As a seasoned researcher who has navigated through numerous market cycles and crashes, I can confidently say that the recent liquidations in the cryptocurrency derivatives market are reminiscent of a rollercoaster ride – exhilarating when you’re riding it, but quite a jolt when you’re on the ground looking up.

Data shows the cryptocurrency market has registered large liquidations in the past day as altcoins like Dogecoin and XRP have crashed.

Cryptocurrency Derivatives Market Has Just Seen Massive Long Liquidations

Based on information from CoinGlass, there’s been a substantial buildup of liquidations in the derivatives market of the cryptocurrency industry within the past day.

In this context, “Liquidation” signifies the compulsory termination of an ongoing agreement or contract. This happens when the wager associated with it sustains substantial losses that reach a specific threshold, which can vary among different platforms.

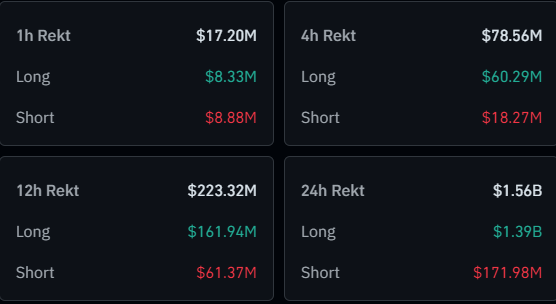

The following table provides a summary of key figures regarding yesterday’s liquidation events.

Over the past 24 hours, contracts related to cryptocurrencies have been completely closed out, amounting to a staggering $1.56 billion. The majority of these closures, approximately 90%, were carried out by long-term holders, with their liquidations totaling around $1.39 billion.

The significant sell-offs are due to the recent downturn experienced by the altcoin market within this timeframe, causing popular cryptocurrencies such as Ripple (XRP) and Dogecoin to plummet by more than ten percent.

It seems that numerous traders have taken a bullish stance in the market, expecting Bitcoin‘s surge towards record-breaking highs to persist soon. Remarkably, Bitcoin has only seen a 2% drop, but unfortunately, the same can’t be said for the rest of the market.

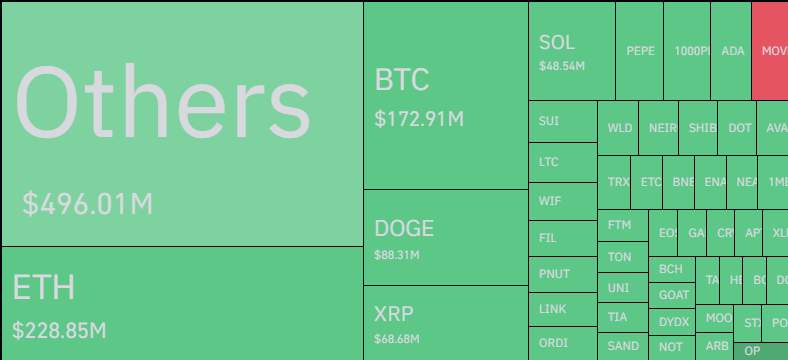

As for which of the assets was responsible for the most liquidations, the below heatmap shows it.

As a researcher examining the recent market events, I’ve noticed an interesting shift: While Bitcoin typically dominates market liquidations, it seems that this time around, Ethereum – the second largest cryptocurrency by market capitalization – has been the primary contributor to the market flush, amounting to approximately $229 million in positions.

As a researcher observing the cryptocurrency market, I’ve noticed that both Dogecoin and Ripple (XRP) have experienced significant liquidations following Bitcoin’s $173 million sell-off, with losses amounting to approximately $88 million for Dogecoin and $68 million for XRP. The substantial nature of these liquidations can be attributed to the popularity of these digital assets and the sizeable drawdowns they have experienced.

It appears that the intense curiosity about this particular sector has led to an enormous accumulation of $496 million in liquidation for the smaller capital assets, often referred to as ‘others’ in the heatmap.

In the world of cryptocurrencies, mass liquidations happen quite often. However, the current event is exceptionally significant, even by the industry’s own high standards.

Occasionally, these occurrences take place due to the inherent volatility seen in various coins, coupled with many investors choosing high levels of financial leverage. Lately, these factors have become more pronounced, leading to a surge in the derivatives market as we see it today.

XRP Price

At the time of writing, XRP is trading around $2.09, down almost 15% in the last seven days.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-12-11 08:11