As an experienced financial analyst, I believe that the recent SEC approval of spot Ethereum ETFs has brought renewed optimism to the crypto community. The potential for Ethereum’s price to reach new heights is a topic of intense debate, with many experts predicting significant gains.

As a crypto investor, I’m thrilled by the SEC’s approval of all Ethereum spot ETF applications, even amidst the heightened regulatory uncertainty surrounding Ethereum. This development has instilled renewed optimism within the investment community regarding Ethereum’s price potential to soar to new heights.

Bullish Sentiment Surrounds Ethereum ETF Approval

Arthur Cheong, Founder and Chief Investment Officer at DeFiance Capital, anticipates that Ethereum (ETH) may hit a peak price of around $4,500 this year before newly authorized index funds start trading. This estimation slightly falls below Ethereum’s record high of $4,878 during the 2021 bull market.

Approximately half of the participants in a WuBlockchain poll within the Chinese demographic expressed confidence that Ethereum (ETH) could reach or surpass $10,000 during this market phase.

The SEC’s recent shift in regulation towards allowing Ether ETFs has fueled increased optimism among investors, leading to significant price increases for ETH. In the seven days following the announcement, Ethereum experienced a remarkable surge of 26%, which represents its largest weekly growth since the crypto market boom in 2021.

As a market analyst, I’m excited about this latest development because it echoes the impressive success of US Spot Bitcoin Exchange-Traded Funds (ETFs). These funds have accumulated an astounding $59 billion in assets since their groundbreaking launch in January.

As an analyst, I’ve noticed that Ethereum ETFs (Exchange-Traded Funds) do not allow investors to stake their tokens and earn rewards by pledging them to support the Ethereum blockchain. This absence of staking functionality could potentially diminish the appeal of these funds compared to holding the actual Ethereum tokens directly, due to the potential benefits that come with staking.

Despite the need for further SEC approvals from companies like BlackRock and Fidelity to introduce their new products, the exact release dates remain undetermined at this point. Currently, Ethereum (ETH) is valued around $3,900, and there’s speculation that its price may continue to rise.

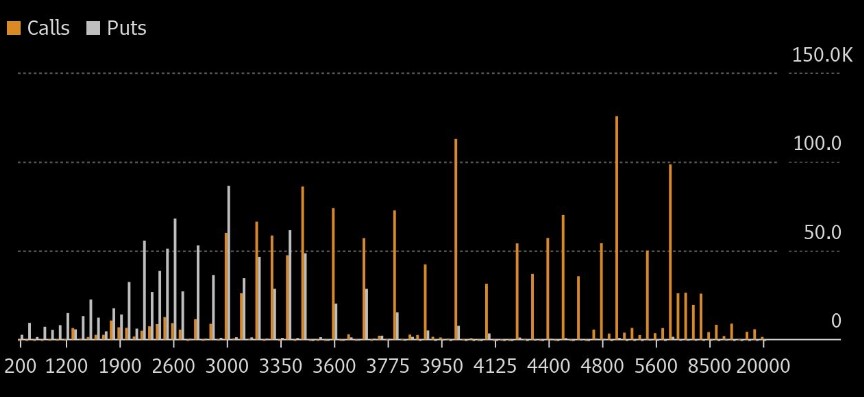

Options Bets Signal Potential Climb To $5,000

As a researcher studying the cryptocurrency market, I’ve come across the perspective of Chris Weston, the Head of Research at Pepperstone Group. Based on his analysis, he sees pullbacks in Ethereum (ETH) as potential buying opportunities. The rationale behind this viewpoint is that the risk remains biased towards positive price movements for Ethereum.

It’s intriguing to note that, according to the graph, certain traders have been making bullish wagers on options, suggesting a possible surge towards $5,000 or even higher.

The T3 Ether Volatility Index points to a higher degree of volatility for Ethereum compared to Bitcoin, implying possible larger price fluctuations for the second largest cryptocurrency.

Evidence of institutional interest in cryptocurrencies, specifically Ethereum, can be gleaned from observations of the derivatives market, such as the CME in Chicago, where high open interest indicates that large investors are seeking regulated avenues for exposure.

As the demand for CME Ether futures continues to rise, it’s important to note that the open interest in these contracts still lags significantly behind that of CME Bitcoin futures. This disparity implies that institutional investors have yet to embrace Ether to the same extent as they have Bitcoin, which could influence the initial investments into Ether exchange-traded funds (ETFs).

Despite the recent surge in interest for Ethereum ETFs and the resulting potential investment opportunities, there remains a heightened focus on Ethereum’s (ETH) price behavior. Investors are predominantly bullish and hopeful, anticipating positive price movements.

Read More

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

2024-05-27 20:10