Last week, there was a notable increase in the usage of stablecoins due to the escalating losses and market turbulence in the cryptocurrency sphere. Among all stablecoins, MakerDAO’s DAI coin experienced the most growth during this period of market instability.

Based on information from the smart blockchain analytics platform IntoTheBlock, DAI reached an all-time high of $240 billion in total on-chain transaction volume last week. This surpassed the combined weekly volumes of all other stablecoins.

$DAI saw $240B in on-chain transaction volume last week.

Not only is this a new weekly high for $DAI, it’s also more than all other stablecoins combined!

— IntoTheBlock (@intotheblock) April 23, 2024

In simpler terms, an increase in the amount of stablecoins being used or stored in wallets often indicates that investors are seeking safety and stability during market turbulence, as stablecoins provide more consistent value than other cryptocurrencies.

An alternate interpretation is that it represents a significant increase in demand from investors and traders, who are actively purchasing during price declines at the exchanges.

Last week, the majority of trading volume for DAI took place on Ethereum (ETH) and Polygon (MATIC), according to data from DeFiLlama.

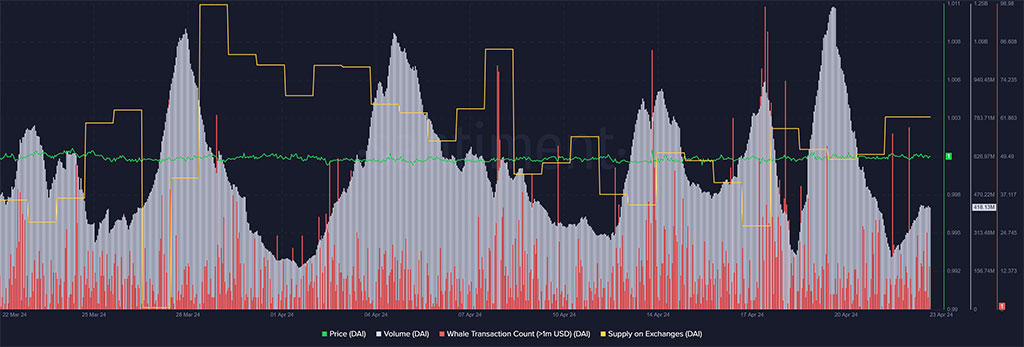

Last week’s increase in DAI transactions within the Ethereum network led to a decrease in the amount of DAI tokens held on exchanges (represented by the orange line). This finding suggests that a significant portion of DAI coins were withdrawn from trading platforms, likely due to investors seeking safety from market volatility.

Photo: Santiment

Currently, as I pen this down, there has been an uptick in the Supply on Exchanges metric. This increase suggests that a larger amount of DAI is shifting to exchanges, likely in pursuit of discounted cryptocurrencies during market recovery.

Significantly, the red spikes represent transactions where whales participated in DAI trading, specifically those involving over a million dollars.

MakerDAO and USDe $1B DAI partnership

The digital currency DAI, which is stabilized by MakerDAO, is mostly employed in Decentralized Finance (DeFi) transactions such as lending and borrowing. On the 8th of April, MakerDAO disclosed a plan to put $1 billion of DAI into Ethna’s USDe pool, which generates yields.

Other traders strongly objected to the deal due to its perceived recklessness and aggression. As a result, Aave, a popular lending platform, adjusted its risk settings and decreased its involvement with DAI in response.

Despite the large-scale transaction, MakerDAO went ahead with it. At present, DAI ranks among the leading stablecoins, with a market capitalization exceeding $5 billion.

USDT from Tether and USDC from Circle occupied the number one and two positions in the market for stablecoins. Surprisingly quick growth of USDe has placed it among the top five stablecoins within a brief timeframe.

The significant collaboration deals struck by MakerDAO not too long ago, combined with increased volatility in the market, may have contributed to the substantial increase in trading volume for DAI during the recent market downturns.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-04-23 19:52