As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find myself particularly intrigued by the recent findings presented by Santiment regarding Dogecoin (DOGE) and other altcoins. The MVRV model, when applied to mid-term investors, suggests that DOGE may be undervalued at the moment, making it an attractive option for potential buyers.

Data from the blockchain suggests that Dogecoin (DOGE) is one of the cryptocurrencies experiencing substantial declines over a six-month period for long-term investors. This potential downturn could pave the way for an increase in the coin’s market value.

Dogecoin MVRV Suggests DOGE May Be Offering A Buy Window

In a new post on X, the on-chain analytics firm Santiment has discussed how assets like Dogecoin and XRP (XRP) have been looking like regarding trader returns on various timeframes.

The key metric we’re focusing on is called “Market Value to Realized Value” (MVRV), which essentially compares the total value that all investors hold of an asset (represented by its market capitalization) with the actual value they paid for it (denoted as the realized cap).

If the metric exceeds 1, this indicates that investors are presently enjoying a net unrealized gain. Conversely, when it falls below the threshold, it suggests that losses are currently prevailing in the market.

In historical terms, when the investors of a cryptocurrency are experiencing substantial profits, it tends to become more likely that the price will peak because the chance of a widespread sell-off, driven by profit-taking motives, increases under these circumstances.

In many cases, the lowest points in an asset’s price seem to occur when most investors are experiencing losses and the sellers run out of steam or energy to continue selling.

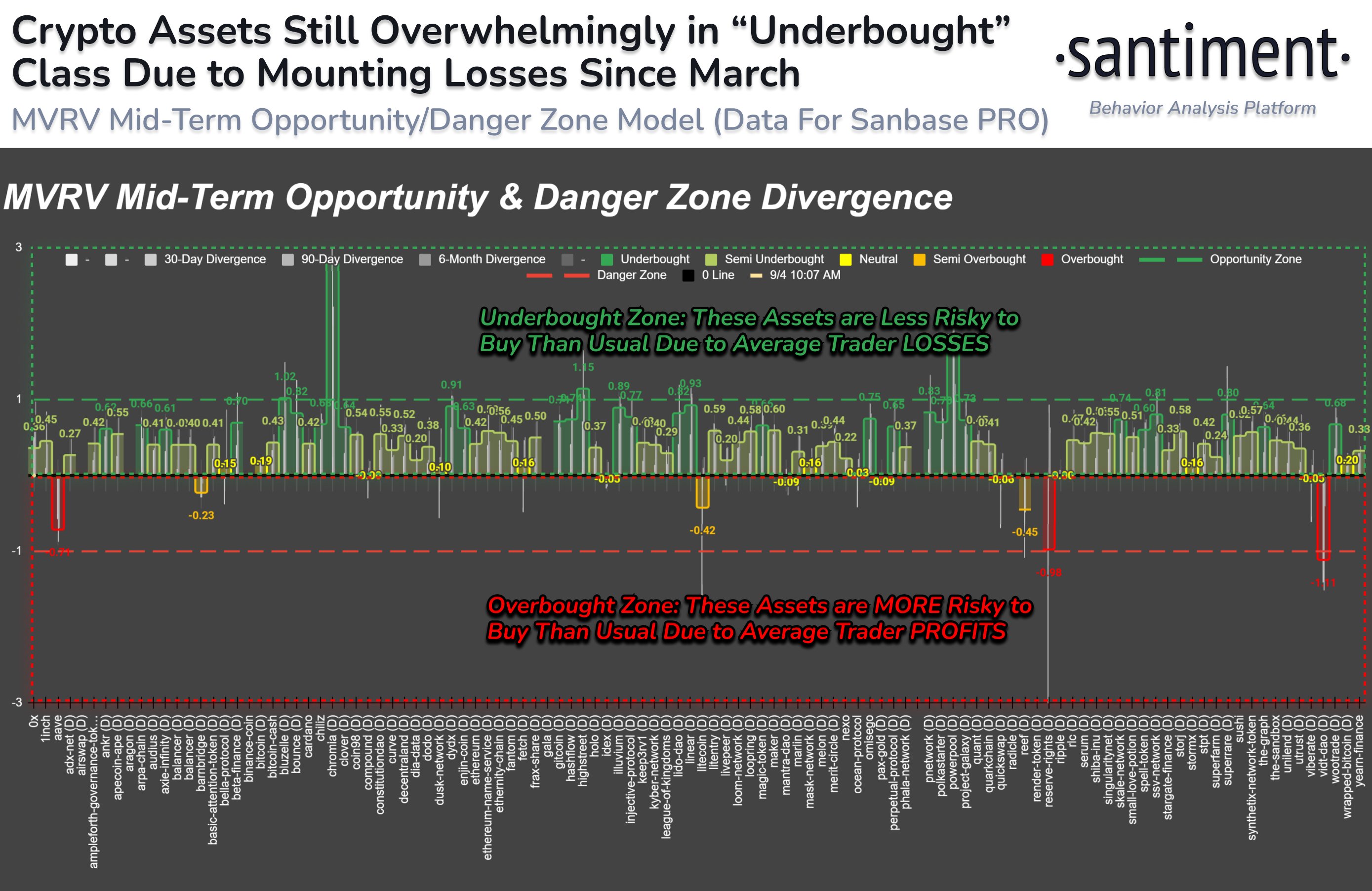

According to the data, Santiment has created a “Opportunity and Risk Zone Model” that determines if the medium-term MVRV values for various cryptocurrencies deviate from typical standards within their respective sectors. Here’s the graph of this model provided by the analytical company.

The “mid-term” MVRV indicators are designed to identify investors who purchased within 30 days, 90 days, and 6 months timeframes. When the differences of these metrics are higher for an asset, it implies that the coin could be currently underpriced. Conversely, a lower divergence might signal possible overvaluation.

Looking at the chart, it’s clear that many altcoins are presently in an uptrend, and some have even exceeded the 1-level divergence, which Santiment labels as the “Potential Profit Area.”

As per the data from a research company, Dogecoin, Toncoin (TON), and Ethereum (ETH) have had the highest negative Multi-Vintage Ratio of Value (MVRV) over the past six months. This means that investors who purchased these coins within the last half year are currently facing losses of 32%, 23%, and 22% respectively. Intriguingly, unlike these cryptocurrencies, traders dealing with XRP have managed to secure profits instead during this same period.

According to Santiment, as a trader, if you derive satisfaction from earning profits, it’s desirable for you to focus on assets where other traders are experiencing losses and pain. Given this perspective, Dogecoin could present the most promising opportunity among the top cryptocurrencies, while XRP might be the least favorable choice.

DOGE Price

At the time of writing, Dogecoin is trading around $0.0975, down more than 3% over the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-09-06 09:04