As a seasoned crypto investor with more than a decade of experience in this wild and unpredictable market, I have learned to take every price surge and dip with a grain of salt. However, the recent 380% surge in XRP over the past 23 days has caught my attention, and not just because it’s reminiscent of the crazy rollercoaster rides we used to go on at the amusement park back in the day.

Over the last few weeks, XRP has witnessed an unprecedented rise, with its value increasing by approximately 380% in the past 23 days. In fact, within just the last four days, its price soared by a staggering 75%, peaking at $2.87 on December 2. This swift climb seems to be driven primarily by heavy buying from major investors, often referred to as “whales.

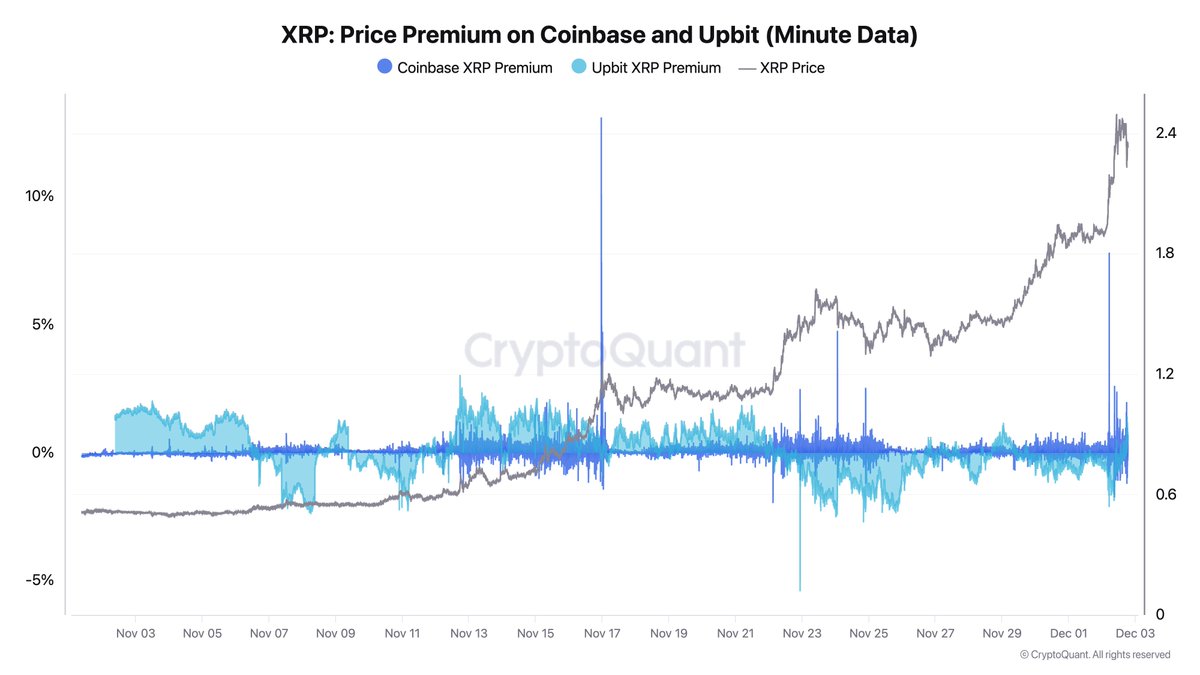

Ki Young Ju, the CEO of on-chain analysis firm CryptoQuant, emphasized that large investors, or “whales,” are predominantly using the US-based exchange Coinbase to fuel the rally in XRP. On December 2nd, he specifically mentioned that “Coinbase whales are behind this XRP surge,” as Coinbase’s price premium during the upswing varied from a 3% to 13% difference at the minute level.

Contrarily, Upbit, a South Korean exchange that boasts more XRP investors than Binance, did not exhibit any substantial price premium. This indicates that the main driving force behind the purchases seems to be coming from the U.S. market.

On his Twitter account @kate_young_ju, Ki Young Ju subtly suggested the presence of inside information impacting market trends, expressing it as, “It seems someone had advance knowledge.

Currently, he’s advising traders to steer clear of selling short on XRP. He believes that at this moment, shorting XRP could potentially be risky. A huge $25B deposit of XRP before a price increase might appear like market manipulation, but it could just be a preemptive move. This significant XRP investor might have information suggesting something incredibly positive about XRP, for instance, the approval of a spot ETF. He’s merely expressing this possibility.

He further shared a chart “XRP: Retail Activity Through Trading Frequency Surge (Spot & Futures), which indicates that retail trading activity for XRP has surpassed the highs of 2021 and is nearing levels last seen in January 2018, when XRP reached its all-time high of $3.92.

Looking at the annual cumulative volume change (CVD) of XRP’s taker buy and sell volumes, he commented: “The 1-year CVD of XRP’s Taker Buy/Sell Volume indicates a significant recovery, with large investors actively employing market orders to fuel an intense demand surge.

A 700% Rallye Incoming For XRP Against BTC?

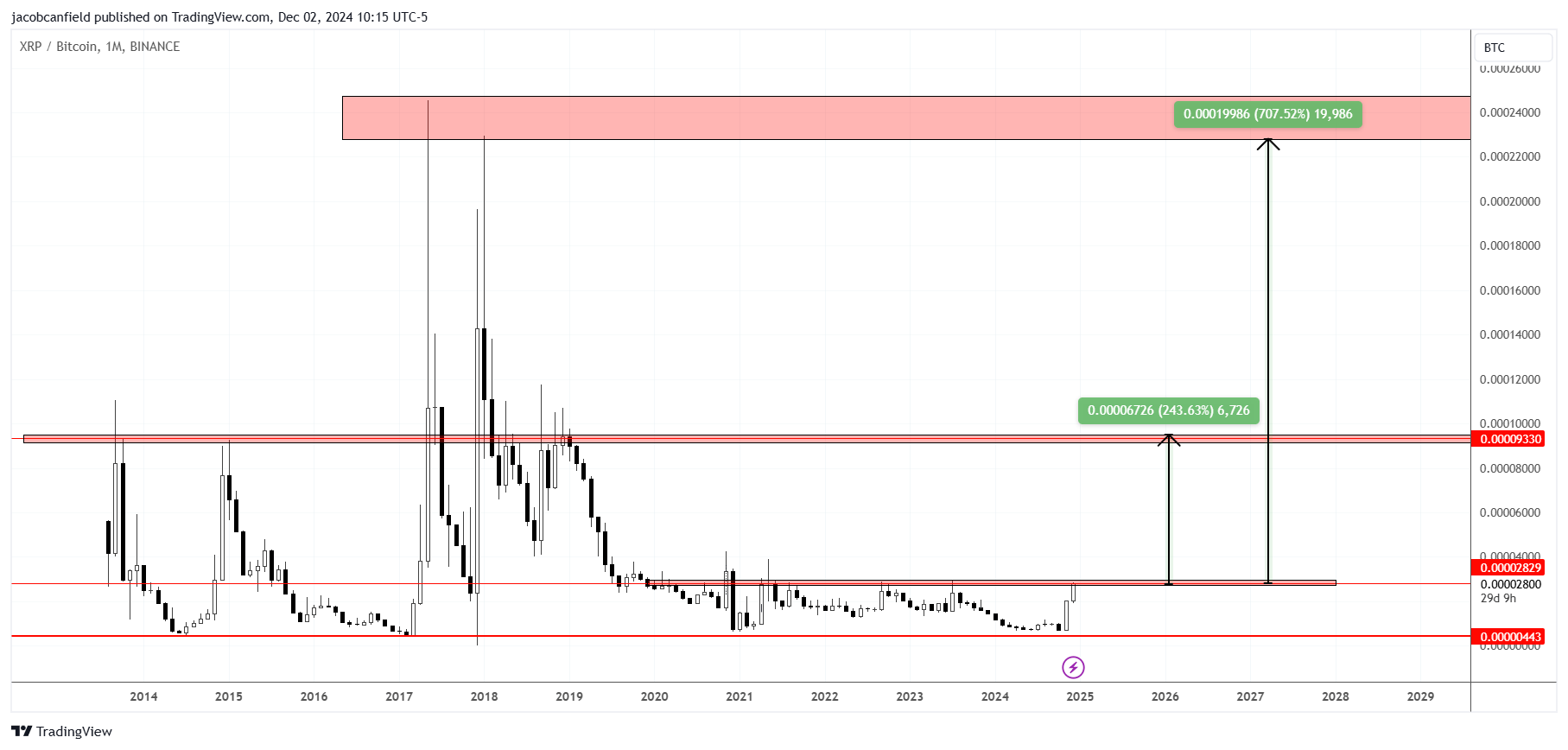

From a technical analysis perspective, crypto analyst Jacob Canfield emphasizes the importance of examining the XRP/BTC pairing. He notes that XRP is currently at a critical resistance zone on the BTC pair chart (XRPBTC), having just reached the $2.75 level on the USDT pair—a resistance point since December 2019.

According to Canfield, a breakout in XRP might indicate a possible 240% increase towards significant resistance levels from 2017, 2018, and 2019. He further stated that if the fear of missing out (FOMO) intensifies, it could potentially lead to an even greater 700% rise in comparison to Bitcoin‘s all-time high. This assessment is based on what he considers as “two of the strongest monthly candles for XRP that we’ve seen in over five years.

When considering shorter periods in the XRP/USD market, Canfield emphasizes the importance of using support and resistance levels to locate fresh entry opportunities within these specific timeframes. To put it simply, during uptrends (bull markets), you should look for new positions by focusing on low-time frame support and resistance. Time frames like 5 minutes or 15 minutes are often the most effective. For instance, in the case of XRP, $2.20 clearly invalidated a prior support/resistance level. This area, marked by the biggest green candle, typically serves as the foundation for the next impulse and is usually an ideal spot to re-enter a trade.

At press time, XRP traded at $2.63.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- CNY RUB PREDICTION

- Criminal Justice Season 4 Episode 8 Release Date, Time, Where to Watch

- Delta Force Redeem Codes (January 2025)

2024-12-03 15:41