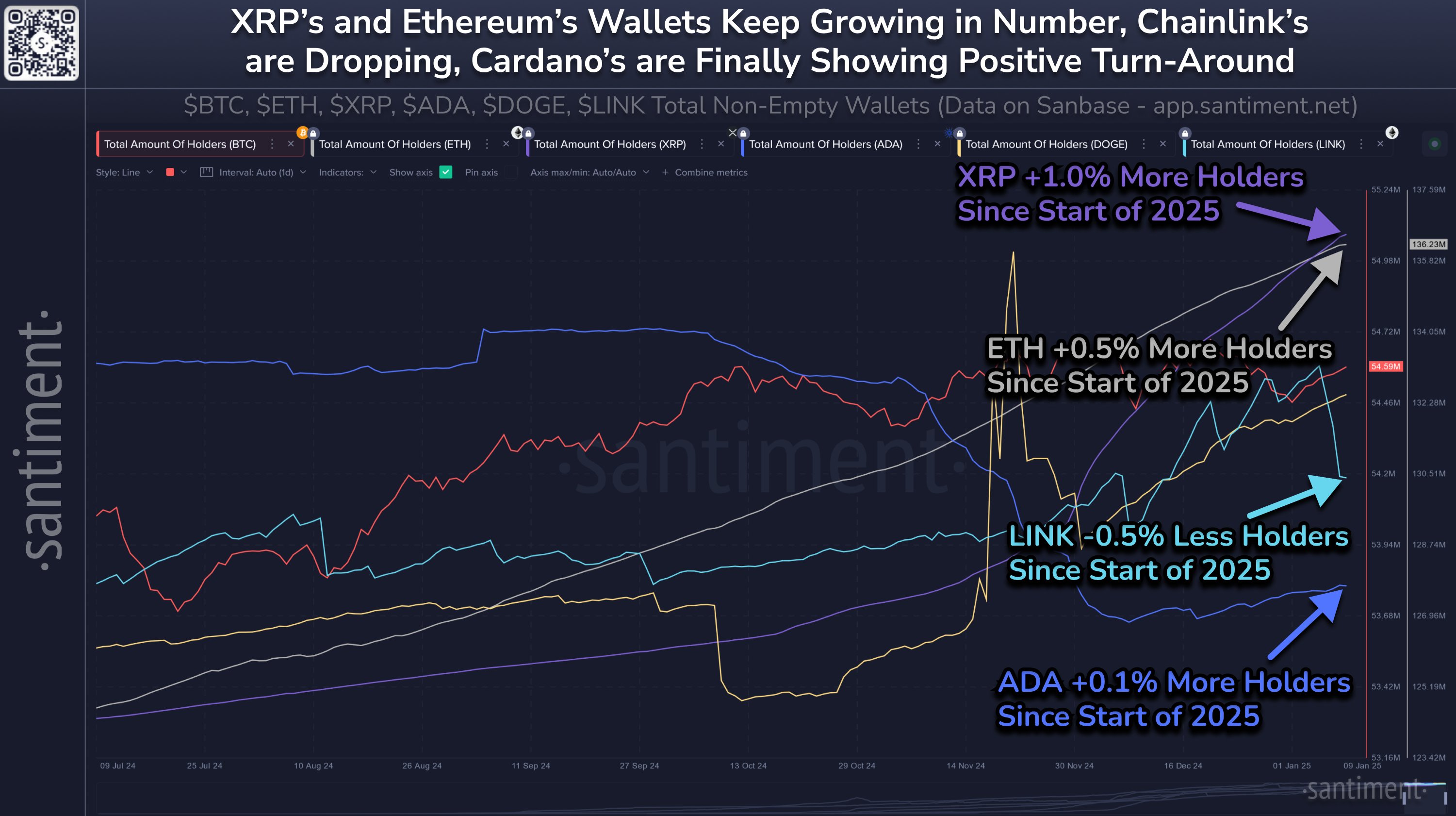

Since the beginning of January, Dogecoin (DOGE) has seen over 29,000 new digital wallets being created, as reported by on-chain analysis company Santiment. Today (January 10), Santiment shared this information along with data about how other significant cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), XRP, Cardano (ADA), and Chainlink (LINK) have performed in terms of new wallet creation.

Dogecoin Hodlers On The Rise

2025 has seen crypto’s leading assets experiencing a roller coaster ride with fluctuating prices since the start of the year, according to Santiment via X. Santiment further explains that an increase in wallets suggests investors are confident about the long-term success of the project. Conversely, a decrease might indicate unnecessary fear, uncertainty, and doubt (FUD), which could signal a buying opportunity as it counters the panic among the masses.

According to Santiment’s data, there was a substantial increase in Ethereum and XRP holders at the start of 2025. Specifically, Ethereum saw an increase of approximately 645,000 wallets, while XRP recorded around 58,000 more. Bitcoin also experienced a growth of about 102,000 wallets during this period, and Cardano noted a more minor increase of roughly 2,800 holders. Interestingly, the number of Chainlink holders decreased by approximately 3,300 within the same timeframe.

According to an on-chain analysis firm’s observations, the number of wallets for XRP, Ethereum, and Cardano have been increasing, while Chainlink has seen a decline. Specifically, the number of XRP holders has grown by 1.0% since the beginning of 2025, Ethereum holders by 0.5%, and Cardano holders by 0.1%. In contrast, Chainlink’s wallet count has decreased by 0.5%. Although no specific number is given for Dogecoin, the chart suggests a clear and strong upward trend.

According to Santiment’s detailed study, there has been a significant drop in total trading volumes within the cryptocurrency market starting from mid-December 2024. Notably, meme coins such as Dogecoin have experienced a substantial decrease in trades driven by speculation. In simpler terms, Santiment notes that despite some positive developments, overall trading activity across the crypto market has been decreasing since mid-December 2024.

Over the last fortnight, it’s been noticed that the average daily trading volume for the leading ten cryptocurrencies has decreased by around 13%. Notably, Ethereum has seen the most significant drop, with a decrease of approximately 17%. Major exchanges like Binance and Coinbase have reported a decline in spot trading volumes, with Binance experiencing a fall of 15% and Coinbase seeing a drop of 12%. Analysts suggest that this drop could be due to seasonal effects, reduced ‘whale’ activity, and concerns about upcoming regulatory changes.

One important metric that Santiment focuses on is called MVRV (Mean Value to Realized Value), which keeps track of the average returns for traders. Right now, most active wallets dealing with top assets are showing negative returns over a 30-day period, suggesting there may be chances for contrarian investors to buy. As mentioned yesterday, Dogecoin’s MVRV stands at -8.89%, indicating a “blood in the streets” scenario.

In comparison to most leading cryptocurrencies and the majority of altcoins, active traders over the past month have experienced significant losses in their portfolios… Consequently, investing further or starting a new investment is statistically less risky than it typically is,” according to Santiment’s analysis.

Moving forward, Santiment highlights a complex market landscape shaped by regulatory adjustments, strategic decisions from institutions, and differing risk tolerance levels. The company draws attention to the positive attitude towards cryptocurrencies expected under the incoming Trump administration, stricter regulations globally, and the increasing influence of major investors (often referred to as “whales”) in determining price fluctuations.

Santiment suggested paying close attention to observe whale actions and the intensity of market activity, while also noting that cryptocurrency is a game where one person’s gain is another’s loss. Despite the perception of everyone in the predominantly optimistic community seemingly earning or losing money collectively.

DOGE’s Technical Picture

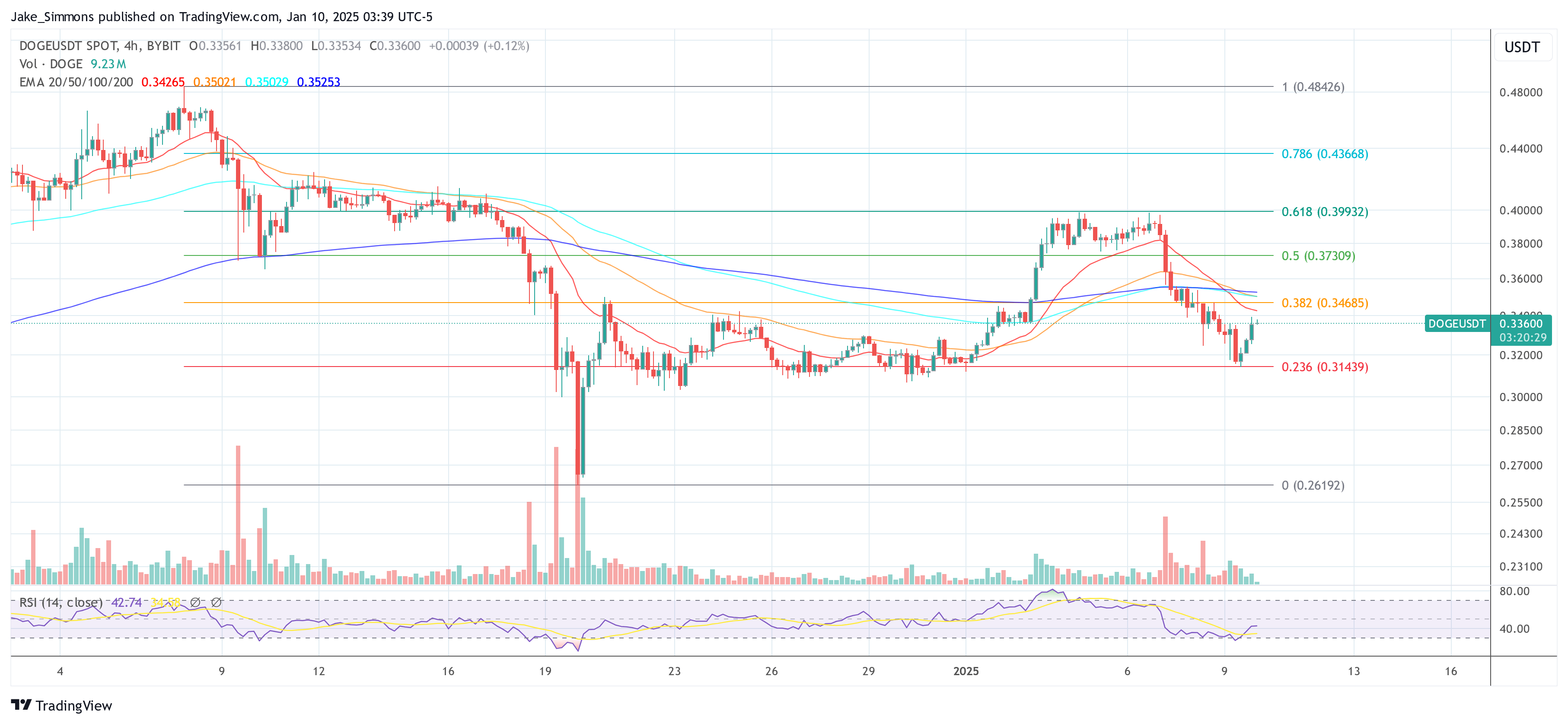

Technically speaking, Dogecoin’s trend has been following Bitcoin’s recent path, dropping below significant Fibonacci thresholds on the 4-hour chart. The price of Dogecoin fell below the $0.373 point (which is equivalent to the 0.5 Fibonacci level), a key support in lower time frames, and then approached the $0.346 mark (0.382 Fib).

Initially, Dogecoin’s price movement paused at the 0.236 Fibonacci level around $0.314, allowing for a brief recovery. This rebound mirrored Bitcoin’s bounce back. For Dogecoin to maintain its bullish trend, it needs to recapture the 0.382 Fib level (around $0.346). If it fails to do so, there might be potential for further falls, possibly leading back to the levels last seen on December 20, 2024, which were around $0.26.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2025-01-10 15:40