As a seasoned crypto investor with a keen eye for market trends and political implications, I find myself intrigued by the recent dance between Bitcoin and the presidential debates. On Wednesday, September 11, I watched with bated breath as the share prices of my favorite crypto firms took a tumble following the debate. However, much like a phoenix rising from the ashes, these stocks bounced back stronger than before by the closing hours.

On Wednesday, September 11th, cryptocurrency and Bitcoin mining shares notably recovered after an initial drop during morning trading. This decline followed the first U.S. presidential debate between Kamala Harris and Donald Trump.

In my role as a researcher, I observed an interesting trend unfold on September 11. The share prices of publicly traded Bitcoin and cryptocurrency mining companies dipped in response to a heated debate. Interestingly, several opinion polls indicated that candidate Harris was gaining ground against President Trump during this Presidential debate. However, as the trading day drew to a close, the share prices of these public-listed crypto firms started to recover from their initial lows.

Initially falling to $150 and hitting a low point, Coinbase Global Inc’s (NASDAQ: COIN) shares rebounded by 5.3%, climbing back up to their pre-debate price of $157. Despite this temporary increase, the stock is still 18% below its monthly trading value on a longer timeframe.

MSTR) – dropped below $125. Yet, as the day ended, its price rebounded and reached $129 again.

As a crypto investor, I noticed that stocks like Marathon Digital Holdings Inc (NASDAQ: MARA) and Riot Platforms (RIOT) initially experienced drops but managed to rebound by the end of trading, closing at decreases of 0.94% and 2.07%, respectively. However, Hut 8 Mining Corp (HUT) was an exception, being the only crypto-related stock to finish the day in the green, climbing 1.29% to $10.58 following a dip to $9.76 earlier in the day.

The Trump and Harris Debate and Crypto Impact

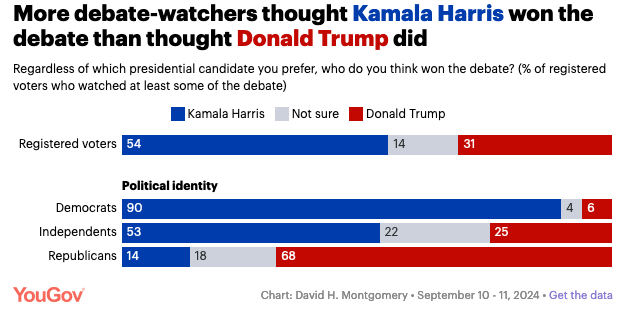

On Wednesday, September 11, results from a survey conducted by YouGov were released, indicating Kamala Harris emerged victorious in the polls, with over 54% of registered respondents stating she was the night’s winner. Conversely, 31% of participants believed Trump had triumphed.

Photo: YouGov

Similarly, CNN’s survey indicated that most viewers felt that Harris excelled more than Trump during their debate.

It’s been observed that the cryptocurrency sector is supporting Donald Trump in the 2024 U.S. Presidential Elections. Trump has pledged to establish transparent regulations for the crypto market, with policies favorable to cryptocurrencies. Moreover, he expressed his intention to boost the Bitcoin mining industry and position America as a global leader in cryptocurrency. Consequently, Trump’s campaign is receiving significant donations in cryptocurrencies.

On September 11th, a drop of approximately $60 billion occurred in the overall value of cryptocurrency markets. However, since then, they’ve bounced back by about 2.3%, returning to their levels prior to the debate. The price of Bitcoin dipped 3.7% post-debate, reaching a low of $55,573 during the day, but later recovered to $57,900 during early trading on September 12th.

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2024-09-12 13:30