As a long-term Dogecoin investor with a few years of experience in the crypto market, I’m keeping a close eye on the recent developments with DOGE. The increased derivatives trading volume and open interest are certainly positive signs that institutional investors and traders are showing renewed interest in the meme coin. However, the lackluster price performance is concerning.

In recent days, several key indicators for Dogecoin have become more positive, fueling investor enthusiasm. For instance, daily trading volumes in derivatives markets and open interest have both risen noticeably. Nevertheless, despite this heightened activity, the price of Dogecoin has yet to show significant growth, causing concern among some investors.

Dogecoin Derivatives Volume And Open Interest See Increase

As an analyst, I’ve noticed a noteworthy surge in Dogecoin’s derivatives trading volume lately. This upward trend initiated on Monday with a substantial 60% increase in volume. Yet, it appears that DOGE traders are far from finished as the volume has nearly doubled since then.

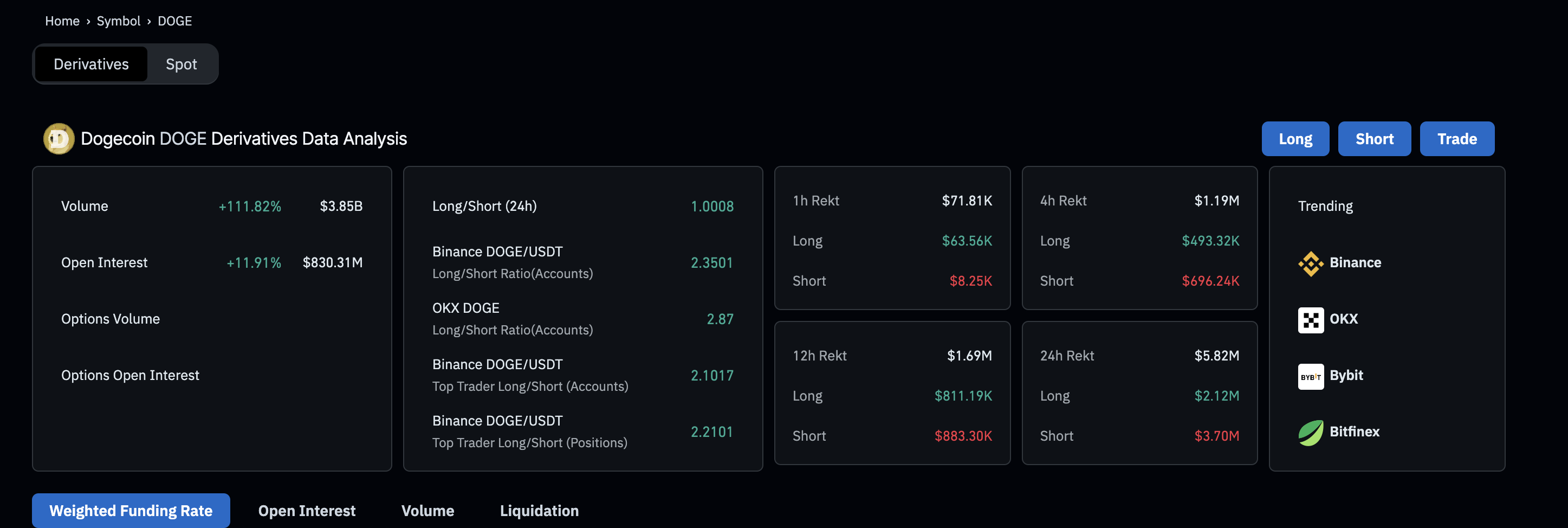

As a researcher examining data from Coinglass, I’ve observed an impressive surge in Dogecoin derivatives trading volume. In just the last day, this figure has jumped by 111%. Consequently, the total derivatives trading volume for Dogecoin now stands at a substantial $3.85 billion – a remarkable leap from the $1.99 billion recorded only two days ago.

Coinbase, the prominent US-based cryptocurrency exchange, introducing Dogecoin futures contracts on April 1, 2024, might be a contributing factor to the surge in demand for its derivatives. Consequently, the interest in these products has led to a significant rise in volume for Dogecoin.

During this period, it’s important to note that the trading volume of Dogecoin derivatives isn’t the only metric experiencing a surge. According to Coinglass data, open interest for Dogecoin has also spiked noticeably. In just the last day, there’s been a nearly 12% jump, pushing it above $830 million.

As an analyst, I’ve observed an uptick in Dogecoin’s open interest recently. However, this current figure of $830 million pales in comparison to its all-time high of $1.91 billion, which was reached on March 29th. In other words, the present open interest represents a more than 50% decrease from its peak. Meanwhile, Dogecoin’s price continues to lag behind these metrics, suggesting a disconnect between the rising open interest and the value of this meme coin.

DOGE Price Doesn’t Respond To Bullish Metrics

Despite the significant surge in trading activity for Dogecoin over the past day, with a 128% increase in daily volume, its price has remained relatively stable, rising only about 4%. This underperformance occurred even as the meme coin market saw renewed excitement following the dramatic 100% rally of GameStop (GME) shares.

The price of DOGE has shown little change over this period, with the $0.15 resistance becoming more formidable. This implies that the market’s attention is shifting away from Dogecoin and towards newer meme coins like Solana’s GME and AMC, which have recently experienced remarkable price surges.

Currently, the DOGE price stands at $0.49, marking a 3.48% growth over the past day. Yet, in the broader perspective, the meme coin has faced setbacks, recording a 5.79% decrease over the last week and a 4% loss on a monthly basis.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-05-15 02:10