As a seasoned crypto investor with a knack for navigating market turbulence and spotting opportunities, November’s events were nothing short of exhilarating. The $10 trillion trading volume milestone was not just another number to me but a testament to the maturing crypto market I’ve been part of since its inception.

In November, the cryptocurrency market reached a remarkable milestone as trading volumes on both centralized spot and derivatives exchanges surpassed an unheard-of $10 trillion. This surge wasn’t just a minor event in crypto history; it served as a loud and clear demonstration of the growing power and maturity of the market.

In an upward trend reported by CCData, Bitcoin (BTC) skyrocketed by approximately 38% and peaked at nearly $100,000. This surge in value corresponds to a staggering 100% increase in trading volume compared to the preceding month, which can be attributed to several factors, such as renewed optimism following Donald Trump’s presidential election victory. The 24-hour volatility remains relatively low at 2.0%, and the market cap currently stands at a massive $1.94 trillion, with over $99 billion in trading volume within the last day.

Jacob Joseph, senior research analyst at CCData, noted that this positive outlook is reflected in the growing interest towards assets such as Ripple, which has a history of facing intense regulatory oversight. Additionally, he pointed out an optimistic trend among institutions, with volumes on CME experiencing a marked increase and noticeable investments into Bitcoin Spot ETFs over the past month.

Spot and Derivatives Trading Hit Historic Highs

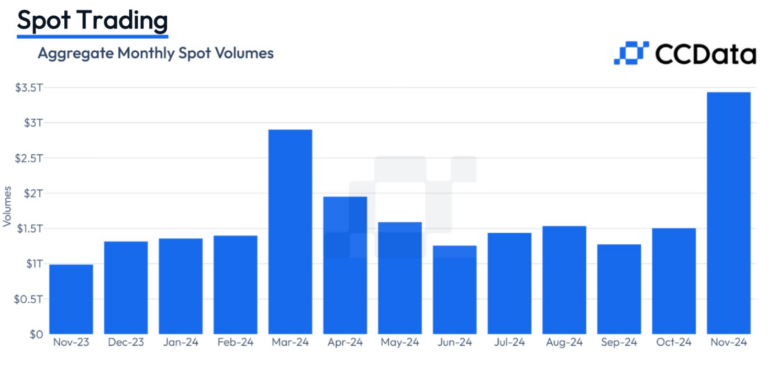

Centralized cryptocurrency exchanges experienced a significant surge in transactions last month. The volume of spot trading jumped by 128%, amounting to an impressive $3.43 trillion, which is the second-highest monthly figure since May 2021. Meanwhile, derivatives trading also saw a notable increase, rising 89% to reach a staggering $6.99 trillion and breaking its previous record set in March.

Aggregate Monthly Spot Volumes | Source: CCData

It’s noteworthy that South Korean trading platforms such as Upbit experienced significant user activity as traders delved into altcoins. Similarly, institutional trading followed this pattern, with the CME exchange recording a 83% increase in total trading volume, reaching an unprecedented high of $245 billion.

In November, several platforms such as Bybit, Crypto.com, Gate.io, and Bullish hit record highs in trading volume – a significant milestone for each exchange. These increases in activity weren’t limited to individual traders; institutional investors were equally active, indicating a more comprehensive shift in the market, hinting at a broader transformation.

The report mentioned that multiple digital asset trading platforms such as Upbit, Bybit, Crypto.com, Gate.io, and Bullish reached new peak volumes in terms of trades for the month, according to their records.

Elections, Regulations, and the Ripple Effect

The U.S. presidential election served as a significant turning point for the cryptocurrency market. Trump’s win on November 5th sparked optimism about a potentially more supportive regulatory environment in the United States, causing investors to seize the positive trend in digital asset values. On that very day, shares of Galaxy Digital, a well-known crypto trading firm, surged by 25%, representing their best performance of the year.

The surge of optimism created a significant impact, rippling through various sectors. Alternative cryptocurrencies received renewed interest, while Bitcoin ETFs garnered more support from institutions. The introduction of options contracts linked to Bitcoin ETFs by the NYSE and Nasdaq, following their approval in September, broadened the market’s scope for investment opportunities.

On November 18th, options for a Bitcoin ETF by BlackRock made their debut, initially offering an exposure of $2 billion during its first day of trading. Financial experts anticipate that this could expedite the process of institutional adoption and open up additional paths for Bitcoin owners to realize its value.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- All Elemental Progenitors in Warframe

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-12-05 00:54