As an experienced crypto investor with a knack for spotting market trends and patterns, I find the recent developments in Dogecoin intriguing. The meme coin’s performance over the past week has been nothing short of spectacular, outperforming even Bitcoin in terms of inflows.

Over the past few days, Dogecoin has seen significant activity in terms of price fluctuations, trading volume, market activity, and investor attention. In fact, it topped the entire market in incoming funds, even surpassing Bitcoin‘s performance over the past week. This surge has significantly altered Dogecoin’s technical perspective, especially when considering the Bollinger Bands on the DOGE/BTC graph.

crypto analyst Tony Severino drew attention to an intriguing perspective: the Bollinger Bands have narrowed significantly, a level not observed for quite some time. In fact, Severino emphasizes that these bands are currently narrower than they were prior to Dogecoin’s surge in 2021.

Dogecoin Bollinger Bands Squeeze To Tightest Level

Bollinger Bands are commonly employed tools in technical analysis which highlight price fluctuations’ boundaries. Narrow bands typically indicate minimal market turbulence, while expanding bands point to increased volatility. When these bands converge (squeeze), it suggests that the asset is trading within a narrow bandwidth. As for Dogecoin, Severino’s observation points out that the DOGE/BTC Bollinger Bands have come closer together than ever before on a monthly chart.

Previously, Bollinger bands contracted as tightly as they did right before the 2021 rally, which ignited an astronomical surge for meme coins. Given the past behavior of Dogecoin in relation to Bitcoin, if history repeats itself, Dogecoin might be poised for a robust rally over the next few months, potentially generating higher gains than the 2024 rally.

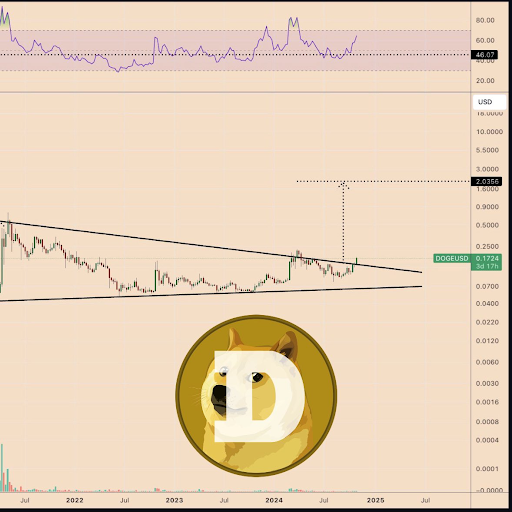

DOGE Breakout From Three-Year Channel

Recently, Dogecoin has experienced an impressive surge in value over the past few days, reaching a high of $0.176 – its highest point in more than six months. This surge allowed Dogecoin to break free from a three-year-long price pattern on the chart, which was defined by a downward-sloping trendline from its 2021 high. This breakout is noteworthy because it indicates that Dogecoin has surpassed a crucial resistance level that had previously limited its growth since reaching its peak in 2021.

There’s a significant boost in the chances of Dogecoin experiencing an uptrend in the near future, thanks to this recent breakout. Yet, it’s crucial to remember that there could be another test before the rally continues. A crypto expert on social media platform X predicts $2 as a possible peak if the momentum persists. Nevertheless, be aware that numerous resistance levels exist between our current price and this lofty goal. Notable examples of these resistance levels include the 2024 high of approximately $0.22 and the all-time high of $0.7316.

Currently, as I’m typing this, the price of Dogecoin stands at approximately $0.1585. This represents a decrease of around 10% compared to its previous level of $0.176. It seems to be retesting the point where it broke out from its channel.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-11-02 02:10