As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I’ve learned to take on-chain data seriously when it comes to understanding market trends and price movements. The recent surge in Dogecoin whales’ accumulation activities is something that should not be ignored.

Given my past observations, I have noticed that large players like the whales can significantly impact the market dynamics of any given asset. In the case of DOGE, their buying spree could potentially signal a bullish outlook for its price in the short term.

However, it’s crucial to remember that the crypto market is notoriously unpredictable, and past trends do not always guarantee future results. The whales might decide to take profits quickly, which could potentially halt or even reverse the current rally.

As I always say, “The only certainty in cryptocurrencies is uncertainty.” So while it’s tempting to make predictions based on whale activities, we should always keep a level head and be prepared for any eventuality.

To lighten the mood, let me leave you with this joke: Why did the Dogecoin cross the road? To get to the other meme!

As a dogged Dogecoin investor, I’ve noticed some exciting trends in the on-chain data. It appears that the big players, or “whales,” have been aggressively buying up DOGE coins lately, a move that often signals positive price movement. This bullish pattern could mean good things for the future value of my Dogecoin holdings!

Dogecoin Whales Have Just Increased Holdings By Around $1.08 Billion

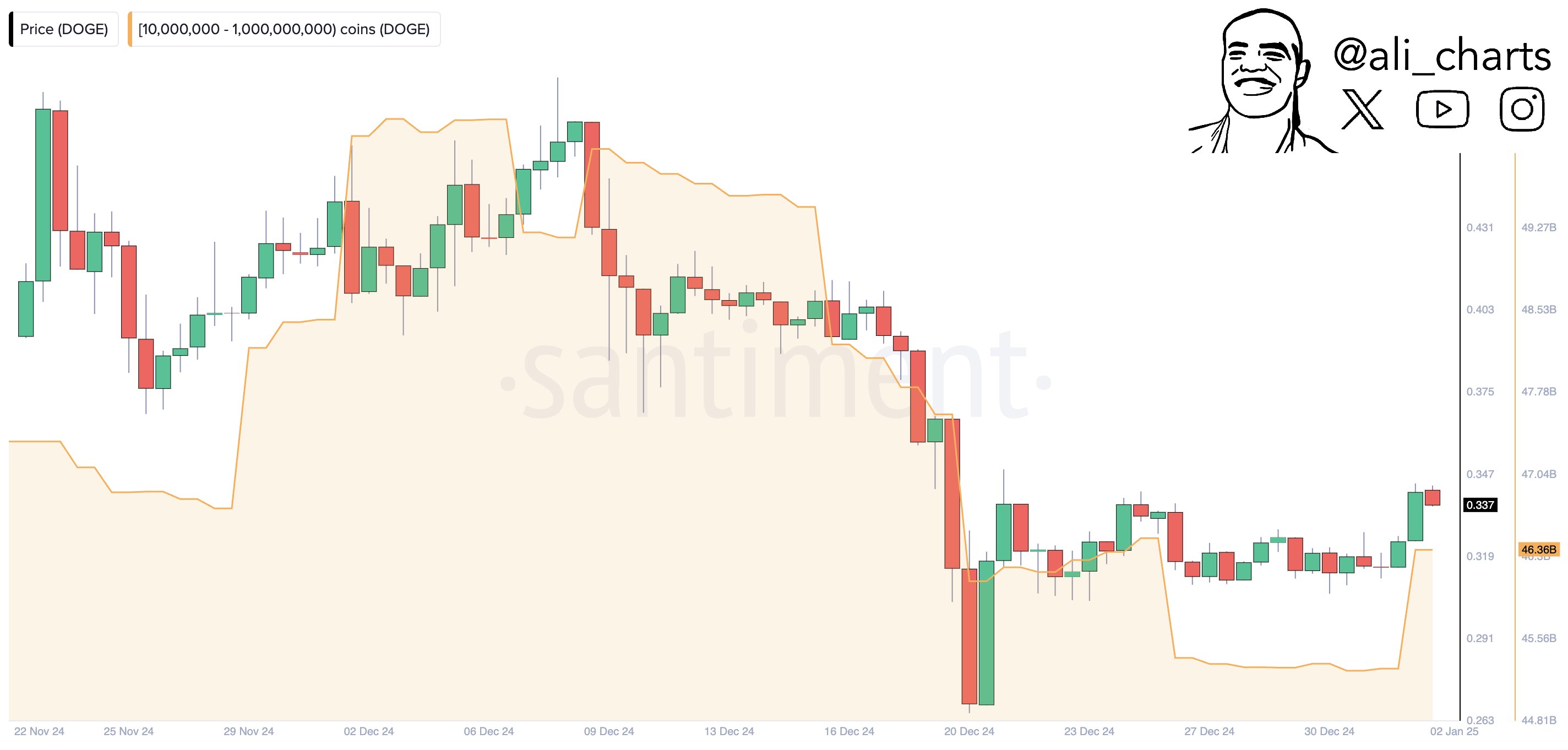

In my recent analysis on X, I’ve noticed that significant Dogecoin (DOGE) holders, often referred to as ‘whales’, have been actively buying the coin. A valuable tool for tracking this trend is the “Supply Distribution” metric from Santiment Analytics. This metric sheds light on the current amount of Dogecoin supply that a particular group of wallets controls at this moment.

Investors are categorized according to the quantity of Dogecoin they have in their wallets, with a focus on the ‘whale’ group for this discussion. This whale group consists of those holding anywhere from 10 million up to 1 billion DOGE.

In simple terms, if you’re considering the maximum and minimum values at the present rate for this memecoin, it translates to a potential worth of $3.5 million (at the highest) and $350 million (at the lowest). Therefore, only those investors who are among the biggest players in the network could be classified as ‘whales’ given these figures.

Essentially, having substantial assets gives holders greater influence over market trends. Consequently, these ‘whales’ can significantly impact a cryptocurrency’s price dynamics. Therefore, monitoring their supply is crucial since fluctuations in their holdings could potentially affect the value of the cryptocurrency.

graph provided by the analyst illustrating the pattern of Dogecoin supply distribution among the larger holders (whales) during the last few weeks.

Or simply:

This chart, from our analyst, demonstrates the trend in Dogecoin whale supply over the past month or so.

According to the graph shown, the significant Dogecoin holders (whales) reached a peak in their supply early in December, but subsequently began to progressively sell off their coins.

During the second half of the month, there was a sudden, steep drop in the indicator instead of a gradual distribution, and coincidentally, the memecoin’s price experienced a significant decrease as well. It’s plausible that this rapid decline in the indicator may have contributed to the fall in the memecoin’s price.

After a final effort to sell just before Christmas, these large investors (whales) ceased their selling activities. However, unlike what was expected, they did not start buying either. Instead, the trend of their supply remained relatively stable, moving horizontally rather than upward or downward.

In recent times, these massive entities have significantly increased their holdings, with a substantial influx of approximately $1.08 billion in coins being acquired during this market uptick.

It seems that the pattern in the distribution of whale holdings for whales is influencing Dogecoin’s value, which is currently showing signs of a rebound. The question now is whether these whales will continue to back this surge or decide to cash out quickly, possibly slowing down the momentum.

DOGE Price

Earlier today, Dogecoin momentarily exceeded $0.350, but it has subsequently experienced a minor dip, now trading at $0.349.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2025-01-04 05:46