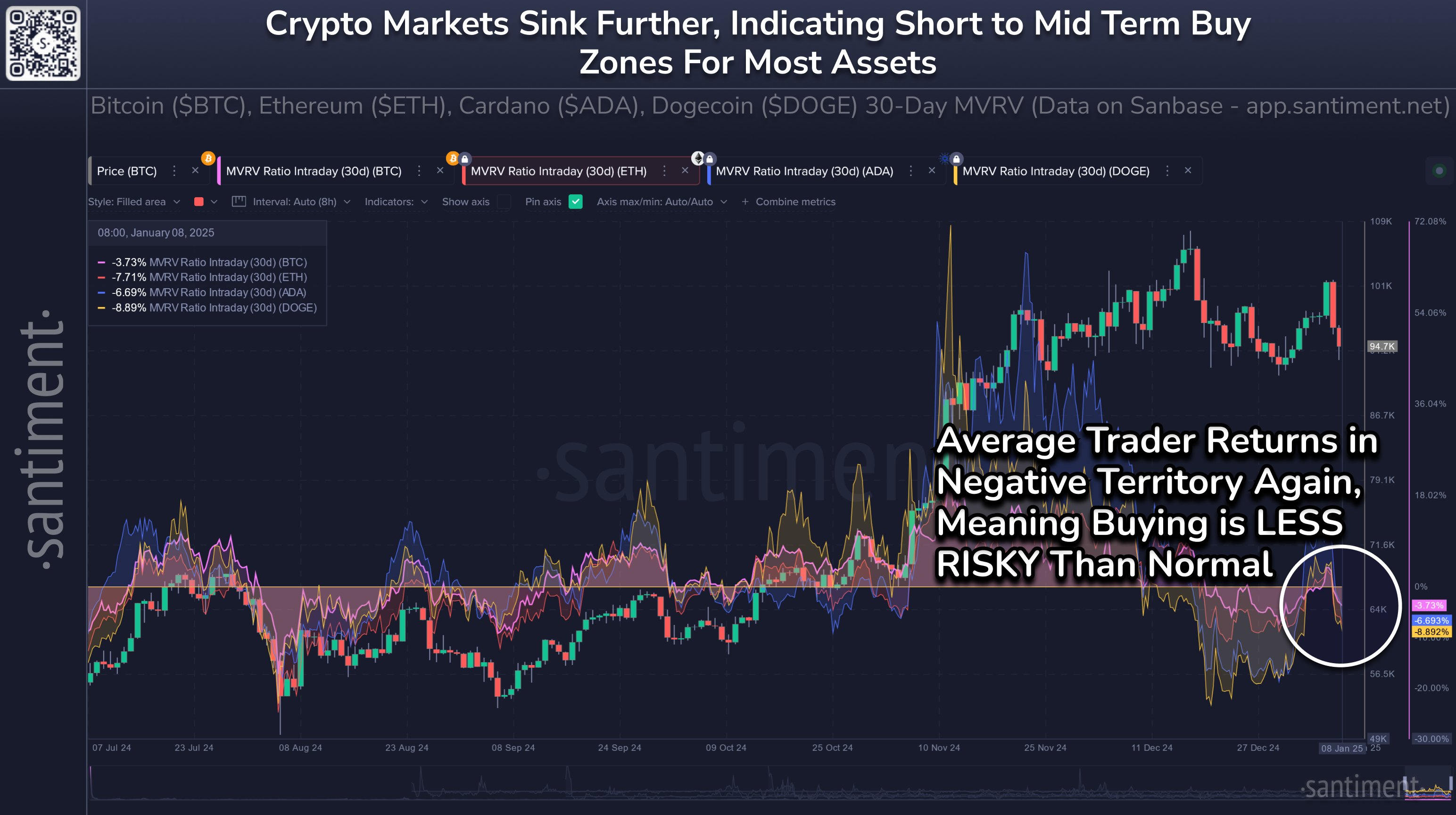

As an analyst, I’ve noticed that Dogecoin (DOGE) is once more under scrutiny, with a potential “blood in the streets” scenario arising based on data from Santiment, a leading on-chain analytics firm. Their recent findings, disclosed on January 8 via their platform, indicate a string of unfavorable MVRV (Market Value to Realized Value) ratios across various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and Dogecoin.

Santiment emphasized that average trading returns serve as a strong indicator if ‘purchasing at a lower price’ or ‘cashing out at a higher price’ is indeed the optimal moment, given current market conditions. They further noted that various cryptocurrencies appear to be overly sold based on their on-chain measurements.

In simpler terms, when the MVRV (Maker’s Value to Realized Value) ratio is negative, it suggests that you’re purchasing or holding an asset while others have already incurred a loss. Historically, such situations where there seems to be ‘blood in the streets’ are often profitable opportunities for experienced traders.

The data recently released by Santiment shows the 30-day MVRV ratios for four prominent cryptocurrencies as of January 8th. Bitcoin’s MVRV ratio stands at 3.73%, Ethereum’s is at 7.71%, Cardano’s is at 6.69%, and Dogecoin’s is at 8.89%.

To put it simply, MVRM (or MVRV, Market Value to Realized Value) calculates the market value of a cryptocurrency against the total cost at which its holders originally bought it. In other words, it’s like comparing the current worth (Market Value) with the initial investment (Realized Value). When MVRM shows a negative figure, it usually means that on average, the holders are currently losing money on their investment, as they haven’t yet made enough profit to cover their original costs.

In simpler terms, the MVRV ratio for Dogecoin shows that people who bought DOGE within the last 30 days are generally experiencing significant unrealized losses. Compared to Bitcoin’s less severe -3.73%, this means that Dogecoin’s recent investors are, on average, in a worse position than those of Bitcoin over the same timeframe. Meanwhile, Ethereum and Cardano also have negative returns at -7.71% and -6.69% respectively, but their holders have fared somewhat better than Dogecoin during this period.

As a crypto investor, I’ve been keeping an eye on Dogecoin (DOGE) because its MVRV (Momentum-Value Ratio) stands out as the most negative among the four cryptos mentioned. This could mean that if market conditions eventually stabilize, we might witness a stronger recovery bounce. However, it also signals a higher risk if the broader crypto sentiment continues to be fragile. As Santiment pointed out, a negative MVRV is often scouted by traders as a potential opportunity to “buy low,” but remember that this doesn’t guarantee an immediate upside. It’s essential to approach every investment decision with caution and a well-informed strategy.

Buy Or Sell Dogecoin Now?

Santiment’s analysis underscores the impact of broader economic trends on the recent crypto market downturn. Specifically, on January 7th, there was a sudden increase in US bond yields due to unexpectedly strong economic data. The yield on the 10-year Treasury increased to 4.67%.

Many investors were worried about the unexpectedly high ISM Prices Paid Index, a measure that might signal inflation, as well as an unanticipated rise in job openings data from the JOLTS report. With indications of a tight labor market and potential inflation concerns, investors shifted towards safer options, causing a broad sell-off in cryptocurrencies.

The cryptocurrency market is falling more, showing potential buying opportunities for many assets in the near to medium term according to Santiment’s chart analysis. This downturn also affects Dogecoin. If economic concerns about yields and inflation persist, investors might be more cautious with risky assets like cryptocurrencies. However, a decrease in inflation or a less strict Federal Reserve approach could spark a rally, possibly boosted by low MVRV ratios across the market.

Despite conflicting indicators, this trading landscape presents challenges. While Santiment’s metrics suggest favorable historical circumstances for those looking to accumulate, particularly in DOGE with a -8.89% MVRV ratio, there are uncertainties on the horizon. These uncertainties stem from ambiguous macroeconomic data such as Treasury yields and inflation rates, which could potentially impede any immediate market recovery.

Currently, Santiment’s perspective is cautiously optimistic: “Don’t jump to conclusions that these opportunity zone signals will trigger an instant recovery. However, the odds seem to favor a short-term to mid-term recovery for cryptocurrencies soon, as long as economic or geopolitical issues don’t intervene.

At press time, DOGE traded at $0.33.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2025-01-09 19:37