As a seasoned analyst with over two decades of experience in financial markets, I find the analysis presented by Ki Young Ju, the founder and CEO of CryptoQuant, particularly intriguing. His approach to estimating Bitcoin’s market cap ceiling based on network hashrate is thought-provoking and could potentially provide valuable insights into the future trajectory of BTC.

According to the head of CryptoQuant, an organization specializing in blockchain analysis, he’s shared his viewpoint about where the maximum market capitalization for Bitcoin might be right now, taking into account the existing hashrate.

Bitcoin Ceiling Could Lie At This Level Based On Network Hashrate

Ki Young Ju, Founder and CEO of CryptoQuant, recently shared insights in a fresh post about a Bitcoin pricing strategy. This strategy sets both an upper limit and a lower limit for the cryptocurrency’s value based on the movement of the mining hashrate trend.

Here, “mining hashrate” is a term used to measure the overall processing power linked to the Bitcoin blockchain by all the miners who are actively participating in it at any given moment.

Miners engage in competition with one another by employing their computational resources to solve specific mathematical problems. The first miner to successfully solve these problems is awarded a block reward as a form of payment for their efforts.

Since Bitcoin relies heavily on miners for its existence and security within a decentralized system, some argue that its inherent worth can be estimated by considering the hashrate – the total computational power being used to mine it.

In essence, the Bitcoin miners must cover ongoing electricity expenses to maintain their hashrate, so they’ll operate as many farms as is financially viable for them.

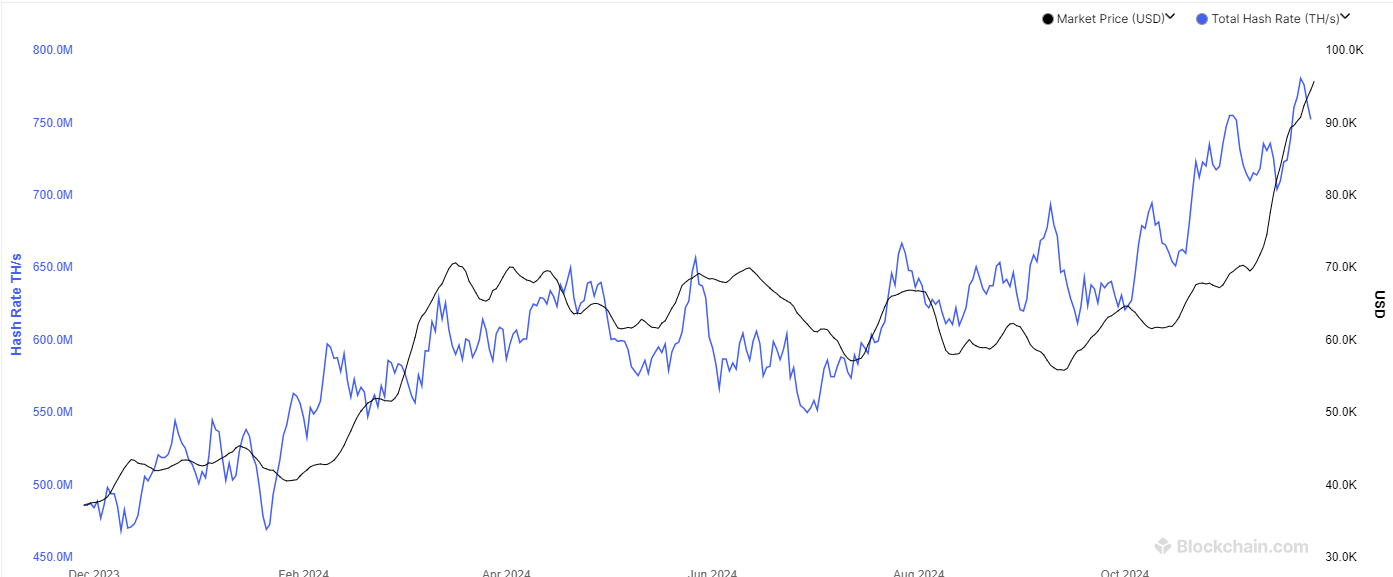

The chart below shows that the BTC mining hashrate has been rising recently and setting new all-time highs (ATHs).

As a crypto investor, I’ve noticed that the recent surge in value is due to the ongoing rally of the assets I’m invested in. The price movement plays a crucial role in the earnings of these chain validators because it directly affects their primary source of income – the transaction fees they receive. Since the block rewards they get in BTC are inherently volatile, they fluctuate with the price changes.

Discussing the block reward, it’s important to note that the Bitcoin network has a unique characteristic: every four years or so, the value of the block reward gets cut in half during an event known as the Halving. This regular reduction in the Halving results in a consistent decrease in miner earnings from Bitcoin over time.

According to Young Ju’s proposed pricing model, the mining hashrate is modified to account for a specific factor. The market capitalization’s proportion relative to this modified hashrate is calculated, which then identifies the maximum and minimum values of this ratio within the asset’s historical data.

This chart demonstrates the target market capitalizations for the asset, where the ratio will match one of the extreme values you provided.

Reflecting on the graph before me, it appears that if Bitcoin’s market cap were to be determined by its current network hashrate, we’re looking at nearly a whopping $5 trillion. However, as I write, the asset’s actual market cap stands at around $1.9 trillion, which translates to about 38% of this upper limit. This suggests that there may be room for growth in the Bitcoin market.

It’s worth mentioning that during the 2021 bull run, the peak occurred below our model’s projected top line. This could imply that the current cycle’s peak might not reach the line either. However, it’s important to note that the market cap came closer to the peak ratio in 2021 than it has so far in this cycle, which may suggest there is still potential for Bitcoin’s rally to continue.

An interesting characteristic of the graph’s trends is that it shows sharp declines around the years 2016, 2020, and 2024. These drops coincide with the Halving instances that took place during those times, mirroring the economic impact these events had on Bitcoin mining operations.

BTC Price

Currently, the price of Bitcoin stands approximately at $94,400, marking an increase of over 2% in the past week.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-11-27 12:04