As a crypto investor with years of experience navigating the tumultuous and unpredictable seas of digital currencies, I find myself intrigued by the shifting sands of our market landscape. The potential altcoin season on the horizon feels different from past cycles, and I’m excited to see how this evolution unfolds.

There’s a possibility that the cryptocurrency market is about to undergo a significant transformation, possibly heralding the long-awaited period of altcoin dominance. But this time around, the factors driving this change seem different, hinting at a more comprehensive adjustment in market trends. Typically, an altcoin season—where alternative cryptocurrencies perform better than Bitcoin—has been sparked by investors shifting their capital from Bitcoin to altcoins.

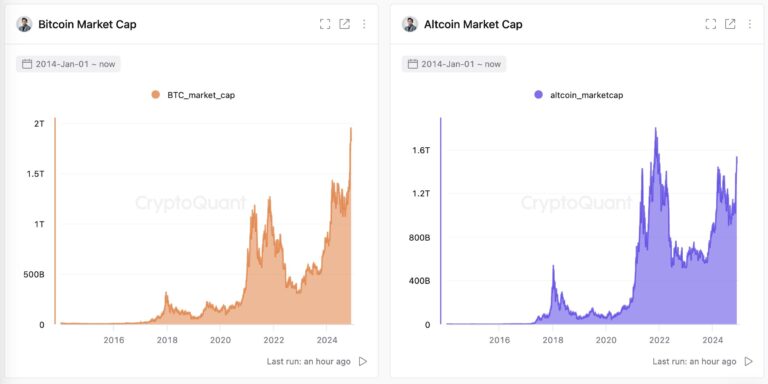

As a researcher, I’ve come to find that the pattern Ki Young Ju, CEO of CryptoQuant, previously observed doesn’t seem to hold up anymore. Instead, he emphasizes a new factor potentially driving this altcoin surge: the trading activity in stablecoin and fiat currency pairs. In contrast to past cycles, it appears that Bitcoin pairs are no longer the main trading grounds for altcoins. On December 2nd, he shared this insight on his platform X.

“Altseason is no longer defined by asset rotation from Bitcoin.”

Altcoin Trades Shift to Stablecoins

Lately, the trading volumes of altcoins relative to Bitcoin have generally stayed low. Despite Ethereum‘s rising prices, there was little surge in the trading pairs of altcoins. This pattern is particularly striking given that coins such as XRP and Solana are nearing their record highs.

As a crypto investor, I’ve noticed an uptick in trading volumes for altcoins versus stablecoins – a trend that feels more like genuine market growth to me rather than just asset shuffling. This points towards the growing significance of stablecoins, which seem to be providing the necessary liquidity that helps shape the altcoin markets. In other words, stablecoins are proving crucial in this rapidly evolving crypto landscape.

The increase in trading volume for altcoins suggests a healthier and more long-term development of the market. Stablecoins, which provide liquidity and price consistency, play a crucial role in increasing demand for altcoins. Consequently, it seems that Bitcoin’s role as a benchmark or trading intermediary is becoming less essential.

Stablecoin Liquidity Reshapes Crypto Market

Alongside the importance of stablecoin liquidity, institutional investment has become a key player in transforming the market. Unlike past market cycles where individual investors held sway, this ongoing bull run is witnessing substantial investments pouring into Bitcoin spot ETFs on the stock exchange.

Source: Ki Young Ju

This change signifies moving away from the previous market dynamics driven by individual investors’ speculation. The involvement of institutional investment adds an element of reliability and steadiness that might positively impact the entire cryptocurrency sector, including alternative coins.

Although these favorable indicators are present, it’s worth mentioning that the total market value of cryptocurrencies, excluding Bitcoin, has yet to reach its all-time high. This implies that a significant amount of new investment is necessary for altcoins to climb to new record levels, as Ki pointed out.

To set a brand-new record for the total value of altcoins, there needs to be a substantial increase in investment flowing into cryptocurrency trading platforms.

The Altcoin Season Index, monitored by Blockchain Center, provides additional insights into market trends. This index indicates an ‘altcoin season’ when at least 75% of the top 50 cryptocurrencies outperform Bitcoin over a span of 90 days. At present, the index shows that about 73% of the leading 50 altcoins have surpassed Bitcoin in the past 90 days. As this percentage continues to rise, we may soon meet the criteria for declaring an official ‘altcoin season.’

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-12-02 23:12