A skilled crypto investor, particularly interested in artificial intelligence (AI) ventures, is said to have earned over $17 million by trading various AI-related tokens. Recently, data from blockchain indicates a shift towards new meme coins, as suggested by Lookonchain’s analysis on platform X. The trader’s substantial profits are primarily attributed to initial investments in GOAT, ai16z, Fartcoin, and ARC.

Crypto Trader Turns AI Coins Into $17 Million

According to reports from Lookonchain via X, an impressive AI-powered coin trader has raked in profits of over $5.14 million with GOAT, $4.5 million with ai16z, $4 million with Fartcoin, and another $4 million with arc. It’s worth exploring which tokens this clever trader is currently investing in.

The trader is said to have scored his largest profit from the GOAT token. He bought into the token when its overall market capitalization was under $2 million, investing around $62,000 for approximately 11.1 million GOAT tokens. After capitalizing on GOAT’s swift rise, he sold all of his holdings, earning a total of roughly $5.2 million, leaving him with an estimated gain of $5.14 million.

The individual’s performance in the ai16z trading fund, which is an AI-driven, decentralized platform on the Solana blockchain, is noteworthy. He invested $123,000 to purchase approximately 6.17 million tokens with a total market cap of $22 million. Data from Lookonchain suggests that he later sold around 4.67 million ai16z tokens at an average price of about $1.78 each. Currently, he still holds around 2.65 million tokens valued close to $2.9 million according to the same data source. Based on Lookonchain’s calculations, this translates to a total profit from ai16z exceeding $4.5 million.

The analysis further emphasizes substantial profits made from Fartcoin investments. A trader purchased this cryptocurrency when its market cap was below $7 million, spending approximately $121,000 for nearly 9.46 million tokens. He subsequently sold 6.81 million of these tokens for $610,000, leaving him with 2.65 million tokens worth a combined $3.55 million. This results in an estimated total profit of around $4 million from Fartcoin.

In his role as an investor in the ARC project, he spent $212,000 to buy around 11.6 million ARC tokens when the total market value was roughly $15 million. Later, he sold 1.6 million of those tokens for a total of $212,000, leaving him with about 10 million ARC tokens worth approximately $4 million. This transaction resulted in an additional profit of around $4 million for him.

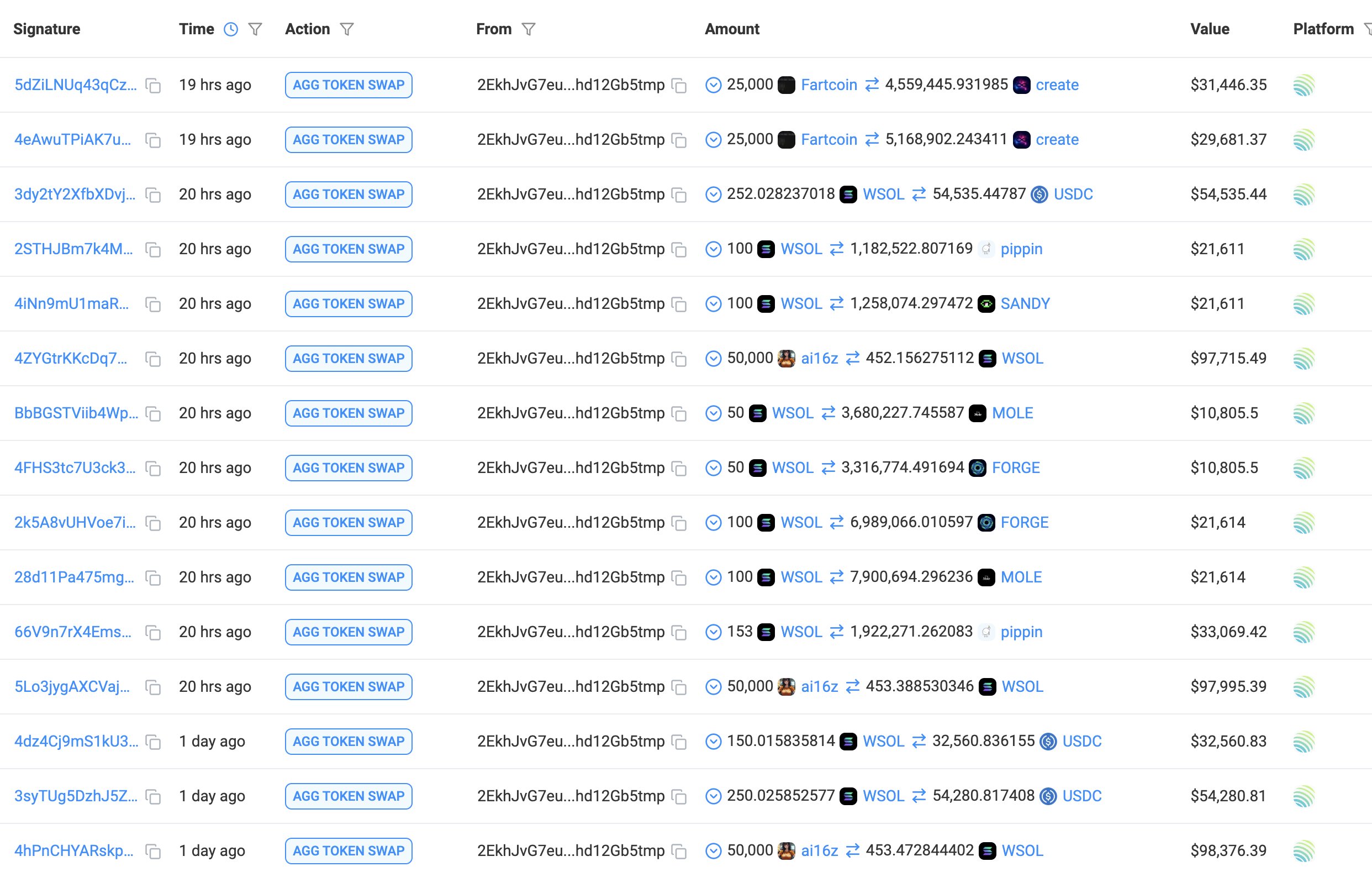

According to a recent post from Lookonchain, the trader has been investing in several lesser-known meme tokens such as CREATE, PIPPIN, SANDY, MOLE, and FORGE. A snapshot shared by Lookonchain reveals that these acquisitions were partially funded by selling Fartcoin, specifically 25,000 units in two transactions at $31,446.35 and $29,681.37 respectively.

It seems that the extra funds were generated through the repeated sale of Wrapped SOL (WSOL), such as selling 100 units at $21,611, 50 units at $10,805.50, and 153 units at $33,069.42.

The pattern of his WSOL sales indicates a systematic strategy to accumulate liquidity prior to investing in CREATE, PIPPIN, SANDY, MOLE, and FORGE. In all, he set aside $202,255 to purchase shares in these memecoins. He invested $61,127 in CREATE, $21,611 in PIPPIN, another $21,611 in SANDY, $65,486 in MOLE, and $32,420 in FORGE.

At press time, GOAT traded at $0.52.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2025-01-06 12:05