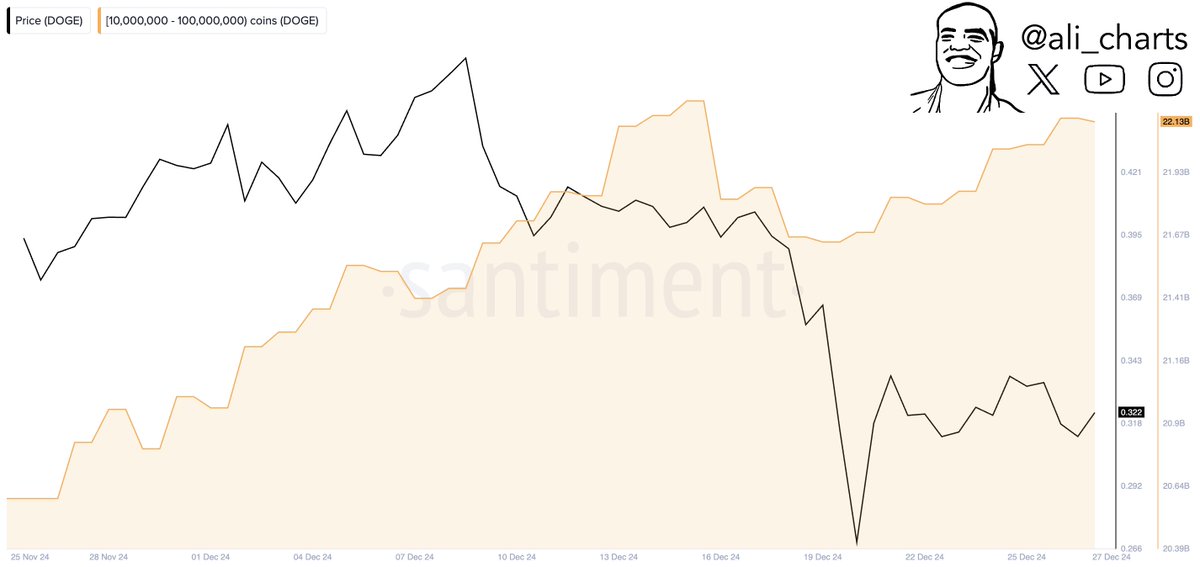

According to the analyst’s reference, they are using the Supply Distribution metric provided by Santiment as their on-chain indicator. This metric provides insights into the current quantity of coins or tokens being held by various wallet groups.

Below is the chart for the metric that specifically shows the data for the whale cohort, massive investors carrying between 10 million and 100 million tokens:

It seems clear from the graph that the total Dogecoin owned by large investors, or ‘whales’, has gone up recently. To be precise, these whales have accumulated approximately 90 million DOGE (which is roughly $28.7 million) in the past couple of days.

This amassment suggests that these crucial investors think that the cryptocurrency is a good buy at its present cost.

DOGE Price

At the time of writing, Dogecoin is floating around $0.319, up more than 10% over the last week.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-12-28 04:34